The markets were shaken and stirred last week by virus and vaccine developments, US stimulus uncertainties, and the Reddit/GameStop frenzy on Wall Street that sparked a jump in anxiety and volatility. While fundamentals have taken a back seat to a lot of exogenous events, there will be plenty of data ahead to digest that will give an early view of 2021 activity.

While attention in the markets has drifted away from data and fundamentals, this week’s US data calendar has several reports that will shed light on how the economy fared into the new year, especially as virus infections accelerated and lockdowns intensified, while the political situation devolved. The January employment report (Friday) takes center stage and should show the economy was shaken but not broken by recent events. We project a 100k bounce in total employment after the -140k drop in December. The jobless rate is expected at 6.7%, matching the reading for December. Notably, we see a 30k gain in January factory jobs after the 38k increase in December. This job category is a source of upside risk to our jobs estimate, as factories were less impacted by the lockdowns relative to the service sector. Of course, the service sector is a wildcard, but the bulk of the layoffs were likely already implemented in December in a sector that was already hollowed out last spring.

Earnings reports will be in focus as the schedule of earnings is again very busy, with two FAANG giants in the spotlight. Amazon and Alphabet (Google) – the world’s fourth and fifth largest companies by market capitalization in the world as of January 2021 – are due to release their earnings reports tomorrow after market close.

Together, the FAANGs make up about 15% of the S&P 500. Amazon has a market capitalization of $1.624 trillion and Alphabet has $1.239 trillion, more than approximately 99% of US stocks. Hence their earnings reports are expected to add heightened volatility for tech stocks, and the USA500 & USA100 of which they are components, especially due to the fact that the 2020 pandemic has been and remains favourable for e-commerce giants and the world’s largest search engine due to the extended and repeated lockdowns worldwide. As already seen in 2020 their shares have surged and sustained close to record highs, with skyrocketing profits for tech companies as the pandemic reckoned with online services such as shopping, streaming and cloud services.

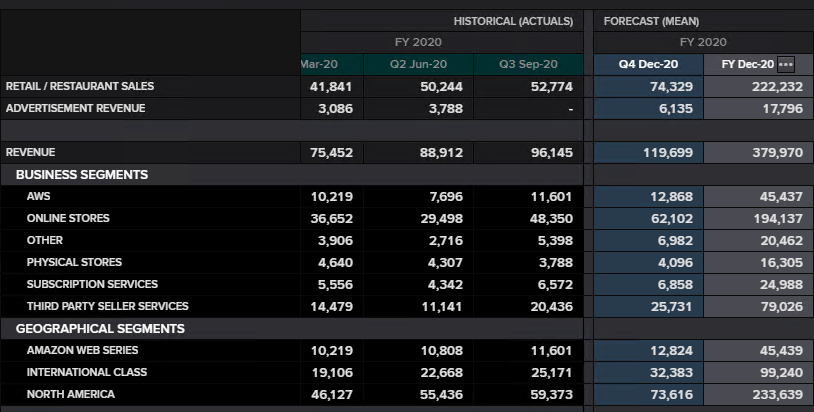

Hence for both companies, the reports are expected to continue the 2020 utopia, howvwer, let’s start with Amazon. The market estimates that Amazon for Q4 2020, will present again a sharp increase in online orders due to the second wave of Covid-19, along with the clash of bank holidays sales such as Black Friday, Cyber Monday, Christmas and New Year’s Eve as well, which are expected to have lifted sales through the roof last quarter for the giant e-commerce business. The strengthening of grocery and delivery services globally, along with Amazon’s smart expansion of its international presence which now spans 58 countries and reaches the greatest international online population, is expected to contribute to a very optimistic report for the company. Also the surge in corporate employees and consumers working at home is expected to have further boosted demand for its cloud services. Amazon is posting rapid growth even as it fights major antitrust charges from European Union regulators, for more than a year now.

According to Zacks Investment Research, the report for the fiscal Quarter ending December 2020 is expected to experience a near quarter rally of its Earnings Per Share (EPS) compared to last year, at $7.47 from $6.47, which reflects a rise of 15% from the same quarter last year. Reuters Eikon predicts a $7.23 EPS, while the company’s revenue are seen between $119.7 billion (Eikon) and $121 billion (Zacks), after the revenues of $96.1 billion in Q3, with the yearly change seen at approximately 36% by the end of 2020.

