The Eurozone’s record inflation print of 9.1% has left markets pricing in a 75 basis point hike at next week’s meeting. The hawks are expected to push the debate of a 75-basis point hike as a way to force the doves into agreeing to a half point move.

This leaves the risk of disappointment if the ECB doesn’t deliver. This could mean further problems for the EUR and thus additional inflation risks. For the Eurozone though, 100 basis points of tightening over two meetings is a significant step, and one that should go some way toward restoring confidence in the central bank and its commitment to defending price stability.

The ECB kicked off its tightening with a bold 50-basis point move at the last meeting. The doves hoped that the front loading would allow a switch to more conservative quarter point moves at subsequent meetings. Yet, instead of now eyeing a return to more “normal” quarter point steps, it is clear that the hawks are pushing for another half point hike and would like to debate a 75-basis point move in the light of record high inflation, which reached 9.1% in August.

This week’s council meeting will come with updated staff projections, which are likely to bring considerable upward revisions to the inflation projections, at least near term. ECB’s Schnabel already said during a panel discussion at the Fed’s Jackson Hole Symposium that

“In this environment, central banks need to act forcefully. They need to lean with determination against the risk of people starting to doubt the long-term stability of our fiat currencies”. The Executive Board member also argued that much speaks in favor of the central bank acting determinedly even if that means risking lower growth and higher unemployment because a “robust control” approach reduces the risk of very bad economic outcomes in the future.

So, how aggressive of a policy path is meant by “determinedly” and “forcefully”.

What is clear is that a recession is looming now, with data signalling broad based contraction already in the Q3. Things could get much worse over the winter if and when energy shortages lead to outages and rationing. Private consumers will have priority over the winter, which in an extreme situation could force outages at major factories that would also hamper the services sector. Russia’s throttling of gas supplies coincides with major outages at French nuclear power plants and weather-related problems for electricity production, and there are few people now who don’t expect Europe to head for recession. The real question is how long and how deep it will be.

Today’s growth data presented an upward revision, with Eurozone Q2 GDP revised up to 0.8% q/q from 0.6% q/q reported initially. The unexpected upward revision doesn’t change the increasingly gloomy outlook, but still indicates that the Eurozone headed into the energy crisis with a higher starting base than previously thought. Household consumption bounced 1.3% q/q, government expenditure lifted 0.6% q/q and investment picked up 0.9% q/q. The bounce in investment was counterbalanced by a downward revision to Q1 numbers, which show a contraction of -0.8%. Still, an overall solid report and with employment growth accelerating to 2.7% q/q from 2.4% q/q.

All that will give the hawks something to argue with tomorrow, although the dovish camp has plenty of survey data highlighting downside risks for coming quarters.

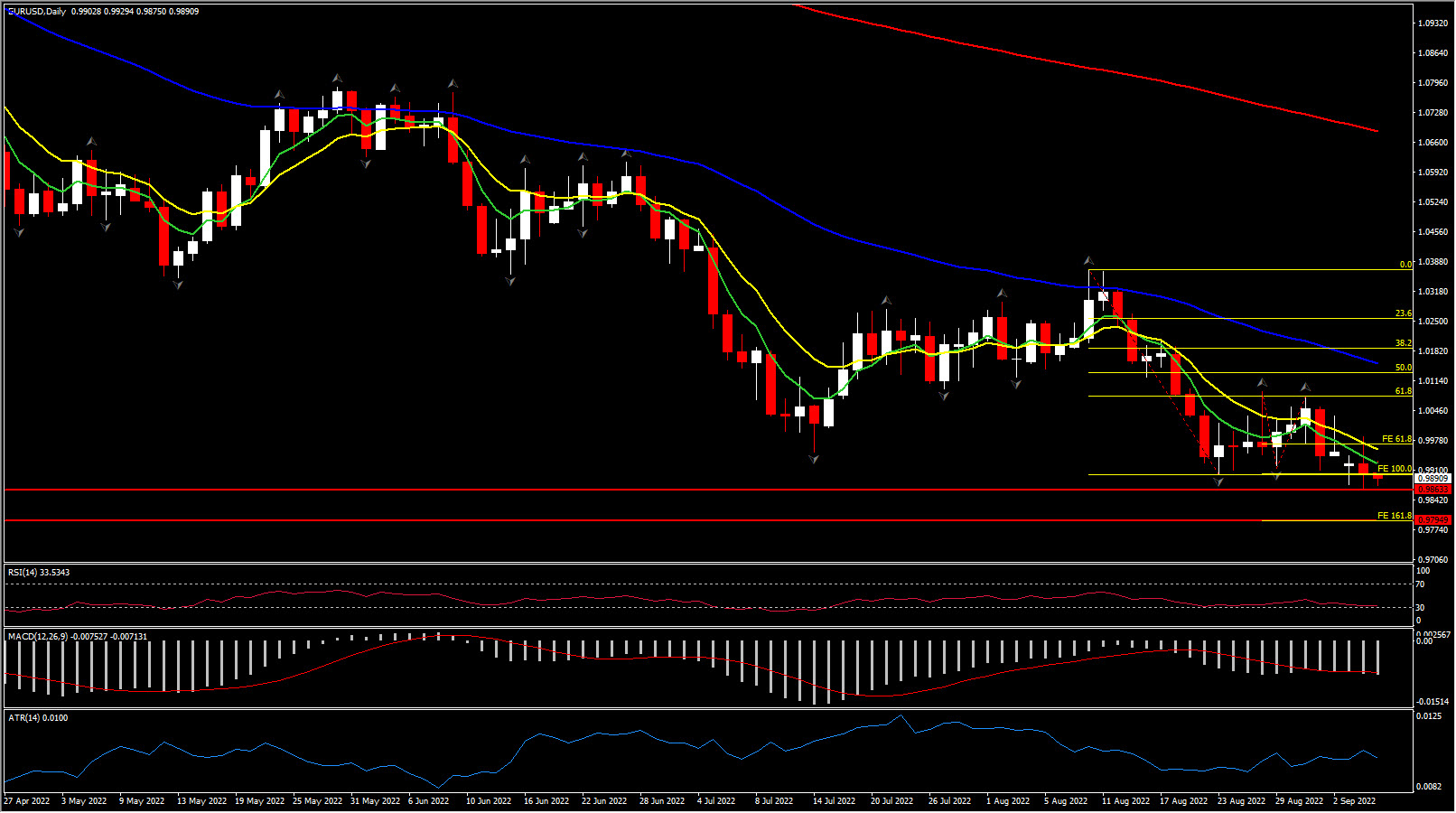

The EURUSD holds below parity as investors also concerned that overly aggressive central bank action will add to growth risks, there may be initial pressure on the EUR in the wake of a half point hike, but the single currency may bounce back quickly, depending on Lagarde’s delivery.

It’s a close call, but a 50-basis point hike is the main scenario, but with a big chance of a 75-basis point hike and an overall hawkish message from the governing council. What is clear is that more tightening is underway. Ultimately, the endpoint for rate hikes will be important for debt financing costs. That endpoint though won’t necessarily be impacted by next week’s decision, as the ECB clearly is front loading the steps towards a neutral position on monetary policy. How far it will go from there will depend on many variables, including the future of relations with Russia and the prospect for electricity production over the winter. Data dependency and flexibility will remain a key part of Lagarde’s message.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.