The FOMC minutes were presented last night, pointing out the need for a continuous increase in interest rates at a rate of 0.50% in the next meetings (June and July) for a faster control of inflation.

The minutes were largely as expected, revealing general consensus across the Committee as seen in the unanimous vote for policy stance. There was the hawkish tone seen going into the May 3-4 meeting as the Fed moved to contain inflation with “all” participants in favor of the May actions. The minutes also confirmed that “most” thought 50 bps increases would be appropriate at the next couple of meetings as it was “important” to move “expeditiously to a more neutral policy stance.” And it was also noted a “restrictive stance” may become appropriate depending on the evolution of the economy and the risks to the outlook. The high level of uncertainty from the war and covid lockdowns in China was noted, and that prompted officials to state that “risk-management considerations would be important in deliberations over time regarding the appropriate policy stance.” And it was also the case that “many” believed that “expediting” the tightening process would leave the Committee “well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.” That final statement could be a harbinger of a Fed blink. Remember Bostic recently broached the potential for a pause after the summer rate hikes. We suspect the Fed will be in a better position to judge by the August Jackson Hole conference.

Most participants felt that 50 basis point increases in the target range would likely be appropriate over the next two meetings” – FOMC Minutes

The FOMC members mentioned that the Russia vs. Ukraine war and the blockades in China have made the economic situation of the United States difficult, leaving it in a position of uncertainty, creating an advantage for inflation and worsening the supply chain. On the other hand, members “considered that it was important to move quickly to a more neutral monetary policy stance” and “that a restrictive policy stance may well become appropriate” as the economic situation evolved.

To this end, participants agreed that the Committee should quickly “move the monetary policy stance toward neutral, through increases in the target range for the federal funds rate and reductions in the size of the Federal Reserve’s balance sheet.” – FOMC Minutes

On the issue of the Fed’s $9B balance sheet reduction, the plan is to increase the maximum level of income progressively in the next 3 months, for Treasury Bonds $60,000 million, for agency debt and mortgage-backed securities $35,000 million in addition to sale direct mortgage-backed securities that would be given advance notice. The Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.

Investors will be wondering if these measures will be enough, doubting what these measures can do to stability and to lower inflation without putting the country in an economic recession, in a world that is already heading that way.

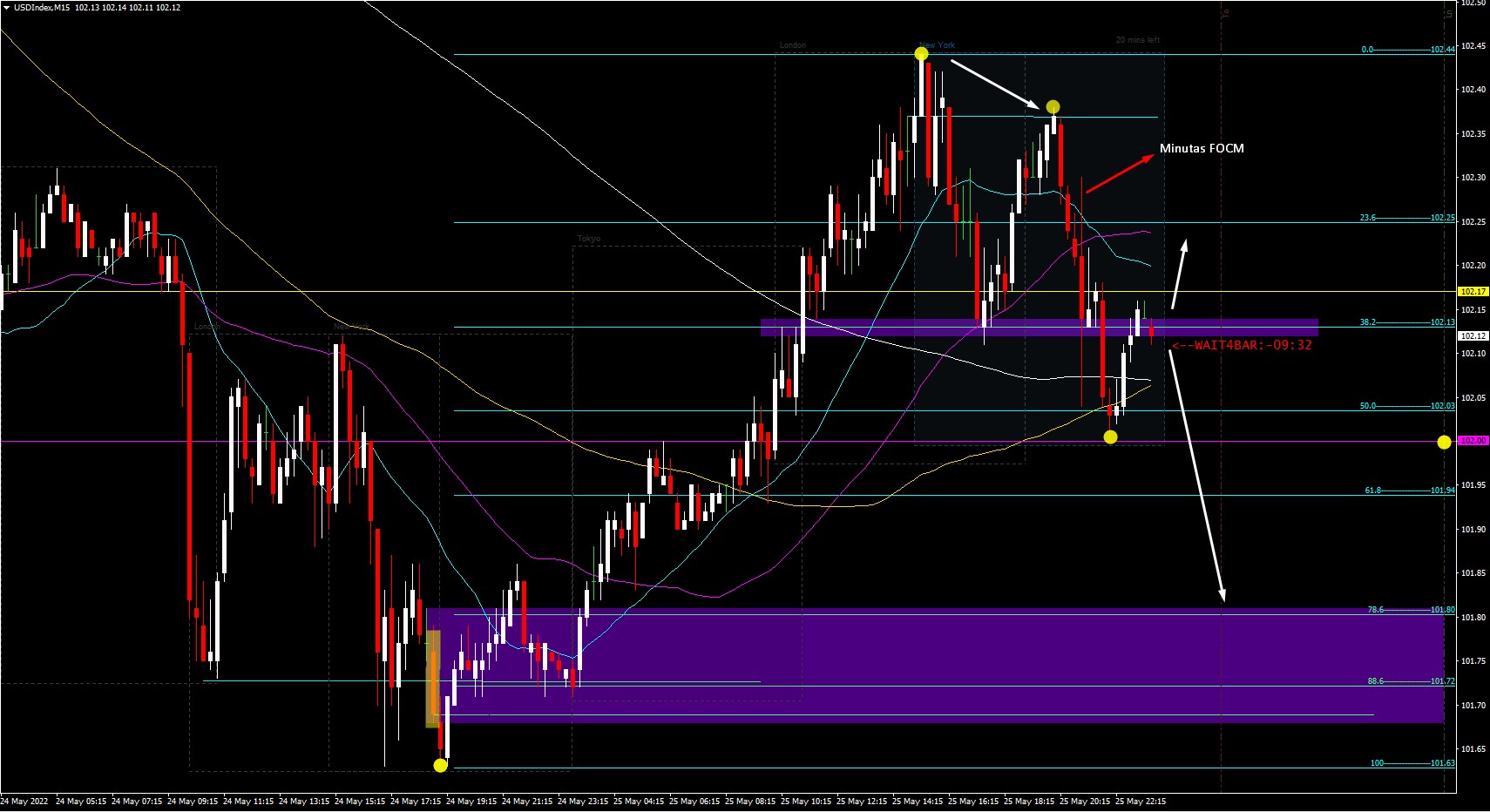

Technical Analysis

The USDIndex price has been in a downtrend since the start of the NY session, marking a failure of highs and fall below the low marked at the Fibo 38.2% level at 102.13, falling to the psychological level of 102.00 and pulling back to the Fibo level previously broken. It could now continue falling to the Fibo 61.8% level at 101.94 and, if broken, to the lows of the cycle at 101.72-101.80 which encompasses the order block of this bullish momentum.

Click here to access our Economic Calendar

Aldo Weidner Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.

Source:

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20220504.pdf

https://www.cnbc.com/2022/05/25/fed-minutes-may-2022.html