Parliament voted on Saturday in favour of the Letwin amendment, which forced the government to request a 3-month delay in Brexit. The amendment does not intend to prevent Brexit on October 31, but rather to ensure that Parliament has successfully ratified PM Johnson’s divorce deal before October 31, and so guarantee that a no-deal scenario could not happen (which it could have in the event that all the legislation hadn’t been passed).

The government still triggered its contingency plan, known as Operation Yellowhammer that deals with a no-deal Brexit, which makes some sense as the EU hasn’t yet granted an extension, having indicated that it will wait on the MPs debate this week before deciding.

A tumultuous week in Parliament now looms. The principal opposition, Labour, are planning to table amendments on the Brexit legislation that demands the Brexit deal be contingent on a confirmatory referendum.

The odds for a second referendum are now looking higher than they were last week. There has been a shift in alliances with regard to delaying Brexit, with the Brexit Party now favouring a delay, such is its distaste of the deal on the table. The idea here is that with the Conservatives and Brexit parties rising quite high in polls (about a combined 44-6%), a pre-Brexit general election, which could only happen with an extension in Brexit, would be preferable. Northern Ireland’s DUP is now, having been thrown under the bus, working against the government, though on the other hand a number of Labour MPs have indicated that they will support the government’s deal.

We assume that the EU won’t disallow an extension in Brexit if one become necessary to avoid a no-deal Brexit and to allow time for a referendum and/or general election.

In Currency market meanwhile….

The Pound, and to a lesser extent the Euro, wobbled in Asia following the weekend’s developments on the Brexit front. Cable dove by nearly a big figure in making a low at 1.2871. The pair has rebounded to 1.2985 on London open, spiking above Friday’s high.

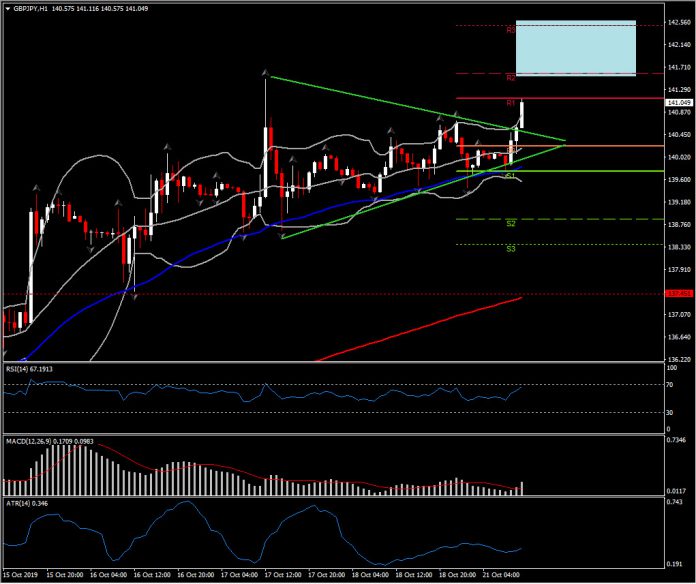

GBPJPY rebounded as markets look that they are still pricing out the risk of a no-deal scenario, after PM Johnson was forced to send a letter requesting an extension on Saturday. The pair moved above the Descending triangle pattern formed since Thursday, breaching R1 at 141.15. The asset presents strong upside momentum intraday, with the asset moving outside upper Bollinger bands, RSI retesting overbought barrier and MACD posting a bullish cross above neutral zone. Next levels to be watched are the 141.70, 142.00 and 142.50. As the asset looks overstretched a correction lower could find support at 140.65 (2-day Resistance converted into immediate Support).

Overall, the Pound is expected to remain broadly underpinned given the guarantee against a no-deal exit on October 31 and with a second referendum now looking like a good possibility (and on the assumption that the EU won’t disallow an extension, if one becomes necessary to avoid a no-deal Brexit).

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.