There was a bounce in US Equities following a collapse in the Oil price to under $100 as Zelenskiy suggests Ukraine will not seek NATO membership & talks with Russia are more “realistic”. Putin’s shelling and grind forward continues. US warns-off any sanction busting Chinese move, more sanctions from the West on Russian property, goods and people, Russia sanctions Biden & Clinton as it prepares for a massive default. Big rally in China shares following Covid infection spike collapse on Monday and a return of risk appetite.

- USD (USDIndex 98.80). Struggling to hold 99.00 so far this week, and last weeks 99.40 high.

- US Yields 10-yr up to 2.16% on close – up to 2.18% now.

- Equities – USA500 +89.34 (+2.14%) 4262. US500 FUTS higher at 4287 now. Airlines rallied over +9%, Exxon & Chevron lost -5.0% as oil prices collapsed.

- USOil – Tanked from $105.00 highs on Monday to $92.70 yesterday. $97.40 now.

- Gold – Down again to $1906, trades at $1915 now.

- Bitcoin tested new March lows at $37,160 yesterday, trades at $38,600 now.

- FX markets – EURUSD back to 1.0960, USDJPY holds over 118.00 & multiple year highs at 118.40 and Cable tested to the key 1.3000 yesterday, back to 1.3050 now.

European Open – The June 10-year Bund future is down 82 ticks, underperforming versus US futures. Yields corrected yesterday amid a sharp correction in oil prices and as demand concerns tempered supply disruptions. With the FOMC announcement coming into view, bonds are under pressure again, while DAX and FTSE 100 futures are up 2% and 1.3% respectively. China vowed to support markets and the economy, which helped to revive risk appetite. Dollar and Yen retreated as safe-haven demand faded and oil prices stabilized after dropping sharply in recent sessions.

Today – US Retail Sales, Export/Import Prices & Canadian CPI, FOMC Policy Announcement & Powell Press Conference. Also Weekly Oil Inventories & ECB’s Elderson & Panetta

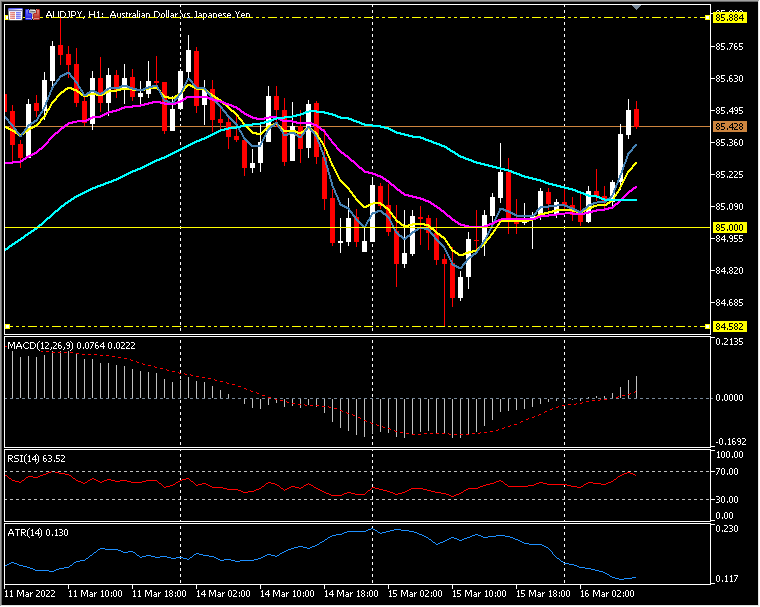

Biggest FX Mover @ (07:30 GMT) AUDJPY (+0.43%) Rallied from 84.60 lows yesterday to over 85.50 now. Friday’s high was 85.88. MAs aligned higher, MACD signal line & histogram hold over 0 line, RSI 66 & rising, H1 ATR 0.1300, Daily ATR 0.9300.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.