European stock markets sold off over concerns over a no-deal Brexit, which seems more likely by the day. EGBs rallied on mounting signs that talks between the UK and the EU will officially break down this week and with the government in London reportedly planning to “punish” EU states backing an extension, fears of a no-deal put pressure on stock markets and saw investors moving into safer assets.

According to a No 10 source as NNC reported, Boris Johnson told German Chancellor Angela Merkel a Brexit deal is essentially impossible if the EU demands Northern Ireland should stay in the bloc’s customs union. The call between the leaders, at 8 a.m. today, came after a text message from one of the prime minister’s officials, reported by the Spectator magazine, saying his government is preparing for talks to collapse.

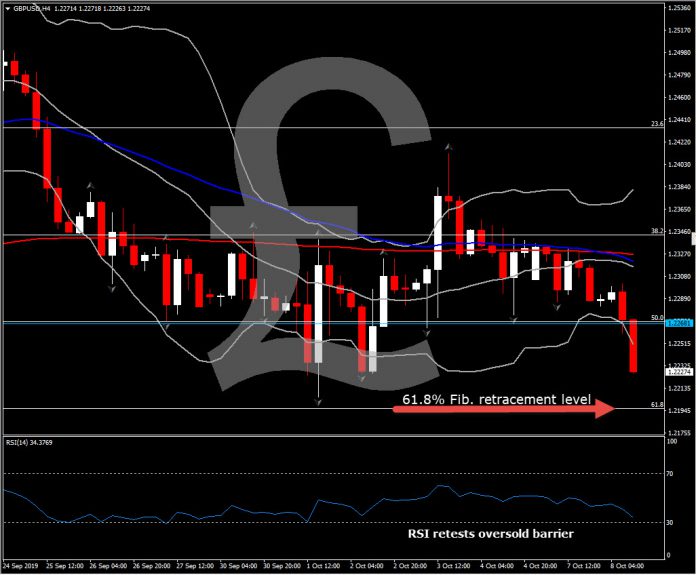

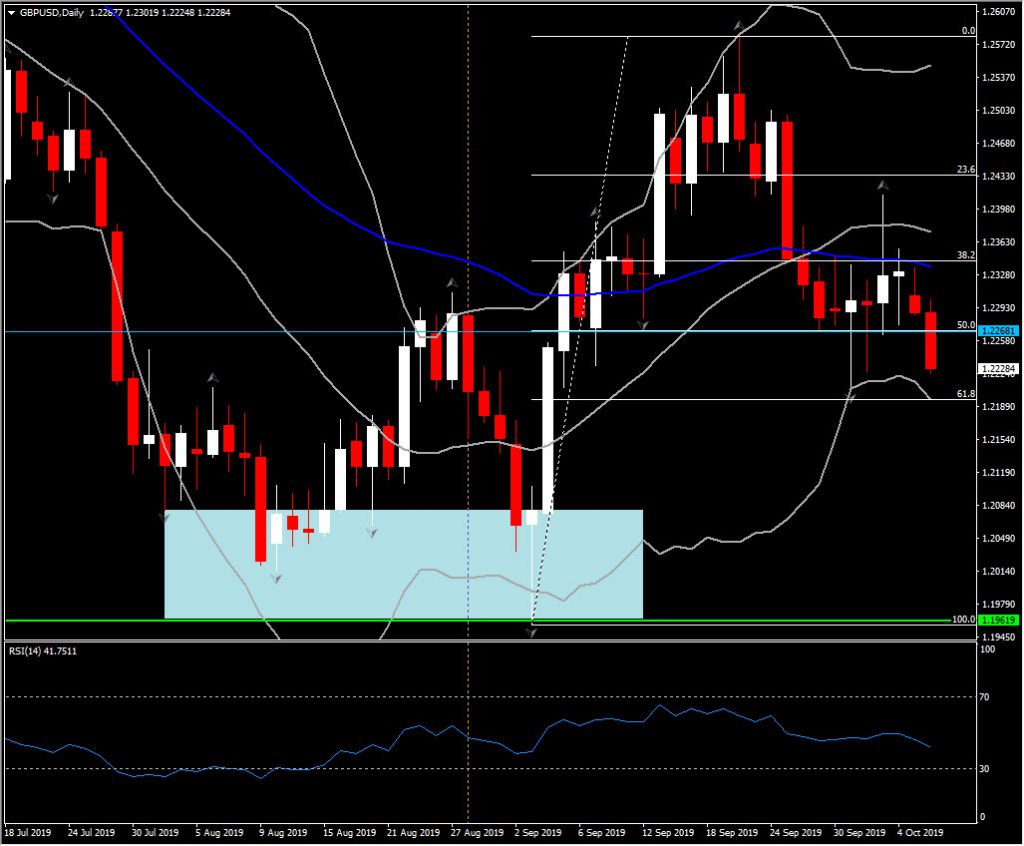

Sterling has taken a skid as market participants factor in no deal being reached by the UK and EU. The currency has also nearly 0.5% loss versus the Dollar and over 0.5% against the Euro, and in the bigger picture continues to trade with about a 14-15% discount in trade-weighted terms compared to levels prevailing ahead of the vote to leave the EU in June 2016.

It remains difficult to see if concessions on both sides are possible with regard to the Irish border issue; how to achieve a “clean” Brexit while at the same time maintaining the Good Friday Peace Agreement in a way that is satisfactory to both sides — a paradoxical case of an unstoppable force meeting an immovable object.

If there is no agreement, then UK Prime Minster Johnson won’t have a deal by the October-19 deadline set out in the newly created parliamentary bill that would require the prime minister to ask the EU for an extension in Brexit to January 31. Johnson has continued to assert that the UK would leave the EU without a deal on October 31 regardless, but that this is likely bluster; an attempt to both keep pressure on the EU and please Brexit voters. Attempting to pull the UK out of the EU on October 31 — i.e. ignore the new legislation, as some in the opposition fear — would be politically risky for him when he could easily lay the blame at the oppositions’ feet.

More likely Johnson would in this scenario acquiesce for an extension while making a big show of blaming the opposition. An election would then be staged in November or early December. In the event that Johnson’s Conservative Party won (and they are favourites according to polling) then the same Irish border problem will be faced all over again. But this time, assuming Johnson carried a majority in Parliament, the PM would be able to make good on his threat to take the UK out of the EU without a deal.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.