FX News Today

- Wall Street kicked off Q4 on bearish footing with the Dow dropping 1.2% to 26,570.

- The weaker than expected ISM manufacturing index to 47.8, a second straight month in contraction, rekindled recession worries.

- Yields are still above Monday’s close, after weak demand in yesterday’s auctions triggered a sharp rise in long yields.

- South Korean indices were hit by reports that North Korea fired what seemed a submarine based ballistic missile of its eastern coast, added to the negative risk backdrop after the S&P closed at a one months low.

- US futures are trying to move higher, GER30 and UK100 futures are in negative territory.

- Brexit: UK Prime Minister Johnson, admitted that customs checks would be the “reality” of Brexit, even though he dismissed an apparent leak of his government’s detailed plans for the post-Brexit Irish border — which involve customs checks on both sides of the border — as being inaccurate.

- Gilts outperformed and UK yields declined yesterday after hopes of a breakthrough on the Brexit front were crashed and political headlines will remain the main driver for UK markets

- The BoE lays the ground for a rate cut even without a no-deal Brexit scenario.

Charts of the day

Technician’s Corner

- GBPUSD pulled back from earlier highs, as Bloomberg, cited a Buzzfeed tweet saying according to an EU Commission spokesman, the earlier report that the EU was considering a time-limited Irish backstop, was not true. Cable fell to 1.2260 from earlier highs near 1.2340.

- EURUSD bounced to 1.0908 highs into the N.Y. open. The Euro has printed 5-straight session of lower daily highs and lows, a bearish signal, and a failure to trade above Monday’s 1.0948 highs today will likely embolden EUR bears going forward. Fundamentally, the US economy remains head and shoulders above Europe’s, while a dovish ECB and interest rate differentials solidly in favor of the Dollar, we look for further EURUSD losses going forward.

Main Macro Events Today

- ADP Non-Farm Employment Change (USD, GMT 12:15) – The ADP is expected to report a 145k increase in private payrolls for September following the better than expected 195k increase in August. Risk is for a weaker headline print after the miss in the September ISM, that included a decline in the employment sub-component. Friday’s September nonfarm payroll report is now crucial for the markets’ expectations on the FOMC, as another 25 bp rate cut is again being priced in with greater than a 50-50 probability.

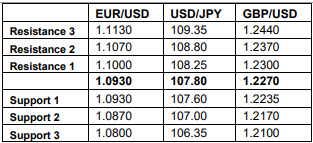

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.