FX News Today

- Treasury yields fell back overnight, with the US 10-year rate trading at 1.7%, down -3.5 bp on the day.

- European bond markets already ended the day lower on Wednesday after paring earlier gains.

- Wall Street managed to snap the losing trend and Asian markets traded mixed, with Japan outperforming after the US and Japan agreed a limited trade deal. President Trump signed a limited pact with PM Abe that will allow easier access for USD 7.2 bln of US agricultural goods.

- European futures are still heading south, however, as are US futures, with concern about political developments in the US and the UK weighing on confidence.

- Brexit: MPs returned to Westminster yesterday, but parliament remains divided as ever and the prospect of prolonged Brexit uncertainty is adding to growth concerns on both sides of the channel.

- RBNZ’s governor said interest rate cuts are working and traders continued to curb bets of additional moves, which helped to underpin the NZD.

- Dollar is slightly weaker and USDJPY is trading at 107.67, after seeing an earlier high of 107.79.

- The WTI future meanwhile fell back to USD 56.46 per barrel, with traders concerned by the US decision to impose penalties on a handful of Chinese tanker firms for continuing to transport Iranian crude.

- German Nov GfK consumer confidence unexpectedly improved.

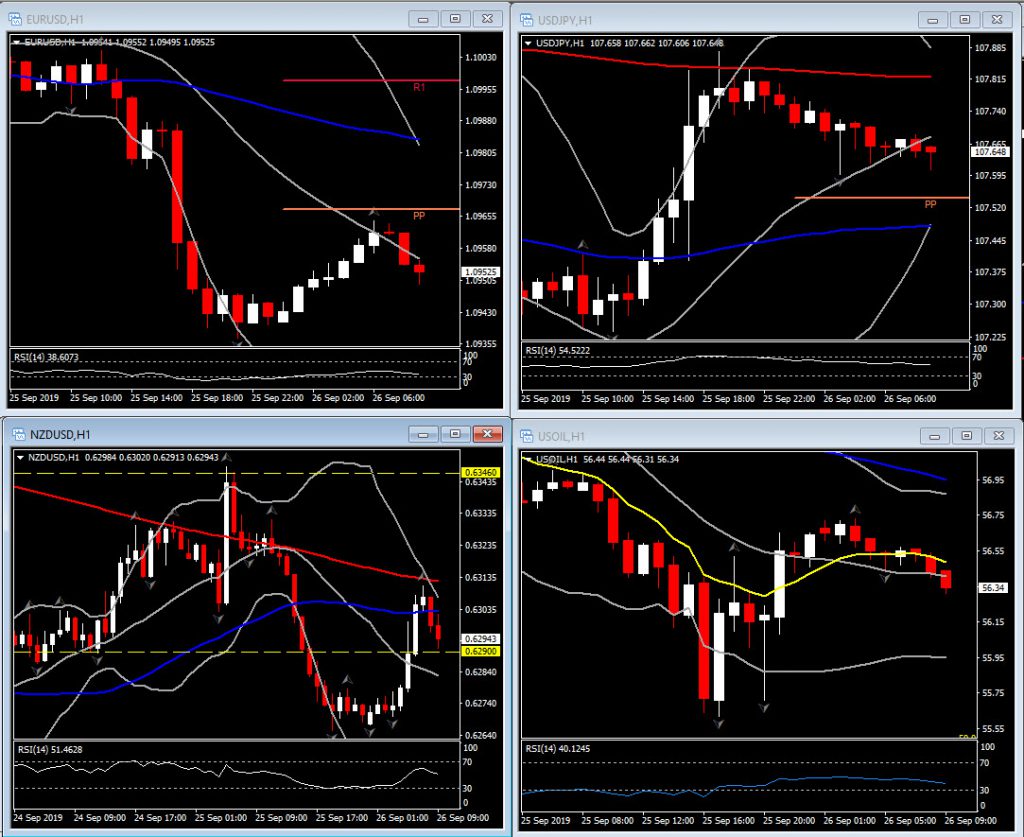

Charts of the day

Technician’s Corner

- USDJPY has rallied to highs of the week, topping at 107.84, from near 107.35 at the open, and getting its latest push higher from a Trump comment, who said a trade deal with China may be closer than you think. Wall Street has moved to session highs on the comment as well, providing additional support to the Dollar pairing. Currently the pair has slipped a bit lower at 107.63, but sunstains a move above PP level the last session.

- GBPUSD: Sterling has made a return to the biggest loser column thanks to a 1% decline to the Dollar. Cable is at its lows, presently showing a bid of 1.2355, extending to correction from the two-and-a-half-month high seen last Friday at 1.2582 to over two big figures. The breach of Monday’s low at 1.2413 has racked up another lower low in what can be viewed as being a nascent bear phase.

- USOIL was little changed, though near session lows at $55.75 following the EIA inventory data which showed a 2.4 mln bbl rise in crude stocks. Currently it is moving lower at 56.35 after rejecting the 56.75 Resistance. The move below PP of the day and 20-period SMA in the hour chart could suggest the retest of yesterday’s low which coincides with S1.

Main Macro Events Today

- Economic Bulletin (EUR, GMT 08:00)

- US Gross Domestic Product (USD, GMT 12:30) – The final Q2 GDP growth is expected to be confirmed at 2.0% annualized, with a $6 bln hike in public construction that accompanies boosts of $2 bln for consumption and $1 bln each for intellectual property investment and exports. We expect a -$2 bln revision for nonresidential investment and a -$1 bln revision to residential construction, leaving a net $7 bln upward GDP revision.

- ECB’s President Draghi speech (EUR, GMT 13:30)

- Tokyo CPI and Production Data (JPY, GMT 23:30) – The country’s main leading indicator of inflation is expected to have risen to 0.8% y/y in September from 0.6% last month, and to slip to 0.5% y/y from 0.7% in the CPI ex Fresh Food reading.

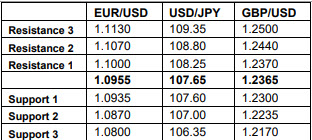

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.