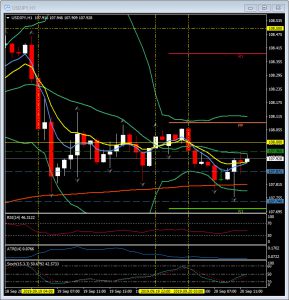

USDJPY, Daily

Comments from the BoJ yesterday, when they left monetary policy unchanged (no surprise), combined with the inflation report this morning, have resulted in the Yen continuing to strengthen with USDJPY falling from 108.45 yesterday to lows this morning at 107.75. Japan inflation hit a two year low, with CPI excluding fresh food coming in at just 0.5%, in line with estimates and the lowest rate since 2017. Weaker energy prices were the main culprit, but with the key inflation gauge holding below 1% for a very extended period, the data will add to easing expectations after BoJ head Kuroda signalled a review of the overall situation and the impact of slowing world growth on price momentum in Japan. Kuroda said he is now “more inclined” to go ahead with additional easing than he was a month ago. Still, excluding energy inflation edged up to 0.6% y/y, which is above the 0.4% average seen last year. Additionally the three key financial institutions in Japan (BoJ, MoF and FSA) met earlier today to “monitor markets” and although there are no signs or suggestions of BoJ intervention, a strong Yen weighs on this export-driven economy.

Technically, the “Tweezer Top”, the rejection of R1, the latest 50.0 Fibonacci level on the Daily time frame and the close back to 108.00 suggest more possible downside. Next key support, should the break of the 108.00 level hold, will be 107.60 (the January 2 close following the flash crash fall January 2), the 50-day moving average, 38.2 Fibonacci level and S2 at 107.40 and then the lower Bollinger Band, S3, and key psychological 107.00. Resistance is this week’s high (108.45) and the 200-day moving average & 61.8 Fibonacci zone at 109.00-20. Intra-day, the crossing EMA strategy had a significant move down yesterday, a failed reversal and then a follow through move lower today.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.