The Walt Disney Company, which has a capitalization of 194.2B, is the world’s largest American media and entertainment conglomerate operating streaming services, movies and theme parks globally. Disney plans to report its earnings report for Q3 2022 (Disney’s fiscal year begins in October of each year) on Wednesday, August 10 after the market closes.

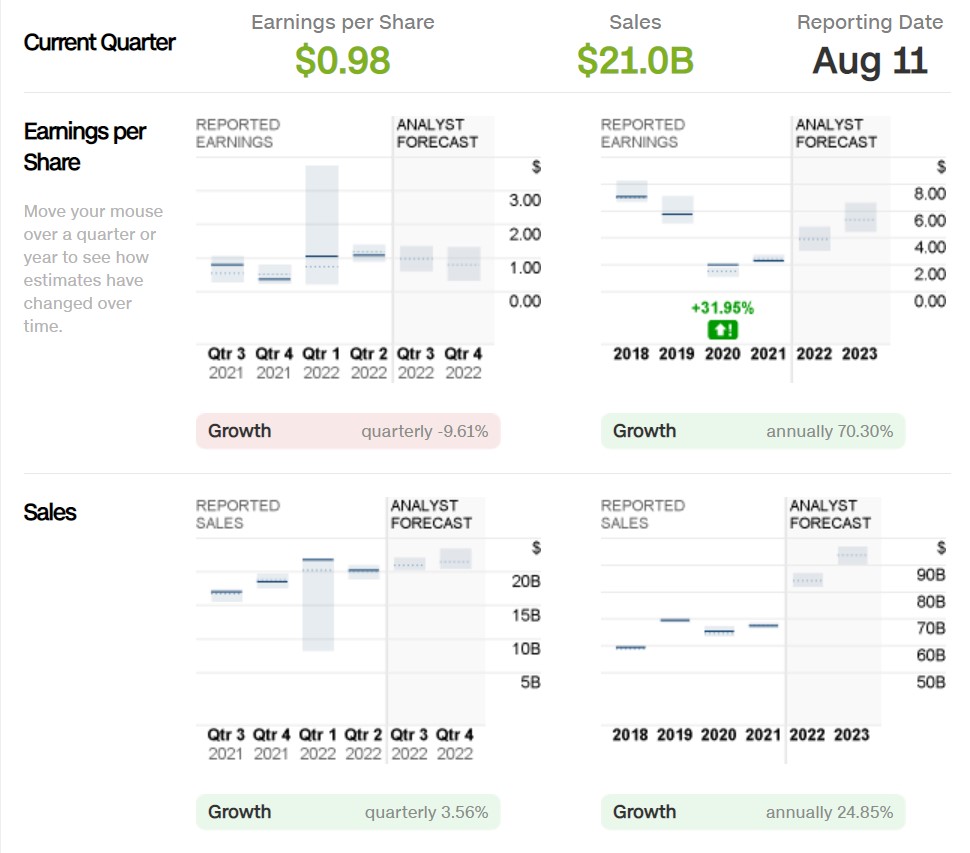

Zacks positions Disney Rank #3 (Hold) in the Top 40% position #103/252 of the Media Conglomerate industry. For this report, an EPS of 0.87–0.94 (+17.5% y/y) is expected, although there are speculations that it could reach $0.99 with a -7.70% ESP. A profit of 21.12B is expected, which would be a year-on-year growth of 24.06% compared to 17.02B last year. The estimate has had 3 upward revisions and 1 downward revision in the last 60 days. The company beat estimates in 3 of the last four quarters only disappointing once, while surprise EPS averaged +89.11%. Disney boasts a P/E ratio of 27.15 and a PEG ratio of 1.28.

Last quarter the company reported EPS of $1.19, up 37% y/y, and revenue of $19.2B, up 29% y/y.

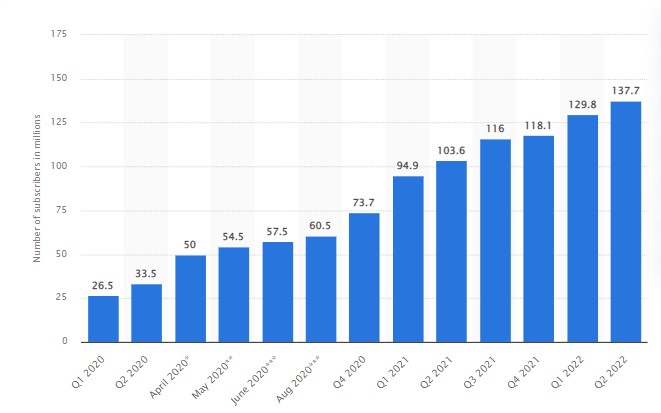

One of the main factors to take into account for this report is the continued growth of subscribers for Disney+, which has become one of its main profit drivers. The platform has not stopped increasing its subscribers since the start of the service in November 2019, thanks to the pandemic that affected online entertainment and its extensive portfolio of exclusive content, currently with an estimate for this Q3 2022 report of 148,703M subscribers globally, up 28% /y and up 7.99% from 137.7 million subscribers in Q2 2022, a new historical maximum that is expected to be broken in this report. On the other hand, Disney+ recently reported that it added several countries in the Middle East and North Africa in its portfolio where the service is offered.

