US Crude (USOil) extended losses to $95 a barrel, down more than 22% from the high seen on March 24, on the back of the release of the US and its allies’ strategic oil reserves and China’s strict pandemic lockdown measures. The oil prices may further fluctuate in the short-term, as OPEC will announce the crude oil market report today (specific time to be determined), and the EIA and IEA reports are due to be released tomorrow.

Weak oil prices also affected Canada, one of the major crude oil exporters, with USDCAD stabilizing and rebounding from a low of 1.2402 on April 5 and extending its upward pattern, recording a gain of more than 1% in five trading days. The former posted gains against a number of major currencies as markets priced in higher inflation and accelerated monetary tightening by the Federal Reserve. In the fixed income market, the 10-year US bond yield reached 2.77% for the first time since March 2019; the 5-year bond yield and the 30-year bond yield also hit the highest levels since late 2018 and May 2019, respectively, closing at 2.77% and 2.81%. Today, the market expects that the US CPI will increase by the highest rate in 30 years, reaching 6.7%.

In addition, the risk aversion sparked by the uncertainty in Ukraine and higher yields in the United States compared to other major countries further cemented the strength of the Dollar. This Wednesday (13/4), the Bank of Canada will announce its interest rate decision and quarterly monetary policy report, and Governor Macklem will also hold a press conference an hour after the meeting.

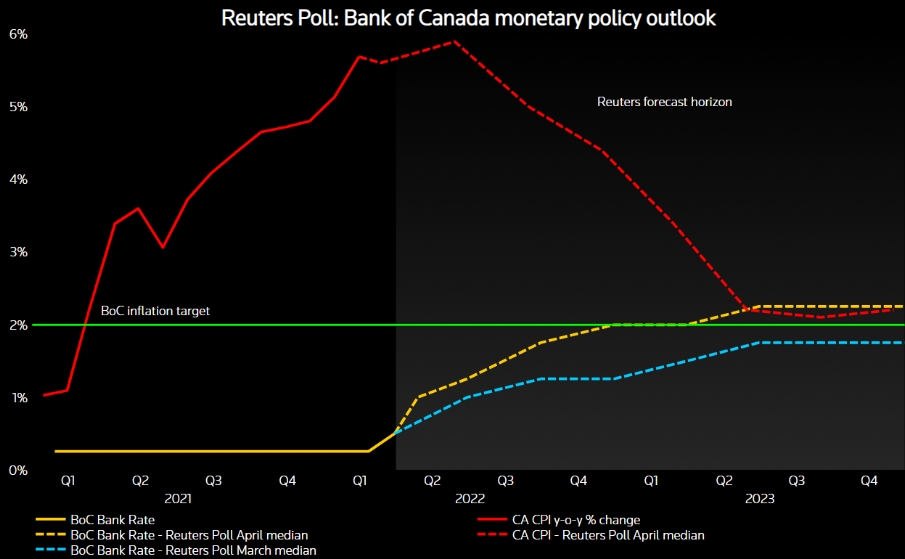

Economists expect the central bank to raise rates by 50 basis points to 1.00%, according to a Reuters poll. If true, this would be the first time the Bank of Canada has raised interest rates by 50 basis points since May 2000. In addition, the outlook shows that inflation is widely expected to remain elevated at 6% in the second quarter of this year, then gradually decline and eventually return to just above 2% in the second quarter of 2023.

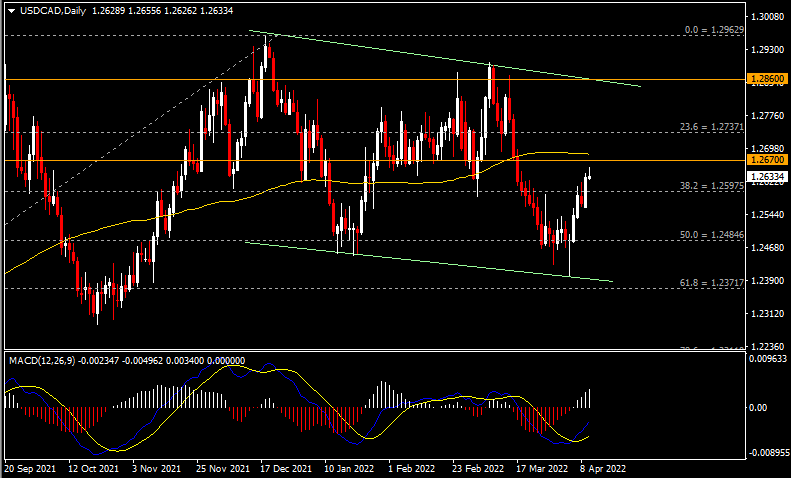

Technical analysis:

On the daily chart, USDCAD closed above the 1.26 level overnight. Near-term resistance is 1.2670, which is also the 100–day SMA. If the bulls break through successfully, this will further validate the signal of the MACD golden cross and continue to test the resistance at 1.2740 and 1.2860. If the price is under pressure and closes below the 1.26 level, it means the pair will continue the downward pattern seen since early March and further test 1.2480 (FR 50.0%) and 1.2370 (FR 61.8%).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.