The CPI report is anxiously awaited, and the markets are priced for a bearish outcome. Indeed, stocks and bonds have sold off so hard this month that risk is for dip buying after the result. Wall Street posted solid gains again Wednesday as investor sentiment has improved with good earnings reports and expectations for some normalcy as covid-19 mandates are being unwound. Treasuries have rallied as jitters regarding an overly hawkish FOMC have eased. Recent Fedspeak downplaying the likelihood of aggressive Fed action helped soothe investor jitters.

- USD (USDIndex 95.50).

- US Yields richened, led by the long end, especially after a stellar 10-year auction. The yield tested 1.93%. The 2-year pared its early rally and was unchanged at 1.344% into the close after sliding to 1.313%.

- Megacap growth stocks powered up due to a pause in rising interest rates while upbeat earnings reports also encouraged investors to buy.

- Equities – USA100 paced the gains on Wall Street, with a 2.08% surge, with the USA500 up 1.45% as all 11 sectors were in the green. The USA30 was up 0.861%.

- Reuters: Asian equities in January received the biggest upgrade in their forward 12-month earnings estimates in five months, boosted by higher commodity prices and demand for technology exports in the region. The – 55% of the region’s large- and mid-cap Asian companies have beaten the average earnings forecasts by analysts, while 58.1% of the companies topped the estimates in the third quarter.

- USOil – steady at $88.70.

- Gold – at $1835.70 – soft Dollar and lower bond yields.

- Bitcoin settled to$43,000 -44,000 area.

- FX markets – EURUSD narrowing to 1.1420, USDJPY spiked to 115.69 & Cable up to 1.3539 from 1.3525.

European Open – The March 10-year Bund future is down -4 ticks at 165.82, while in cash markets Treasuries have remained supported overnight, although yields have moved up from session lows going into the European morning. Asian stocks have traded narrowly mixed. That also holds for Europe, where yields have jumped sharply since the central bank meetings last week, forcing central bankers to warn against overcorrections and big policy moves. A number of speakers from both BoE and ECB are scheduled to speak today.

Today – As noted, the January CPI features today. Initial jobless claims are also due today. The January Treasury budget is also on tap. The Treasury auctions $23 bln of 30-year bonds and announces 20-year bonds and 30-year TIPS. For Fedspeak, Barkin is on deck. Today’s earnings calendar features reports from Coca-Cola, PepsiCo, AstraZeneca, Philip Morris, Duke Energy, Moody’s, Global Payments, DexCom, Republic Services, TELUS, Twitter, VeriSign, PG&E, Martin Marietta, Kellogg, SS&C Technologies, Zillow, and Aegon.

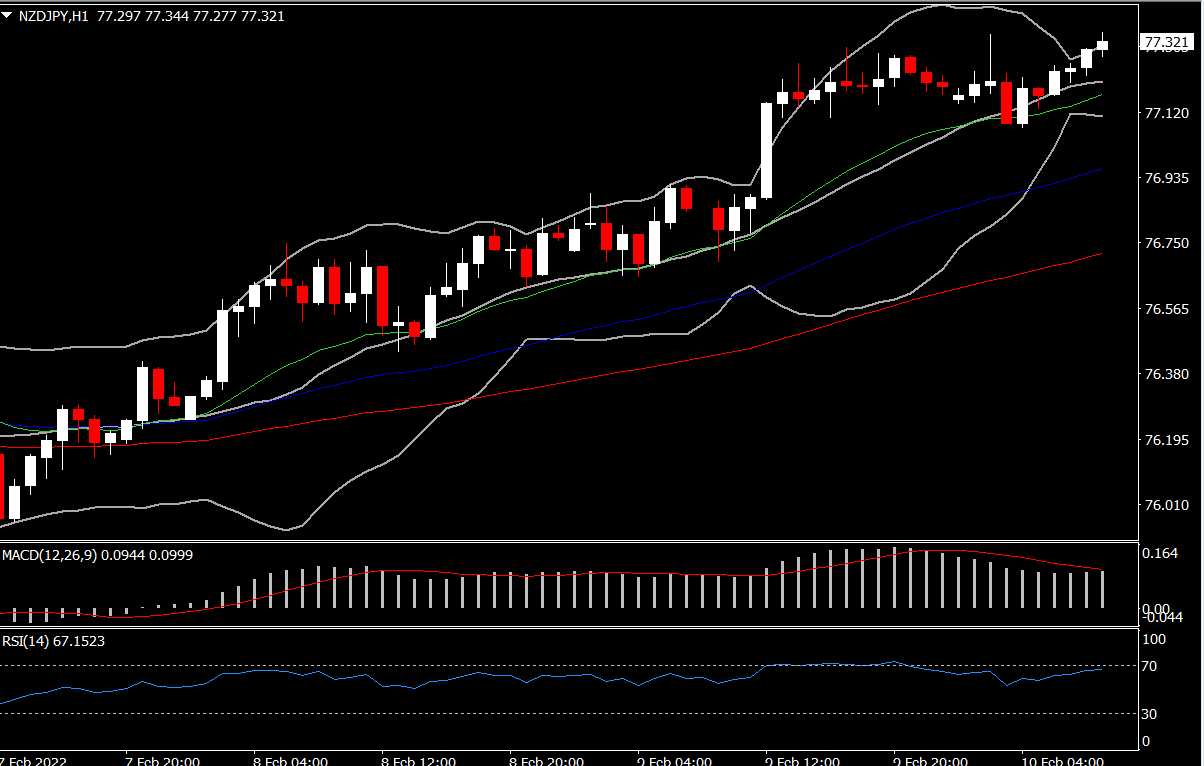

Biggest FX Mover @ (07:30 GMT) NZDJPY (+0.28%) – The Aussie and Kiwi dollars were trading near multi-week highs as investors turned more bullish on risk assets such as equities. Fast MAs aligned higher, MACD signal line & histogram extend northwards and RSI is retesting 70 area.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.