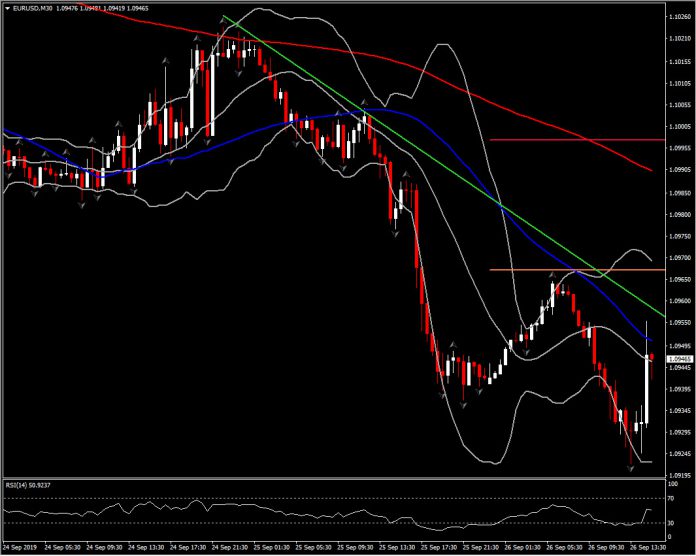

The Dollar was little changed following the mix of data, where the revised Q2 GDP was in-line with consensus, jobless claims as expected, and the advance trade deficit slightly narrower than forecast. EURUSD sits at 1.0945, above earlier 29-month lows of 1.0922, while USDJPY is steady near 107.57. Equity futures continue to indicate a modestly higher Wall Street open, while yields are little changed.

US initial jobless claims rose 3k to 213k in the week ended September 21 after the prior week’s 4k increase to 210k (revised from 208k). We had expected a larger increase on the week due to the spillover effects from the GM strike, though that may show up in coming weeks. The 4-week moving average dipped to 212k versus 212.75k (revised from 212.25k). Continuing claims declined 15k to 1,650k in the September 14 week following the prior 9k drop to 1,665k (revised from 1,661k). The data still reflect a solid labor market.

US Q2 GDP growth was steady at the prior 2.0% pace, and compares to the 2.1% clip in the Advance report. The Q1 pace was 3.1%, with Q4 at 1.1%. Back to Q2, consumption was nudged down to 4.5% versus 4.7% previously. Business investment worsened further to -6.3% versus -6.1%, slowing sharply from 6.2% in Q1 as trade uncertainties and Boeing weighed heavily. Government spending was revised up to 4.8% versus 4.5%. Inventories subtracted -$46.6 bln versus -$47 bln previously after adding $23 bln in Q1. Net exports subtracted -$36.7 bln versus -$38.5 bln, after adding $39 bln in Q1. The chain price index was unchanged at 2.4%, and was 1.1% in Q1. The core rate rose to 1.9% from 1.7% previously and 1.1% in Q1.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.