The war in Ukraine has finally pushed traditional safe-haven Gold closer to the all-time high seen in August 2020 after the United States and Britain announced a ban on oil imports from Russia. The EU will cut gas imports from Russia by two-thirds by the end of the year despite threats from Russia that it will close gas pipelines to Europe if oil imports are banned.

In addition to the war in Ukraine, Inflation, which is at a decades record high is another key reason that has helped drive gold prices to this point. And the war is about to exacerbate the inflation situation, because in addition to disrupting the supply chain the policy action of central banks may also be disrupted.

However, as the price of gold heats up towards a new all-time high, the US Dollar is also at its highest since May 2020, with the USDIndex hitting a new high of 99.40 this week, the same level as it was before the coronavirus crisis. Meanwhile, ahead of the FOMC meeting on March 15-16, Fed Chair Powell said in his testimony last week that he supported a 0.25% rate hike (to 0.5%) for the March meeting. So if the Dollar strengthens further it may become a major obstacle for gold prices.

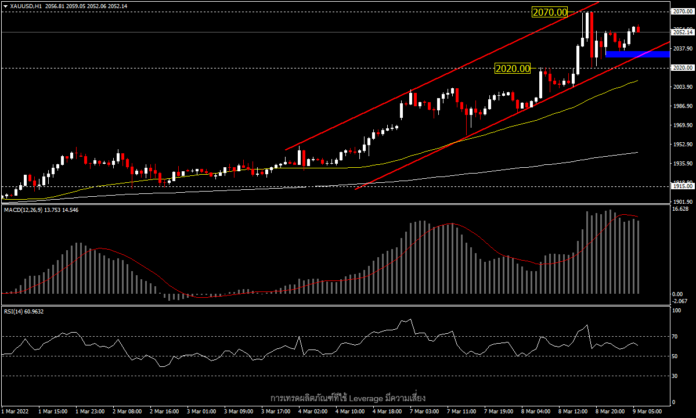

Intraday technical view: in the H1 timeframe the price is narrowing within the bullish channel frame, indicating a correction has formed, while the MACD has dropped below the signal line. It is still significantly above the 0 line and the RSI is at 61 and has just dropped from the overbought zone. The intraday trend is still in an uptrend. The first resistance is at the latest high at $2070. If it breaks, there is the next resistance at the all-time high $2075 zone. There will be the first support at $2035 and the next support at $2020.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.