Jitters over the war and the imposition of harsher sanctions on Russia continue to roil the markets. The shortages of key commodities are boosting prices to record highs. In fact the 250% surge in nickel over the past two sessions broke the market and caused the LME to halt trading until Friday. President Biden was pressured into banning US imports of oil, gas, and coal, further adding to the supply crunch and exacerbating inflation fears. Those concerns overshadowed the recent flight to safety and pushed rates higher. The market is also looking toward rate liftoff next week.

- Foreign ministers from both countries are set to meet in Turkey tomorrow, the same day the ECB meets and the EU leaders summit starts. Plans for a drawn out exit from the reliance on Russian energy imports? – Pressure on the ECB to continue its asset purchase program?

- The UK followed the US with an oil ban (not gas), though to be phased in over months. Scholz said the EU had no choice but to continue with imports.

- Norway’s sovereign wealth fund – the world’s largest – is to snub a Chinese apparel firm raising human rights issues.

- JPY GDP missed (1.1% vs 1.4%) & Chinese Inflation dipped but remained hot – (CPI 0.9%, PPI 8.8% down from 9.1%). RBA’s Lowe said the economy is expected to expand further in Q1.

- USD steady (USDIndex 99.00).

- US Yields up 1.0 bp at 1.86% and it seems core EGB yields in particular are set to continue to jump higher.

- Equities – CSI 100 and Hang Seng down -1.5% and -1.8% respectively, while the JPN225 has corrected -0.30%, and the ASX actually managed to climb 1.0%. USA500 dropped -0.72%, with the USA30 tumbling -0.56% and the USA100 off -0.28%.

- USOil – steady at $120-122 after it had shot up over $129.00/bbl.

- Gold – Rallied to $2070. Currently at $2042.

- Bitcoin 7% up – trades at $41,383. US Treasury statement allayed market worries about a sudden tightening of US rules around digital assets.

- FX markets – EURUSD higher at 1.0929, USDJPY extends to 115.90 and Cable unchanged at 1.3080.

Today – Today’s calendar is limited and will not distract from the focus on Ukraine. For data, January JOLTS job openings data are due, Weekly MBA mortgage and oil inventory figures are also on tap. The Treasury auctions $34 bln of reopened 10-year notes.

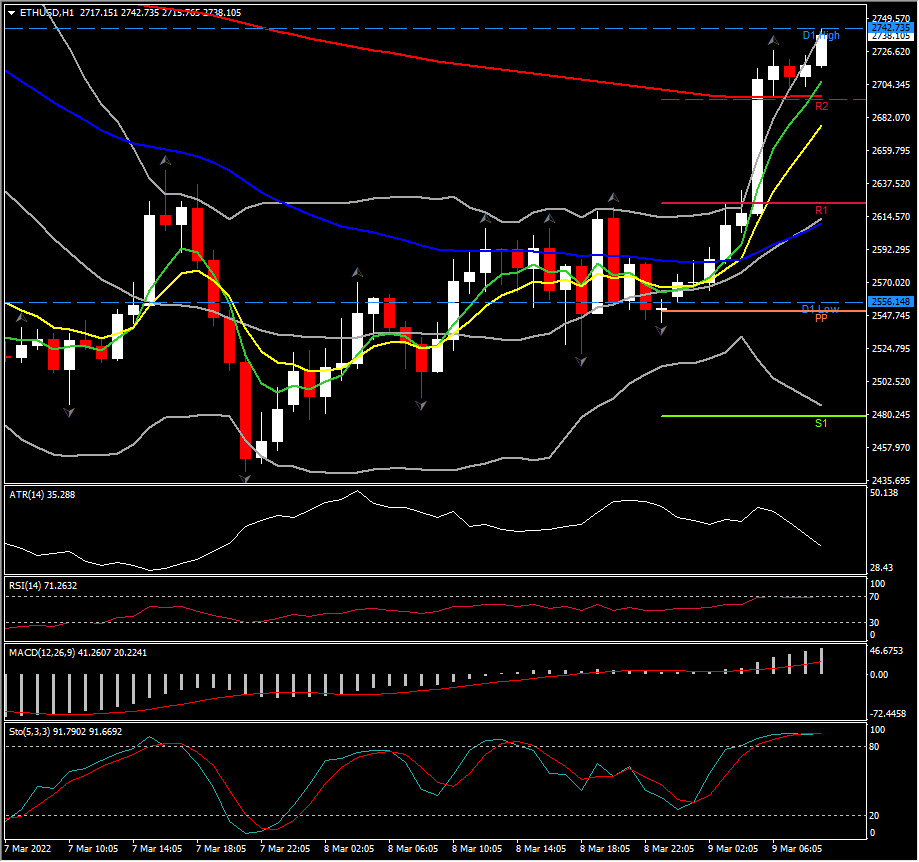

Biggest FX Mover @ (07:30 GMT) ETHUSD (+7.30%) Spiked to 2742, breaking R2. R3 is at 2767. Currently MAs aligned higher, MACD signal line & histogram steady northwards, RSI 5774 but flat, all implying a short term positive bias.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.