Mexico’s seasonally adjusted manufacturing confidence index fell to 52.2 in March 2022 from a downwardly revised 52.4 in the previous month, its lowest in five months. Markets are generally less interested in investing, and to a much lesser extent sentiment is deteriorating regarding the future economic situation of the country and the future financial situation of companies. On the other hand, opinion about the company’s current financial situation is more optimistic (55.4 vs 54.4) as well as about the country’s current economic situation (50.3 vs 50.1).

Meanwhile, the annual inflation rate in Mexico remains high. In February 2022 it rose to 7.28%, from 7.07% in January, above market expectations of 7.23%. The core inflation rate rose further to 6.59%, the highest since June 2001, from 6.21% in January. On a monthly basis, consumer prices rose 0.83% from the previous month, above market expectations of a 0.80% increase and rebounding from a 0.59% increase in the previous month. The report for March will be released this Thursday, April 7, with a forecast of an increase to 7.44% and a consensus of 7.35%.

Earlier, Mexico’s central bank raised its overnight interbank rate target by 50 basis points to 6.5% on March 24, as expected, citing inflationary pressures from the war in Ukraine and expectations of a faster withdrawal of monetary stimulus worldwide. It was the 7th straight gain and brought borrowing costs to their highest level since March 2020. Policymakers noted that headline inflation rose to 7.29% from a year earlier in the first two weeks of March and core to 6.68%, while expectations for 2022 and 2023 will increase again. Medium-term forecasts for headline inflation were revised up, while expectations for core inflation were unchanged and longer-term expectations remained steady at above-target levels. The bank revised its forecasts for headline and core inflation significantly upwards for the entire year and convergence to the 3% target is now expected to be achieved in the first quarter of 2024.

Why does the Peso stay strong?

The Mexican peso has gone from being just a national currency to a formidable international financial instrument in recent decades. Typically, Mexico has higher interest rates than the United States, which can attract investment funds into higher-yielding Mexican government bonds that support the carry trade, the adjoining Mexican and US borders have driven billions of dollars in commercial activity, and Mexico’s crude oil reserves contribute to international trade. These 3 catalysts make the Peso a highly liquid currency.

Technical Overview

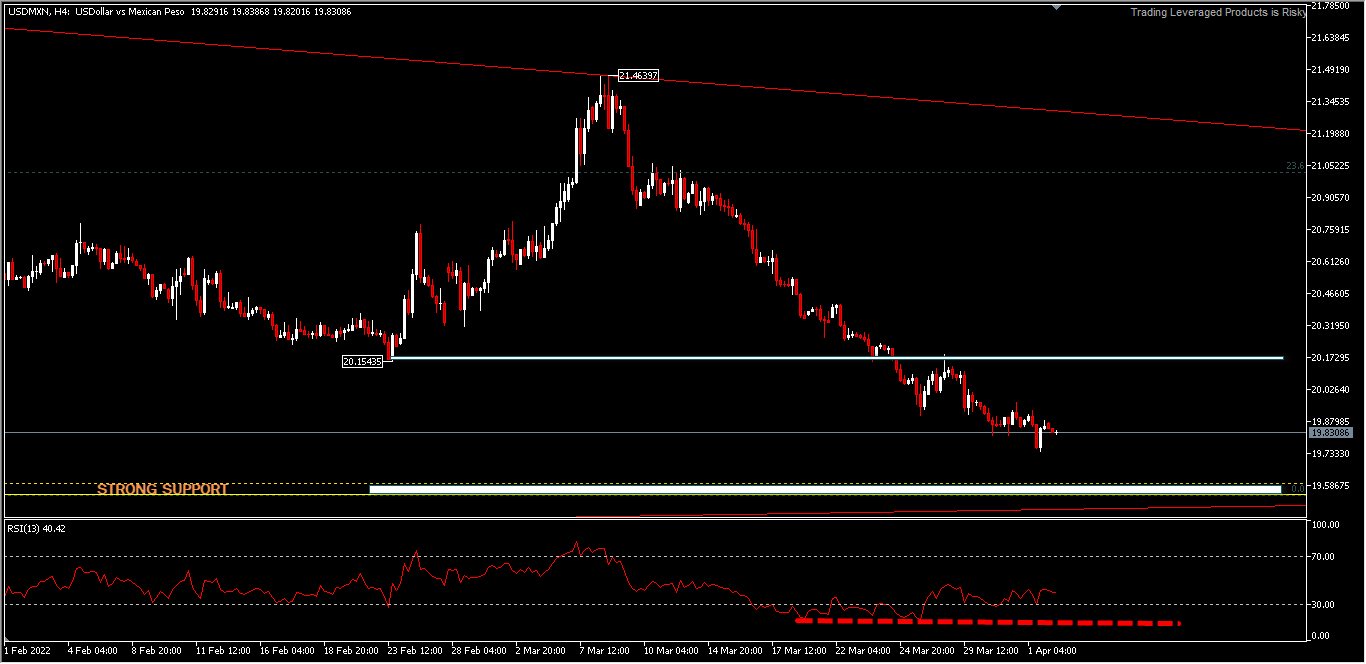

On the weekly timeframe USDMXN has hit its lowest high since the peak of the pandemic in March 2020, at 25.7695. In November 2021, the pair bounced off the 38.2% Fibonacci retracement of March 2020 highs to January 2021 lows, near 22.1498. The resistance persisted and the price continued to fall. USDMXN bounced once again and hit the descending trendline for the week and the pair has been moving lower since then. The price has dropped from the 3-week trendline resistance and broken the key 20.00 psychological round-figure support level and is currently working to test the last 2 remaining supports at 19.5953 and 19.5471. A break of the last support at 19.5471 would take the prospect of a major trend change to the deep downside. The intraday bias remains on the downside to test the 2 support levels mentioned above. Failure to test these 2 support levels will bring a bounce to the upside for 20.0000 and 20.1542 first. The market has been expecting and anticipating action from Banxico. With the RSI so oversold on the 4-hour timeframe, a move above 20.1542 will bring some ripples of a correction wave.

Click here to access our Economic Calendar

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.