EUR: Limited rally?

|

Asset

|

Weekly bias | Week’s Range |

|---|---|---|

|

EURUSD

1.1129

|

Bearish | 1.1097 – 1.1200 |

- A no-deal Brexit avoided theme has given both the Euro and Pound a lift lately, though the possibility for a no-deal further down the track remains on the cards, while the protracted political uncertainty in the UK is having a deleterious economic on both sides of the Channel. The ECB is also taking a dovish tilt with Christine Lagarde having taken up the reins. On the dollar side of the balance, with regard to EURUSD, markets are anticipating US non-manufacturing survey data for October, due later today, to rebound from the 3-year low seen in September. This would follow the strong US October jobs report (despite the General Motors strike) and the backdrop of the Fed’s three precautionary rate cuts.

- EURUSD printed a 6-day low at 1.1112 in what is now the pair’s fourth day trading on a 1.11 handle. The pair has been losing upside momentum after rallying out of sub-1.0900 levels in early October. The Euro has seen signs of weakness against other currencies, although EURJPY has been buoyed by Yen trade yesterday.Against a sputtering Eurozone economy and a dovish ECB, the upside potential of EURUSD should be kept in check. In the long-term pair still classified as being amid a down trend that’s been unfolding since early 2018, from levels around 1.2500. The trend has coincided with the 10-year Bund yield dropping from levels over 0.70% to the prevailing -0.325 % yield (a -0.739% low was seen in early September).

JPY: Looking northwards despite risk-on mode

|

Asset

|

Weekly bias | Week’s Range |

|---|---|---|

|

USDJPY

108.80

|

Bullish | 107.76 – 109.27 |

- The Yen continued on a softening tack into the EUropean session amid a backdrop of continued risk-on positioning in global markets, which have seen sovereign bonds come under pressure and stock markets rally. Maintaining investor spirits were the PBoC cutting its 1-year medium-term lending facility (MLF) rate by 5 bps for the first time since early 2016, and an FT report that the Trump administration was considering removing some tariffs on Chinese goods, which is something that Reuters sources have been saying Beijing has been pushing for.

- USDJPY rose to a 5-day high at 108.88. EURJPY and AUDJPY also made respective 5-day peaks, at 121.12 and 75.18, and other Yen crosses gained. AUDJPY lifted by over 0.5%, drawing back in on the 3-month high seen last week at 75.29. Positive sentiment for USDJPY holds in the medium picture, as the asset holds above 20- and 50-Day SMA, with momentum indicators positively configured. Hence the intraday decline remains a temporary correction on the 3-day rally.

GBP: Struggling to hold above 1.2900

| Asset | Weekly bias | Week’s Range |

|---|---|---|

|

GBPUSD

1.2904

|

Neutral | 1.2800-1.2980 |

- A no-deal Brexit avoided theme has given Pound a lift lately, though the possibility for a no-deal further down the track remains on the cards, while the protracted political uncertainty in the UK is having a deleterious economic on both sides of the Channel.

- The Pound stuck at 1.2900 (mid 3-week range) after making up the fourth week out of the last five where a higher high has been set. From month-ago levels, the Pound is the strongest performer out of the main currencies, up 5% against the Dollar and by over 6% versus the Euro, reflecting an unwinding in the pound’s Brexit discount, with a Halloween no-deal Brexit scenario having been avoided.

