USDIndex lost some ground, albeit with the index at better than 20-year highs, as the market repriced for more hawkish BoE and ECB outlooks. Yen is also back in demand, suggesting risk appetite is waning .There has also been a significant repricing of BoE and ECB risks. While the Fed remains on track to tighten policy 50 bps at upcoming meetings, there is growing expectation for the BoE and ECB to act to rein in inflation. The BoE is seen lifting rates in June, and may have to move more aggressively due to the increasingly tight labor market, with the ECB likely raising rates in the summer. The Stock markets’ rally has already started to run out of steam and mainland China bourses are struggling to add to yesterday’s gains, leaving the CSI 300 little changed on the day.

- Japan’s economy contracted -0.2% q/q at the start of the year, less than feared, but with Q4 growth revised down to 0.9% q/q from 1.1% q/q reported initially.

- UK CPI inflation hit 9.0% y/y in April, a sharp acceleration compared to the 7.0% y/y in March.

- Equities – a hefty 2.76% pop has been seen in the USA100, along with solid gains of 2.02% and 1.34%, respectively, for the USA500 and USA30. Hang Seng managed a further 0.3% but the advance is looking nothing like the rally yesterday, with dip buying in tech stocks and confidence in China’s economy already faltering. Nikkei and ASX managed gains of 0.9% and 1%, while European equity futures are also managing slight gains.

- Yields 10-year rate is unchanged at 2.986%. The curve bear flattened 2.5 bps to 27.5 bps.

- Oil dipped to 111.80, but currently at 113.10 – there are signs of waning momentum today.

- Gold fell to $1807 as the USD recovered slightly, piling pressure on greenback-priced bullion alongside firm Treasury yields and an aggressive inflation stance by the US Federal Reserve chief.

- FX markets – USDJPY drifted to 128.93. Cable rallied to 1.2500, posting its biggest move in 17 months; EURUSD rose to 1.0563. Also, AUD firmed thanks to hawkish RBA minutes and a pick-up in oil prices.

Today – The calendar includes EU HICP, US Housing Starts, and Canadian inflation.

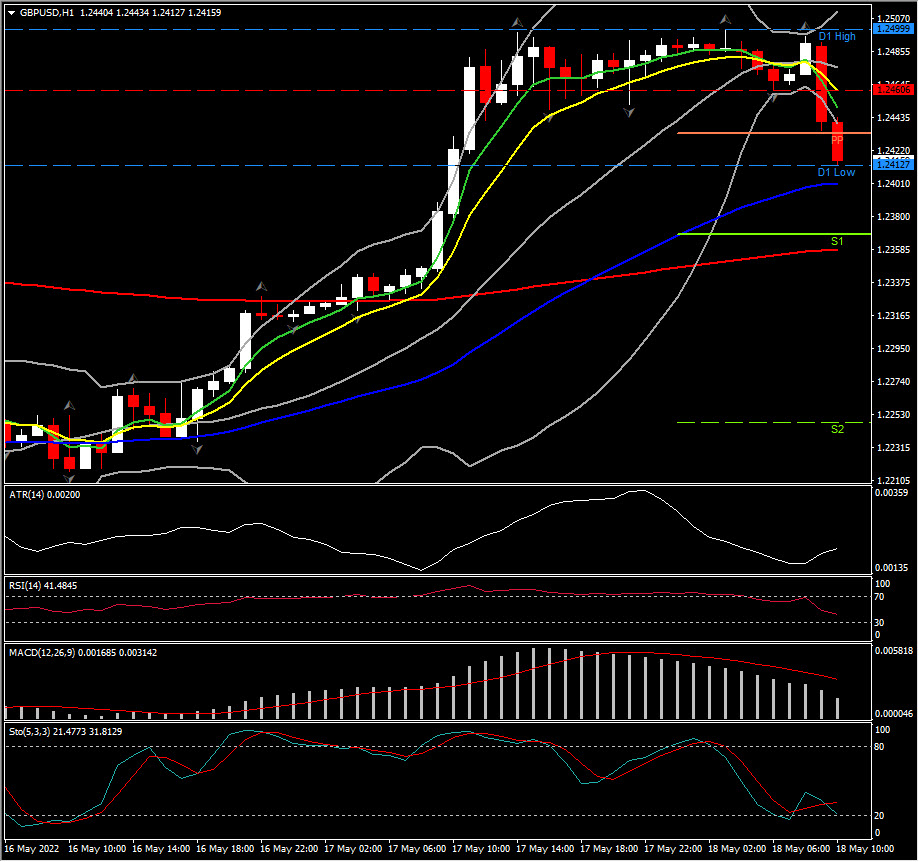

Biggest FX Mover @ (06:30 GMT) GBPUSD (-0.61%) down to 1.2412. MAs aligning lower, MACD signal line & histogram declining, RSI 41 pointing down, H1 ATR 0.002, Daily ATR 0.0140.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.