Disney+ is in position #3 of Streaming Services, behind Amazon Prime with 205M subscribers and Netflix with 225M. Disney+ is expected to overtake these based on growth in the coming years.

Streaming Marvel movies on Disney+ is a reliable revenue generator and key element of subscriber retention. The recent Marvel movie Dr. Strange in the Multiverse of Madness grossed $185M in the US alone, which made it the second highest-grossing film of the year. However, in contrast, the most recent film, Lightyear, failed to meet box office expectations grossing only $50.6M vs. $70M expected.

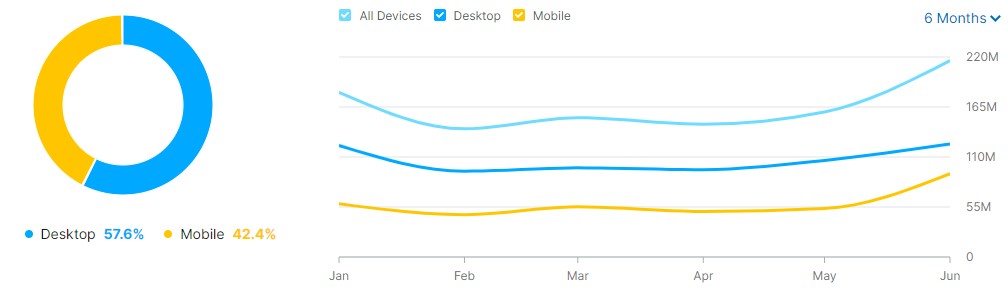

Disneyplus.com had a total of 521.5M page views in April (146.1M), May (159.5M) and June (215.9M). 25.7% of visitors were in the United States followed by the United Kingdom with 9.4% and Canada with 6.29%. The age range of 18-34 years formed more than 60% of the total. The page has 987,000 visitors daily with daily ad revenue of $80k. The value of the website amounts to $700,900,000.

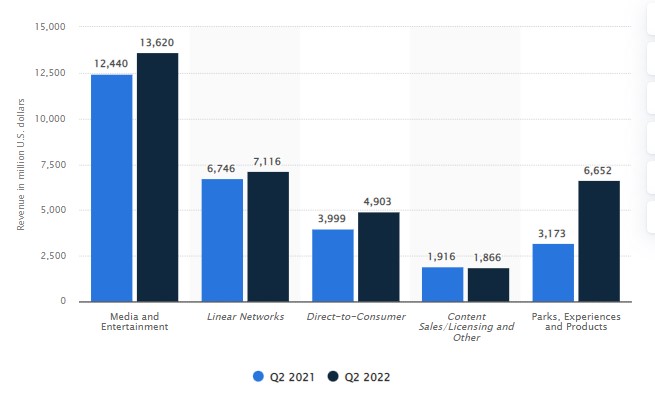

On the other hand, the reactivation of theme parks will also be important for this report since it will reflect the benefit of the recovery that has taken place in recent quarters following their temporary closure due to the outbreak of Covid. The increase in the Dollar and gasoline will also be a headwind for theme parks outside and inside the US creating difficulty for international and national visitors to attend the parks.

Zacks estimates revenue from parks, experiences and consumer products at $6.71 billion, up +54.6% y/y and up +0.87% from Q2 2022. In other segments, last quarter Disney obtained 13,620M in Media and Entertainment, 7,116M in linear Network, 4,903M Direct to consumer, 1,866M from content sales, licenses and others.

We cannot ignore the current world situation. The vertiginous increase in inflation and the already more palpable fear of a recession, together with the increase in the price of gasoline, has marked a change in the behavior of consumers who have stopped spending on non-essential things and increased capital for basic products. Consumers have stopped paying for cable and satellite TV in which Disney is one of the main payment recipients. Likewise, the world situation has reduced spending on advertising not only for Disney but for most companies in general, which also creates difficulty for the company. All of this has marked an underperformance this year, marking a more than 40% drop in its shares from its highs in 2021.

Technical Analysis – #Disney $109.17 (+2.33%)

On a weekly basis the price has fallen from its all-time high at $203.02 on March 21 for 16 months to the 88.6% Fibo at $93.18 with current lows at $90.22 from where it bounced back to the 20-week SMA at $108.51 currently under test. The last lows from where this current cycle started is at $79.05 in March 2020. The price recovered $100 3 weeks ago and has remained above it so far.

Resistance is at the psychological level and previous highs at $120.00, the 61.8% Fibo at $126.41. There is a “Death Cross” (which is unlikely to last long) with the 50-week SMA at $137.75 and just above the 200-week SMA at $139.45, 100-week SMA at $153.21 just shy of the 38.2% Fibo at $155.66. Regarding the supports, the low of the cycle is our support since 2014, if it is broken the price could have a strong fall to the psychological level of 50.00 and from there to the low of 2011 at $30.00.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst – Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Sources:

- https://www.zacks.com/stock/quote/DIS/detailed-earning-estimates

- https://thewaltdisneycompany.com/app/uploads/2022/05/q2-fy22-earnings.pdf

- https://www.statista.com/statistics/1095372/disney-plus-number-of-subscribers-us/

- https://finance.yahoo.com/news/walt-disney-dis-report-q3-165204000.html

- https://markets.money.cnn.com/research/quote/snapshot.asp?symb=DIStemp