The FOMC raised rates as expected by 25 bps AND also announced a further six hikes in 2022 and four in 2023 (which was not necessarily expected). Chair Powell’s press conference soothed the initial hawkish reaction. US stocks leapt higher (NASDAQ +3.77%) USD cooled and Yields moved up. Canada Inflation was hotter than expected, US Retail Sales softer and NZD GDP missed significantly. Overnight AUD Jobs & CHF trade balance both beat significantly. Asian stocks rallied (Nikkei +3%) led by China’s continued bounce back. Biden called Putin a “war criminal”, Russia & Ukraine still talking, China & Israel tout mediator credentials.

BoE Preview: Recent comments suggest that the central bank remains on course to lift the Bank Rate by another 25 bps to 0.75%. The latest BoE survey flagged upside surprises on wage growth and with energy bills going through the roof second round effects from the inflation overshoot are already materialising. Against that background, this is unlikely to be the latest rate hike – at least in the central scenario. Like the ECB, the BoE will have to keep some degree of flexibility on policy options as stagflation risks are mounting, but with the Fed flagging a series of rate hikes this year, and even the ECB on course to normalise policy, the BoE has more cover to continue to tighten policy.

- USD (USDIndex 98.28). Tested 99.00 briefly on FED, down after Powell.

- US Yields 10-yr up to 2.188% on close – down to 2.15% now.

- Equities – USA500 +95.41 (+2.24%) 4357. US500 FUTS flat at 4347 now. Tech rallied FB +6%, NFLX & TSLA +4.78%, Starbucks + 5.16%.

- USOil – Found support at $93.00 yesterday. $96.40 now.

- Gold – Down to test $1900 yesterday, trades at $1934 now.

- Bitcoin tested over $41,000 yesterday, trades at $40,600 now.

- FX markets – EURUSD back to 1.1035, USDJPY holds over 118.00 & 5-year highs at 118.75 and Cable tested to the key 1.3000 yesterday, back to 1.3050 now.

European Open – The June 10-year Bund future is up 26 ticks, U.S. futures are also backing up from yesterday’s lows. Yields have started to move up from overnight lows, but for now it seems bonds are set for a positive start, despite the Fed decision yesterday. Still, markets were pretty much prepared and took solace in the Fed’s apparent confidence that the economy can withstand the withdrawal of support. Coupled with China’s promise to support markets and the economy that is bolstering stock market confidence, DAX and FTSE 100 futures are up 0.4% and 0.2% at the moment. There doesn’t seem to be progress in the Russia-Ukraine talks though, which will likely keep a lid on indexes, that already jumped higher yesterday. Investors may also be cautious ahead of today’s BoE announcement.

Today – EZ CPI, US Weekly Claims, Ind. Prod., Japanese CPI, BoE & CBRT Policy Announcements, Speeches from ECB’s Lagarde, Lane & Schnabel.

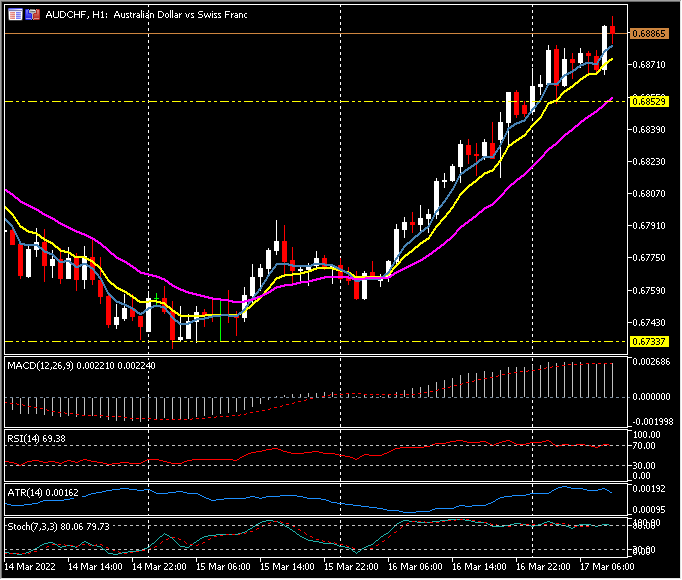

Biggest FX Mover @ (07:30 GMT) AUDCHF (+0.43%) Rally continues after another big move yesterday from 0.6730 lows Tuesday to over 0.6885 now. MAs aligned higher, MACD signal line & histogram hold over 0 line, RSI 69 & rising, H1 ATR 0.00162, Daily ATR 0.0071.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.