| Asset | Weekly bias | Week’s Range |

|---|---|---|

|

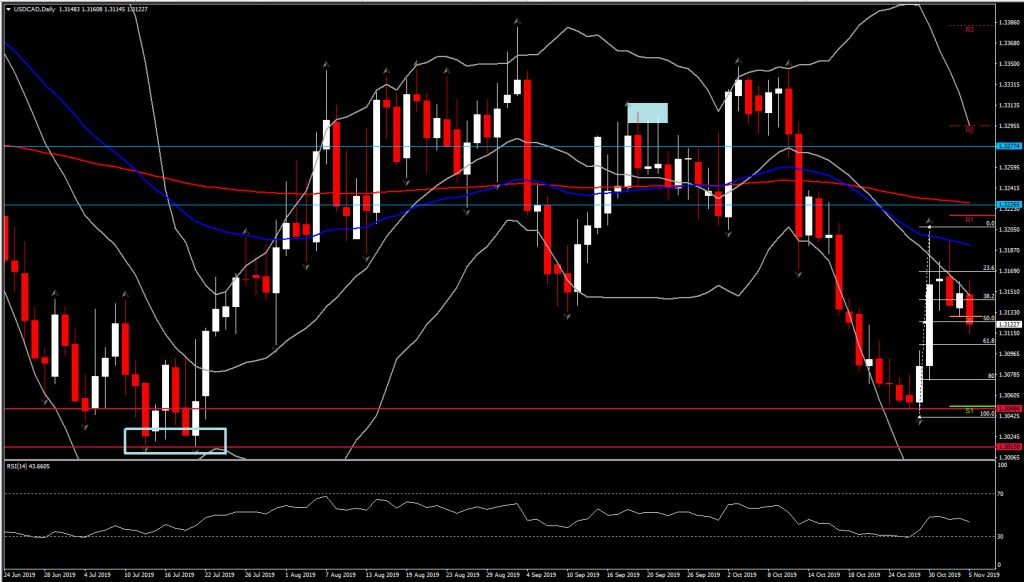

USDCAD

1.3124

|

Bearish | 1.3075 – 1.3200 |

- USDCAD has remained heavy, today matching the 6-day low that was seen yesterday at 1.3130, with the Canadian dollar being floated by a backdrop of coursing risk appetite in global markets, similar to the other Dollar bloc currencies, which has offset the jump in US yields following the strong US jobs data on Friday.

- Taking a step back, USDCAD is near to the midpoint of the range that’s been seen over the last 4-plus years.

|

Asset

|

Weekly bias | Week’s Range |

|---|---|---|

|

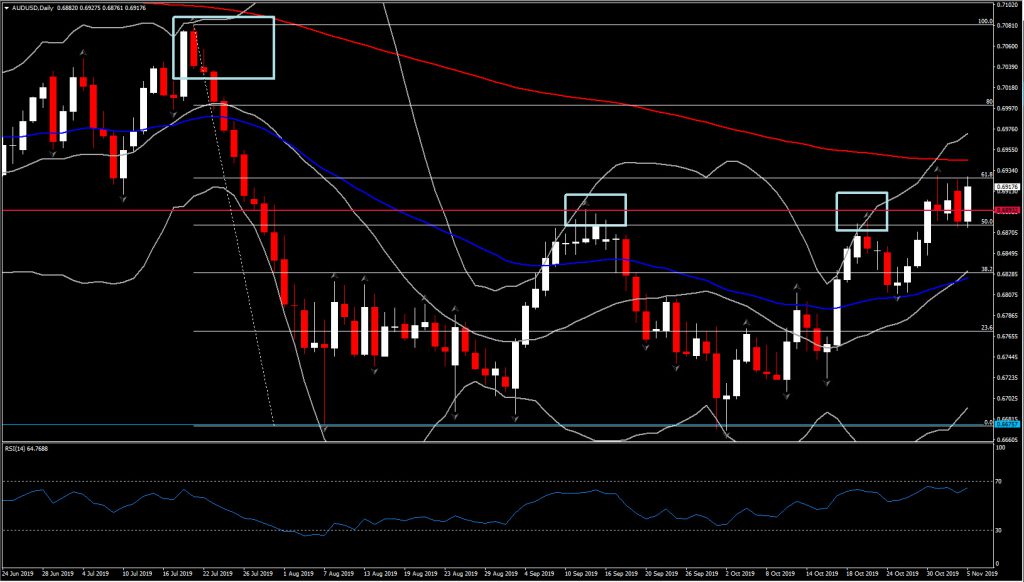

AUDUSD

0.6917

|

Neutral to Bullish | 0.6770- 0.6945 |

- AUDJPY is the biggest gainer on the day so far, showing a rise of 0.9% at prevailing levels. The cross has printed a three-week high at 75.40. AUDUSD has concurrently rallied by over 0.6%, coming within of the three-week peak that was seen last week, at 0.6929.

- The Aussie Dollar is also showing outperformance form month-ago levels, with only sterling having been stronger out of the main currencies over this period. The currency has a relatively high beta characteristic, and is widely seen as a liquid currency proxy of China, which accounts for over a third of the total demand for Australian commodity exports, and has therefore acted in a true to form manner amid the recent upward scaling in global stock markets. The main three US indices hit new record peaks yesterday, while Asian and European markets have rallied to fresh major-trend highs today.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.