NVIDIA is scheduled to announce its fourth-quarter 2021 earnings report on Wednesday February 16, 2022 at 10:30 PM GMT.

NVIDIA has a market capitalization of $618.2 billion, making it the seventh largest American company. The company specializes in manufacturing desktop computers, graphics processors, and mobile technologies. The company was founded by Curtis Priem, Jen-Hsun Huang, and Christopher Malachowsky in 1993 and is headquartered in Santa Clara, California. NVIDIA develops integrated circuits that are used in many things, including electronic games and personal computers. The company has the distinction of being a leading manufacturer of advanced GPUs.

Nvidia has a #2 “buy” rating from Zacks. Zacks expects fourth-quarter earnings per share of $1.22, higher than the $1.17 in the previous quarter.

In its third-quarter earnings report, NVIDIA reported record revenue of $7.10 billion, an increase of 50% from the previous year and an increase of 9% from Q3. Diluted earnings per share, according to accepted accounting principles, were $0.97, up 83% from a year ago.

On Tuesday, February 8, 2022, Nvidia’s purchase of ARM from SoftBank with an initial value of $40 billion, which was expected to become the chipmaker’s largest ever deal, was cancelled. The two companies said in a joint statement that they had agreed not to proceed with the deal “due to significant regulatory challenges.” The US Federal Trade Commission sued last year to block the deal over concerns it would harm competition and shift the balance of power in the industry in ways that would unfairly favor Nvidia over other chip companies. The deal would have given Nvidia control over the chip designs that its competitors rely on to develop chips.

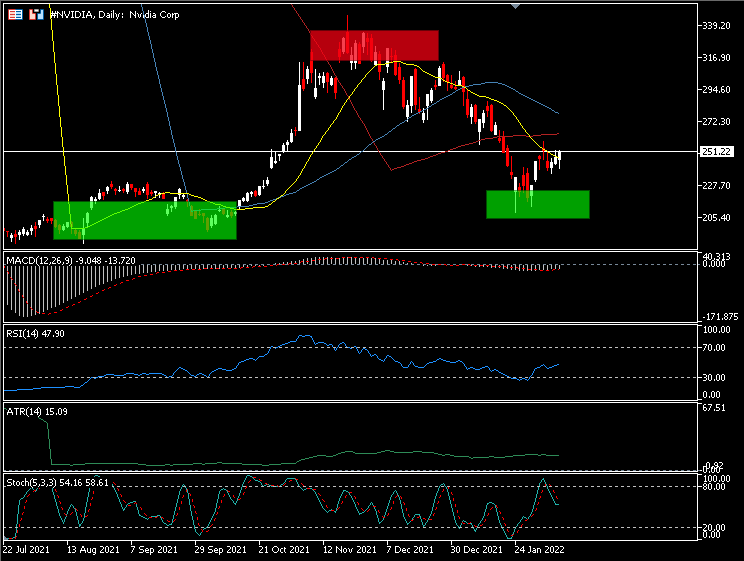

Nvidia’s share price rose from its lowest key support at 190.76 on August 18 and reached its highest key resistance at 333.60 on November 29. The stock is now trading at 251.22. MACD signal line and histogram are below the 0 line, RSI at 47.90, Stochastic continues declining. Average True Range (14) on an hourly time frame is at 15.09, in oversold territory.

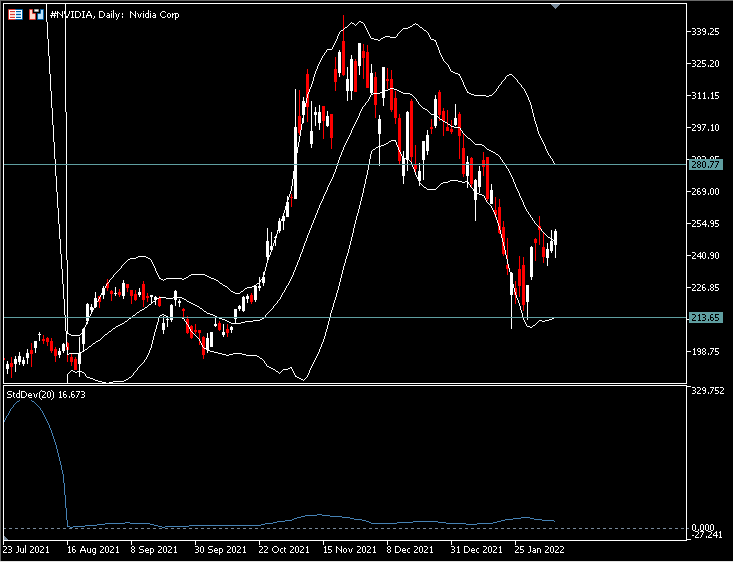

The Bollinger Bands indicator indicates the upper band of the volatility channel at 280.77 and the lower band of the volatility channel at 213.65. The 20 day simple moving average is at 247.20. Here we notice that the upper, middle and lower bands are moving away from each other and this indicates a period of high volatility. Standard Deviation (20) is at 16,673, in oversold territory.

The asset is showing an intraday increasing positive bias ahead of the earnings release, with major support at 219.33. A break below 219.33 could open the door to a lower 190.35 (August low), while a further rise above 251.22 could draw attention to the 333.60 area once again.

Click here to access our Economic Calendar

Εslam Salman

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.