Amazon’s revenue stream is also impressive, including from the Amazon Web Service, as the biggest part of Amazon’s income is derived from its cloud segment. Amazon Web Services (AWS) has posted a significant growth in both sales and operating income since its launch, but has skyrocketed in 2020 more precisely due to the pandemic-induced growth of the work-from-home economy. Further, Prime-based customer benefits are likely to have remained positive while its Prime Day event experienced record sales between Oct 13 and Oct 14.

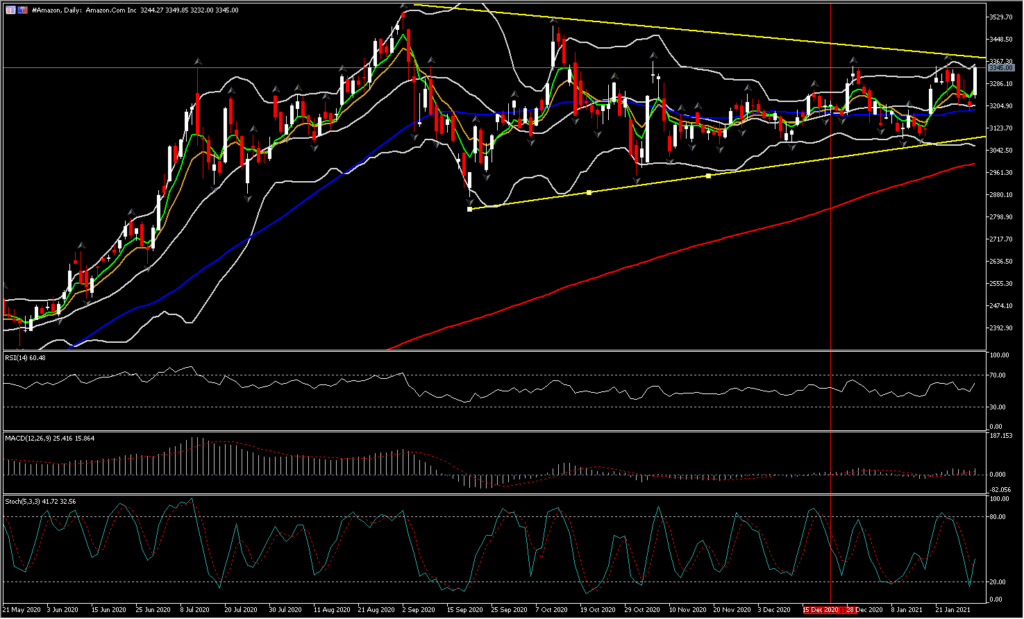

Amazon share price appears to have spiked to the $3,345 area this week, ahead of the Q4 earnings report. It is currently traded only 5% below all record highs and has been strongly sustaining the $3,000 floor the past 7 months.

