USDIndex retests 106.81 after better than expected Retail Sales and the 2-fisted FOMC minutes did not lean particularly hawkish or dovish. They did not clarify the likely outcome at the September 20-21 policy meeting, leaving the door wide open for either another 75 bp increase or a 50 bp hike. What is clear is policy is data dependent. US Treasuries Yields pulled back slightly while US Stocks closed weaker. Metals gains were kept in check. Concern over China’s property sector has flared up again and the current heatwave has led to power cuts in some regions. Meanwhile Australia’s jobless rate fell to 3.4%, but an unexpected decline in employment should give the Reserve Bank more room to maneuver. Elsewhere RBNZ Governor Orr apologized to lawmakers for the bank’s contribution to high inflation saying “our core inflation is too high and that suggests at some point monetary policy was too loose for a period”.

- USDIndex chopped as the market assessed the inflation, recession, and Fed dynamics. The index was modestly firmer as the FOMC assured it is still on a rate hike path while there are doubts about how aggressive the BoE and ECB will be able to be in the face of a looming recession.

- Equities – USA500 was -0.72% lower (4,262.70). The USA100 slumped -1.25% (13,405), and the USA30 stumbled and posted a -0.50% decline (33,885). Nikkei corrected -0.96%, the ASX -0.2% and Hang Seng and CSI300 are down -0.8% and -0.7% respectively.

- Yields – 10-year Treasury rate is down -1.1 bp at 2.89%, but rates moved higher in Australia and even more so New Zealand. Japan’s 10-year has lifted 1.1 bp to 6.19%.

- Oil – steady above $85 territory after the surprising draw in crude oil inventories.

- Gold – fell to $1761.85.

- FX Markets – EURUSD dropped to 1.0152, USDJPY lifted at 135.38 and Cable slumped to 1.1995 extending losses post UK CPI at 10.1% y/y.

Today – US Jobless claims, Philly Fed, Existing Home Sales. FOMC Member George and Kashkari Speeches. Earnings: Estee Lauder, Applied Materials, Kohls.

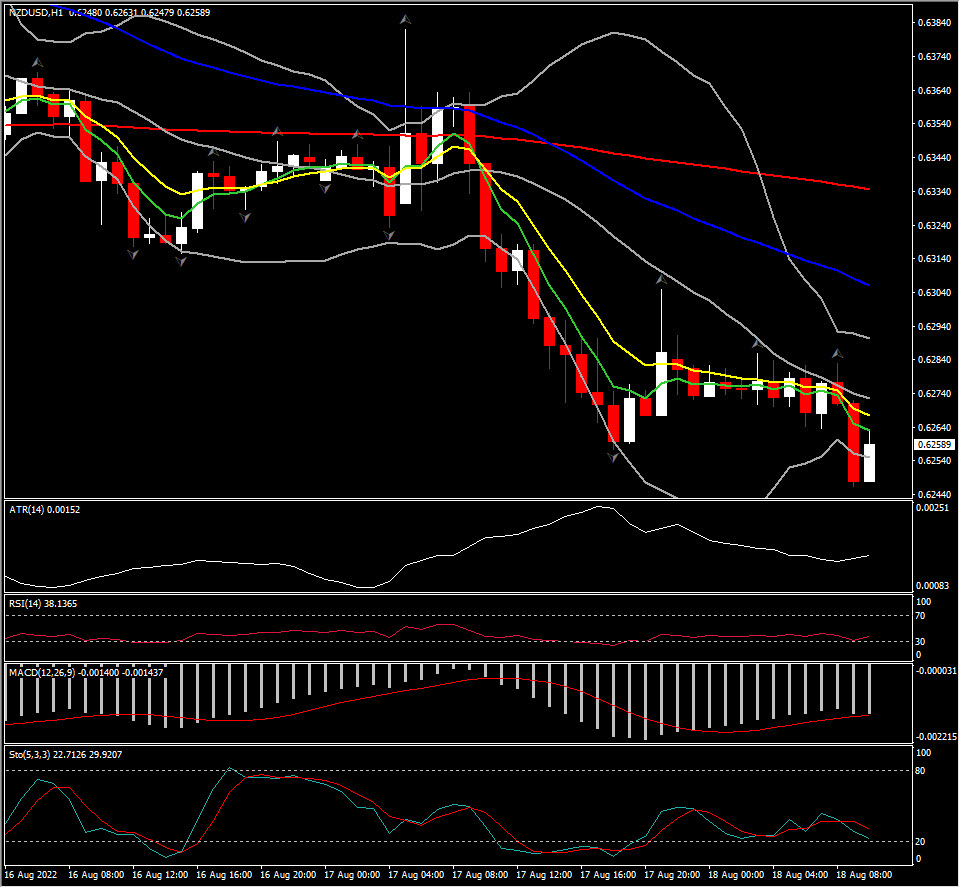

Biggest FX Mover @ (06:30 GMT) NZDUSD (–0.27%) down to 0.6246. Fast MAs aligning lower, RSI 36 & falling, Stochastic also down, but MACD lines flattened below 0. H1 ATR 0.00152, Daily ATR 0.00796.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.