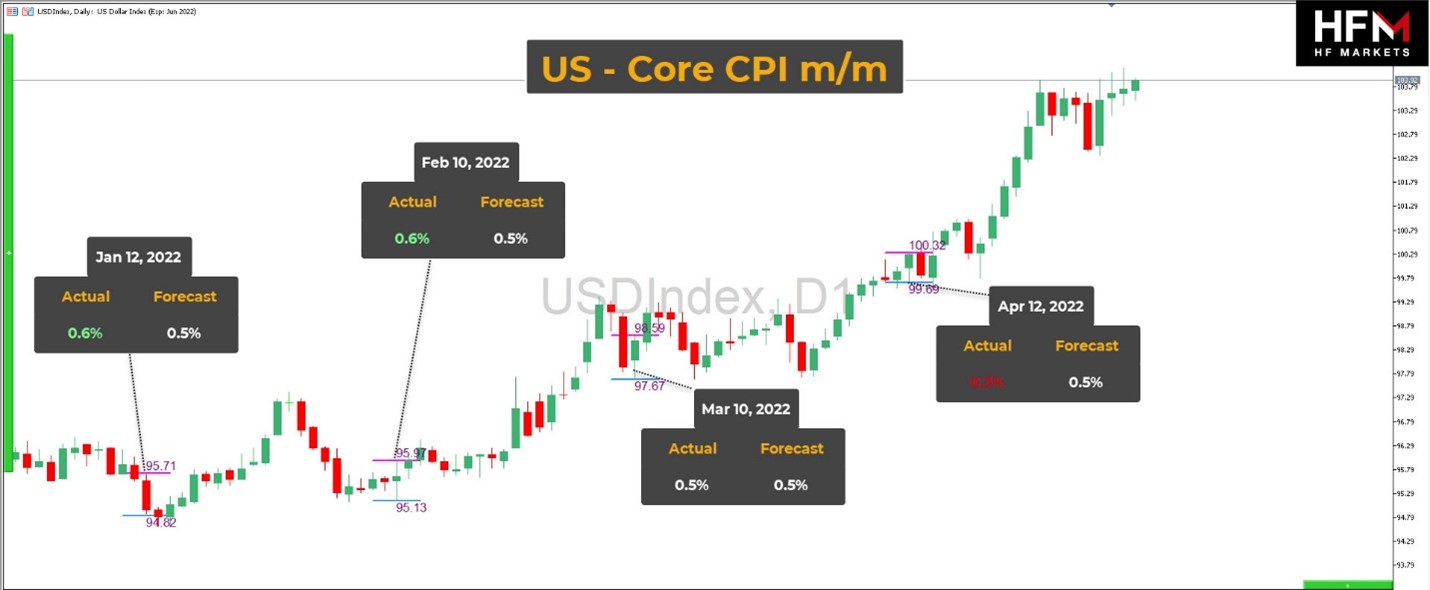

The forthcoming US CPI data are expected to indicate that inflation continued to rise in April, albeit at a slower rate than in previous months. The Bloomberg survey of experts forecasts an 8.1% increase in US consumer prices following March’s 8.5% increase. This is the first decline in inflation since August 2021. It is also anticipated that the “core” CPI, which removes the influence of volatility in the energy and food sectors, will have slowed in April compared to the same month last year. However, a report anticipated on Wednesday could reveal that core inflation has risen from the previous month.

Greg McBride, chief financial analyst at Bankrate, believes that house prices warrant close attention. He stated that housing represents 40% of the CPI, as do household budgets, and that this, together with double-digit rent hikes, strains household budgets even if food and energy prices remain stable. In addition to this CPI report, the US Federal Reserve is expected to contemplate a further increase in interest rates of 0.5 basis points at its June meeting. Consequently, the Fed’s computation may deviate significantly from its CPI projection if the CPI divergence is considerable in either direction.

Due to the quick rise in inflation, the US Federal Reserve has been compelled to aggressively raise interest rates and deleverage its balance sheet by $8.9 trillion. Consequently, equities are currently in correction area or a bear market. Inflation was mostly caused by problems with the supply chain and growing demand as a result of the outbreak.

We shall learn the April consumer price estimate on Wednesday, prior to the opening of the stock markets. The proportion of all items is anticipated to decline from 8.5% to 8.1%. Compared to March of the previous year, energy prices increased by 32% in March. Diesel and gasoline prices were nearly steady in April, which will help restrain inflationary pressures, given that they account for around 4% of the CPI, and climbed 48.2% year-over-year in March.

How much did UK GDP grow in the first quarter?

Following the removal of all Covid-19 limitations earlier this year, the Bank of England forecasts a first-quarter expansion of 0.9% for the British economy. According to Reuters, economists predict that the gross domestic product could climb by 1% during the quarter for which data will be revealed on Thursday. During this period, manufacturing is also anticipated to increase by 0.1%. This would affirm the 0.1% growth rate in February, which decreased from 0.8% in January. Ellie Henderson, an economist at Investec, forecasts that economic expansion will resume. However, manufacturing and construction are anticipated to decrease in March, while services are projected to increase by 0.1%. As a result, covid immunisation will be less burdensome, but the leisure and hospitality industries will recover more slowly.

USDIndex

The 4-hour chart of the US dollar index shows an interesting scenario. The index declined and is now wobbling around the 20-period SMA. If the index does not find any support here and falls below the 20-period SMA, we may see a little deeper correction towards the 100.00 benchmark. However, the probability of rangebound market behaviour is rather high.

In case of any upside trend resumption, the multi-year high around 104.20 will be the key level to watch. If the index finds resistance, it may bounce back to the 100-102 range. However, on a valid breakout, the price may soar to 105.00.

Click here to access our Economic Calendar

Adnan Rehman

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.