Rising inflation rates, rising bond yields, deficient labor sector conditions and rising commodity prices have put pressure on the stock market. In addition to the Russian invasion of Ukraine, this poses a major challenge to banking sectors around the world and adds to Investor concerns that economic growth might slow in the future and in turn impact stocks in the financial sector.

Major US banks begin their earnings reporting season on Wednesday, April 13, 2022, starting with JPMorgan Chase & Co, a major finance and investment bank company, which is scheduled to report its Q1 2022 fiscal report ahead of the US market opening. JPMorgan offers a variety of investment banking products and services in the capital markets covering corporate and structural strategies, equity financing campaigns, brokers, market research and more.

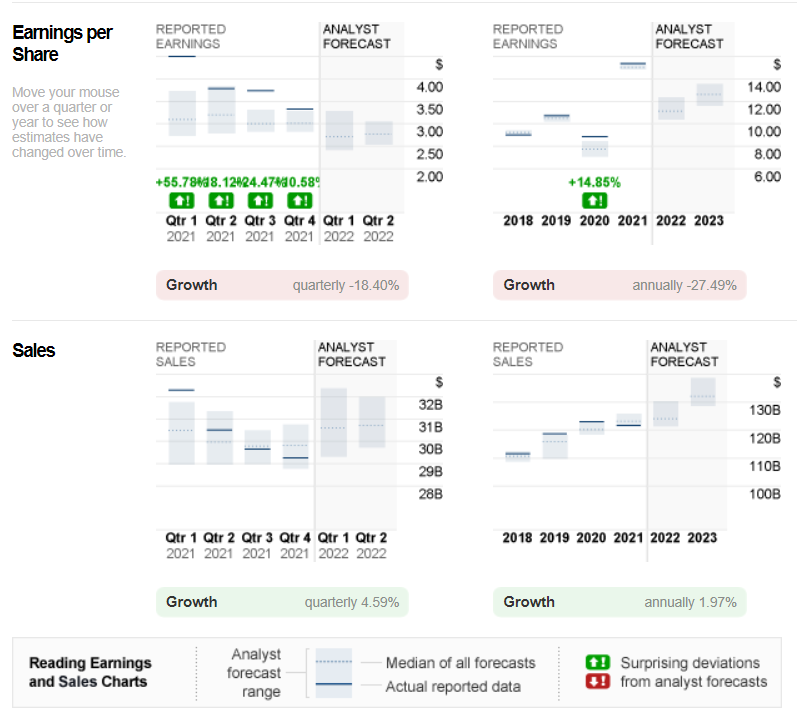

After a good earnings report in 2021 where JP Morgan managed to outperform market projections in 4 consecutive quarters, investors expect JP Morgan’s report for Q1 2022 to be slightly lower compared to the same quarter last year. Analysts project Q1 earnings (sales) report at $30.6 billion, up from $29.8 billion in the 4th quarter of 2021, but earnings per share are expected to be lower at a projection of $2.72 per share compared to $3.33 per share in the 4th quarter of 2021. The consumer and community banking sectors are expected to be the largest contributors to JP Morgan’s revenue followed by the investment and corporate banking sectors.

Although JP Morgan’s financial data (MT5: #JPMorgan) has showed an increase since last year, #JPMorgan’s share price clearly moved the opposite way, with #JPMorgan’s stock showing a downward trend since October 2021 and reaching its lowest level in early March 2022 at $128.95. #JPMorgan is down nearly 25% from its October 2021 high of $172.93 and is currently trading at $131.64. Technically, #JPMorgan is now in the area of a price correction (retracement). It is currently trading below the 38.2% fibo retracement level of $136.12 which is now an important resistance followed by resistance at the MA-50 at $142.00 The 2022 low of $128.95 has become an important support for #JPMorgan followed by an important psychological level at the 50% Fibo retracement of $124.75. The RSI-14 shows #JPMorgan shares in bear territory but yet to reach the oversold level with the MACD line also below the 0 level.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

HF Education Office Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.