Commodity currencies posted fresh highs while the Yen retained a softening bias amid a backdrop of rising global equity markets following upbeat rhetoric from both the US and Chinese officials.

Q3 corporate earnings have so far been positive, albeit with expectations having been guided lower in the run in to the show-and-tell season.

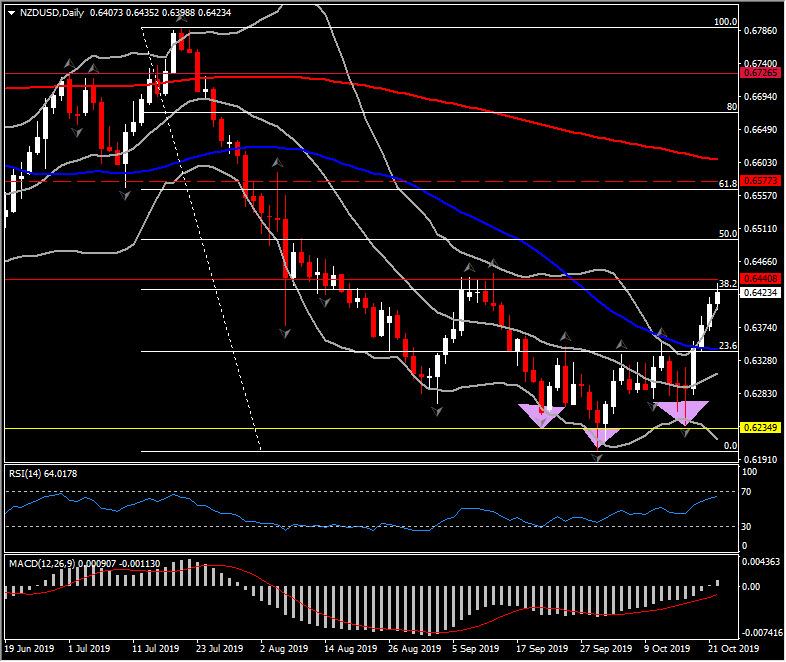

AUDUSD posted a two-month high at 0.6682,AUDJPY a 12-week high, while NZDUSD ascended into one-month high territory. NZDUSD continues to support an overall bullish outlook after the formation of inverse head and shoulders pattern. It is currently retests 8-week Resistance which is close to 38.2% Fib. level since July’s peak. A move above the latter could strengthen the outlook, with next level to be watched at 50% Fib. , at 0.6500. Support is seta t 0.6350-0.6350.

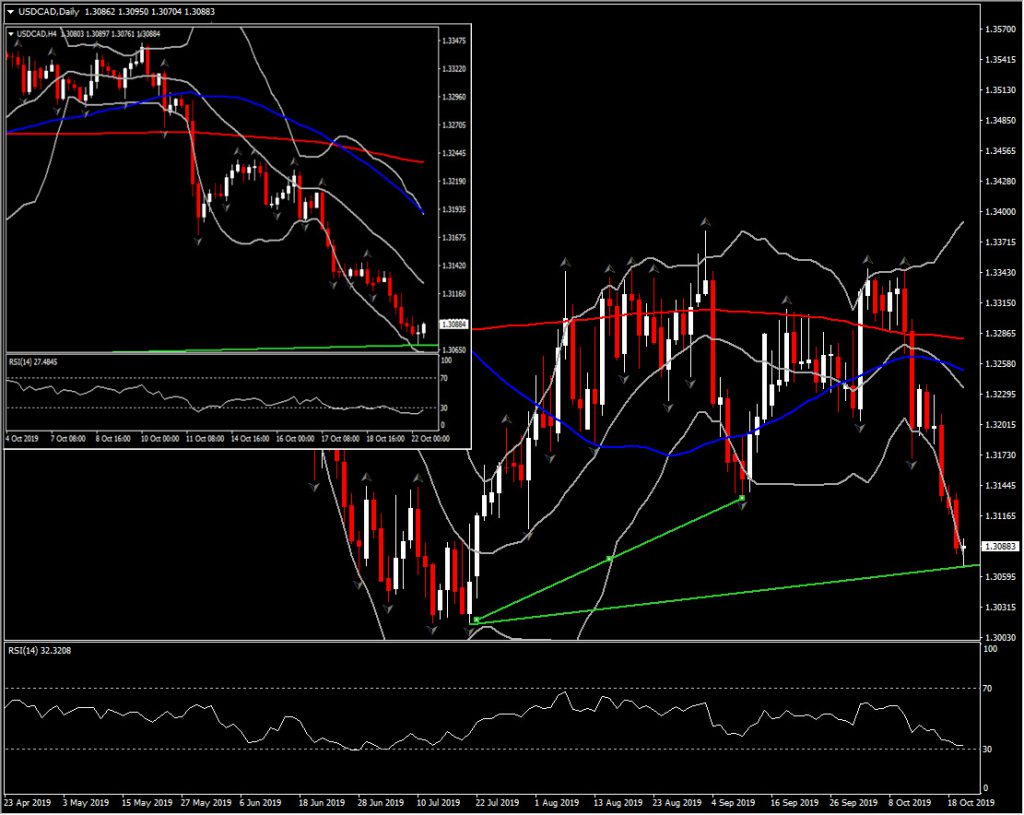

USDCAD, meanwhile, has printed a 3-month low at 1.3071. The pair is down by about 1% form week-ago levels, and is showing just over a 4% decline on the year-to-date. This follows what is now a three consecutive weeks of underperformance. A recovery in global risk appetite (much reduced no-deal Brexit risk, cancellation of planned U.S. December tariff hikes on Chinese goods) has helped underpin the Canadian Dollar, and other commodity-correlating currencies.

On the domestic scene, Canadian PM Trudeau’s Liberals are set to form a minority government after a tight election yesterday, though they will have to rely on the left-leaning NDP party to govern, which wants to raise corporate income tax rates and implement a wealth tax, and opposes the Trans Mountain oil pipeline project, which is seen as negatives from the perspective of financial markets.

On the domestic scene, Canadian PM Trudeau’s Liberals are set to form a minority government after a tight election yesterday, though they will have to rely on the left-leaning NDP party to govern, which wants to raise corporate income tax rates and implement a wealth tax, and opposes the Trans Mountain oil pipeline project, which is seen as negatives from the perspective of financial markets.

Elsewhere, EURUSD, after coming under pressure yesterday in the wake of printing a 2-month high at 1.1179, settled in the mid 1.1100s. The Euro is showing net gains of around 1% against both the Dollar and Yen from week-ago levels, with markets having pretty much unwound the perceived risk for there being a no-deal Brexit scenario on October 31. Currently it reversed lower at 1.1144, while it remains choppy so far, bouncing between 1.1133-1.1160 area.

GBPUSD has settled in the mid 1.2900s after yesterday posting a 5-month high at 1.3012. The pair is up by nearly 9% from the major-trend lows seen in early September. Regarding Brexit, the UK’s Parliament will today start voting on the legislation for PM Johnson’s divorce deal. This needs to pass at the first go if Brexit is going to happen on October 31. Once the deal has been fully ratified it would still remain subject to the “meaningful vote.”

The opposition are scheming to either amend the deal so that there is an all-UK customs arrangement, which is unlikely to have sufficient support, and to made the Brexit deal subject to a “confirmatory” referendum, which looks unlikely to pass, though not an impossibility.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.