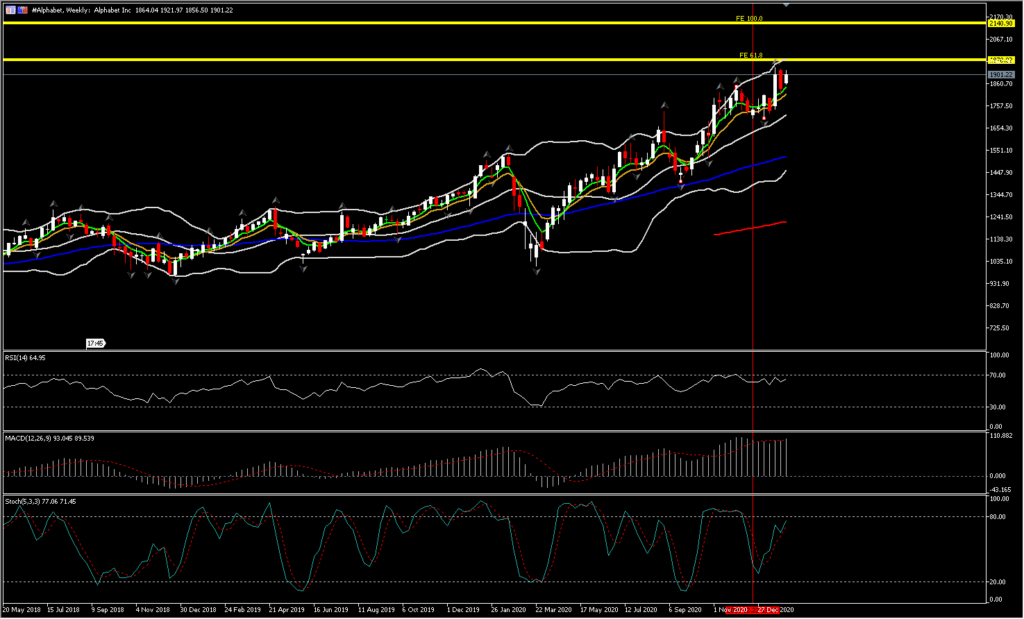

Alphabet’s share price has face an impressive rally, nearly doubling its value. Hence a promising report is expected later today for Q4 2020 as it is another beneficiary form the pandemic and work from home conditions. The company has already reported a substantial recovery from the lack of advertisement demand seen in Q2 from the majority of businesses amid the economic slowdown globally. Hence this growth since then comes despite uneven earnings and revenue performance even as Google users sharply boost their time online while confined at home, during the second wave of the pandemic since autumn. At the same time, Google faces similar antitrust lawsuits as Facebook and Amazon etc, including cases alleging that the company abuses its dominance in advertising. Due to the latter, despite a strong revenue growth Alphabet could report an exiguous EPS today.

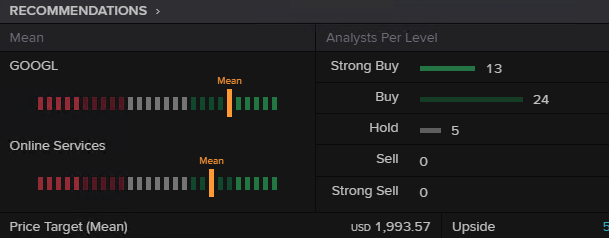

The forecasts for Q4 have the company well positioned with the consensus recommendation “buy”, corresponding to the majority of the consensus recommendation from Reuters Eikon, as 37 out of 42 analyst firms recommend “buy” and “strong buy”, while only 5 recommend ‘hold’. Hence, no analyst firm is making a “sell” or “underperform” recommendation for the company.

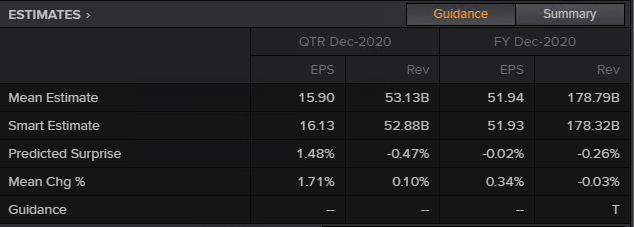

According to Zacks Investment Research and Reuters Refinitiv, the information service is expected to have $15.90 in earnings per share during the fourth quarter of 2020, which represents a yearly rise of 1.71% since the reported EPS for the fiscal quarter ending December 2019. Focus should also turn to the revenues number which is projected to hit $53.13 billion, from the $46.1 billion reported last year. Cloud revenue meanwhile is seen at $3.8 billion.

Alphabet’s share price appears to have spiked to a $1,934.50 high in January. It is currently trading, almost double, from the $1,013 low seen in March 2020.

Additionally on tap this week will be: Tuesday provides Alibaba, Pfizer, Exxon Mobil, Amgen, UPS, Sony, BP, Chubb, ConocoPhilliips, Takeda Pharma, Ferrari, Emerson Electric, Eaton, EA, IDEXX Labs, Sysco, Microchip Technology, Match Group, Sirius XM, McKesson, Marathon Petroleum, Transdigm, Catalent, Amcor, PerkinElmer, Royal Caribbean, Imperial Oil, Entegris, Fortune Brands, and Lennox. Wednesday brings PayPal, AbbVie, QUALCOMM, GlaxoSmithKline, Spotify, Boston Scientific, Humana, MetLife, Biogen, Cognizent Tech, Allstate, Canon, Yum China, DTE Energy, IAAC/Interactive, IDEX, Avery Dennison, and Apollo Global Management. Thursday has Toyota, Merck, Unilever, T-Mobile, Shell, Bristol-Myers Squibb, Philip Morris, Total, Gilead, Cigna, Becton Dickinson, Snap, Activision Blizzard, ABB, ICE, Air Products, DuPont de Nemours, Ford, Peloton, Unity Software, Pinterest, Baxter International, Nokia, Cummins, ING, Alexion Pharma, Parker-Hannifin, Carrier, Prudential, Yum! Brands, Hershey, Clorox, Ball, AMTEK, Fortinet, Fortive, Deutsche Bank, FleetCor, IP, Xylem, Hartford, Quest Diagnostics, CMS Energy, Nomura, Monolithic Power, News Corp, Carlyle Group, Wynn Resorts, and Snap-on. Friday has Sanofi, Estee Lauder, Illinois Tool, Regeneron, Aon, Honda, Trane, Zimmer Biomet, FirstEnergy, and Cardinal Health.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.