The Alibaba Group, best known as China’s largest e-commerce company, was founded in 1999 by Jack Ma. It includes online platforms such as Taobao (C2C), Alibaba.com (B2B) and Tmall (B2C), providing all kinds of e-commerce services to cater for online shopping needs. The company has also expanded its businesses internationally through AliExpress and Lazada.

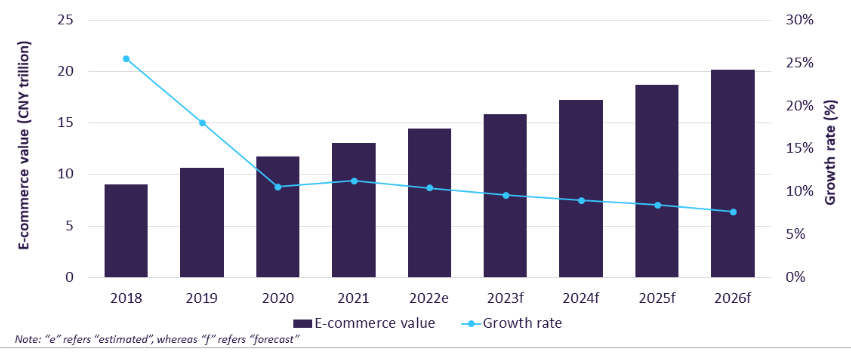

Fig.1: China E-commerce Value (CNY trillion). Source: GlobalData

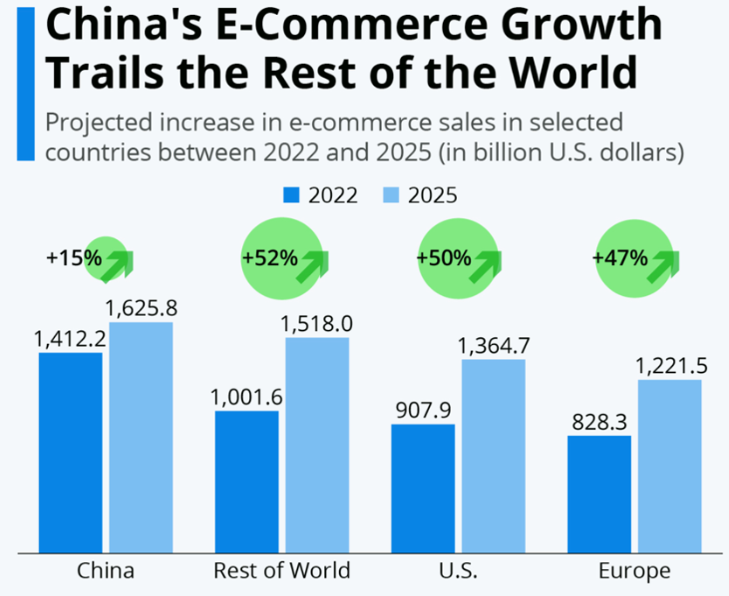

In conjunction with China’s National Day (also known as Golden Week, from 1st to 7th October), investors may be interested to know if there will be a spending boom during this period especially in the midst of rigid anti-Covid curbs imposed by the local health officials. According to GlobalData, a leading data and analytics company, the Chinese e-commerce market is expected to achieve a compound annual growth rate (CAGR) at 8.7% between 2022 and 2026, though the growth rate is seen deteriorating compared to the period between 2018 and 2021 (CAGR was 13.3%). This actually shows a worrying sign in the bigger picture. High penetration rate and stiff competition has led to China’s e-commerce industry entering the maturity phase much faster than the rest of the world (and thus hurt the growth of sales for local companies), as displayed below:

Fig.2: E-Commerce Growth – China versus US, Europe and the Rest of World. Source: Indigo Digital

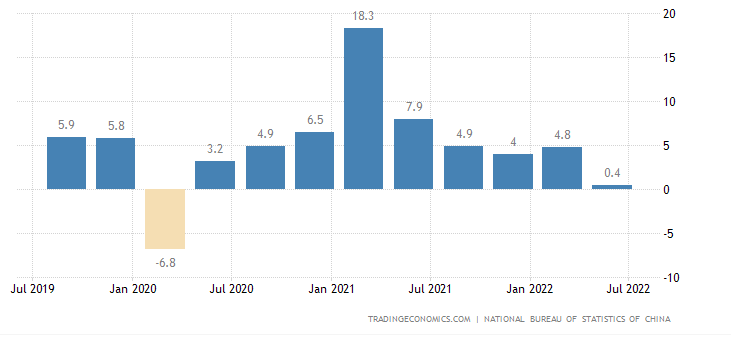

A slowing economy could also be an inevitable alert to the companies. In Q2 2022, China’s annual GDP growth rate was 0.4% (y/y), a sharp decline from that recorded in Q1 2022 which was 4.8%. This was also the softest pace of expansion since a contraction in Q1 2020.

Fig.3: China GDP Annual Growth Rate. Source: Trading Economics.

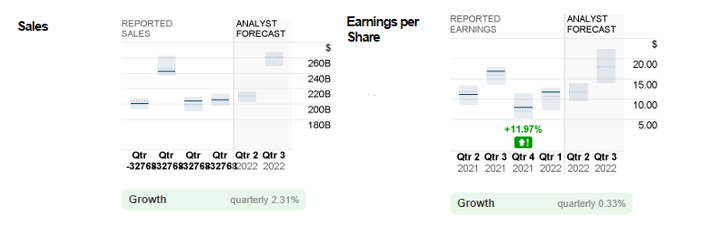

In the near-term, Alibaba may continue to be clouded by soft macro environment, weak consumer sentiment and its slower sales outlook. On the contrary, the current share price of the company may be seen as attractive following its “near historical” trough valuation. Last week post-market close, the Alibaba share price was seen at $79.98, below the low estimates given by analysts by -30.58%.

Fig.4: Reported Sales and Earnings Per Share (EPS) of Alibaba versus Analyst Forecast. Source: money.cnn

The Alibaba Group will report its Q2 2022 financial results on 4th November (Friday). Market consensus remains flat, in which sales is expected to hit $210.3B (was $205.6B in Q1 2022 and $200.7B in Q2 2021). Consensus estimates for EPS stood at $11.77 (was $11.73 in Q1 2022 and $11.20 in Q2 2021).

Technical Analysis:

The #Alibaba (BABA.s) share price hit its all-time high on 27th October 2020, at $319.27. It then suffered massive selling thus erasing all the gains from the past few years. To date, the high and low of the share price in the period of 52-week are $182.07 and $73.27, respectively. Technically, it is currently hovering at the psychological mark at $80. A strong bullish breakout above this level may indicate short-term correction, with the 100 daily SMA and $104 being the next resistance to watch. On the other hand, if the share price remains pressured below $80, this could indicate the bearish pressure remains intact. The next support levels are seen at $73.27 (52-week low), $65 and $40.85.

The #Alibaba (BABA.s) share price hit its all-time high on 27th October 2020, at $319.27. It then suffered massive selling thus erasing all the gains from the past few years. To date, the high and low of the share price in the period of 52-week are $182.07 and $73.27, respectively. Technically, it is currently hovering at the psychological mark at $80. A strong bullish breakout above this level may indicate short-term correction, with the 100 daily SMA and $104 being the next resistance to watch. On the other hand, if the share price remains pressured below $80, this could indicate the bearish pressure remains intact. The next support levels are seen at $73.27 (52-week low), $65 and $40.85.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.