- USDIndex – Spiked down to 111.30 following more BOJ intervention as the JPY whipsawed and GBP rallied following the news that Boris Johnson will not run for PM again. USDIndex is now back to 112.00. Xi Jinping cemented power for a third 5-year term, Chinese data very mixed, GDP & Ind Production & Trade balance all big beats but Unemployment rises and Retail sales misses significantly. AUD & JPY Manu. PMI’s both missed. More Fedspeak over weekend shows signs that some may be looking to slow down rate hikes, possibly as early as the December meeting. Has cycle-high “Peak Dollar” been realised? Asian markets also very mixed following Chinese data, despite strong Wall Street close (Nikkei +0.51% Hang Seng -5.54%), European FUTS higher.

- EUR – rotated from 0.9700, lows on Friday to 0.9900 today as USD demand swung wildly.

- JPY – FT reported that BOJ bought $30 bln Yen on Friday as the pair hit 152.00, spiked to down to 146.00, before rallying to 149.50 again today and then further signs of BOJ action took the pair to 145.70 before once again recovering to 149.00 now.

- GBP – Sterling rallied from 1.1060 lows on Friday to close at 1.1300 and then rally to 1.1400 on open following Johnson news. Trades at 1.1360 now. A Sunak/Hunt combination the most acceptable to the markets, Gilts, Sterling and FTSE FUTS all higher.

- Stocks – Wall Street rallied on Friday (+2.37-2.47%) and had its best week (+4.74- 5.22%) in 4 mths. SNAP tanked -28.08% on worst Earnings in 5-years as Advertisers cut back (Pintrest -6.4%, META -1.6%) Weak earnings too from AMEX -1.67% & Verizon -4.46%) US500 3752 (+2.37%) US500 FUTS trades at 3766 now. Biggest week ahead for Earnings.

- USOil – from $83.00 lows on Friday to $85.51 highs today and now trades at $84.00.

- Gold – plunged to $1617 lows on Friday before recovering to $1670 peaks today and trades at $1654 now.

- BTC – plummeted to test $18.5K on Friday, spiked to $19.7k today before slipping back to $19.3k now.

Today – EZ, UK, US Flash PMIs, UK Conservative Party Leadership Election (Sunak likely new PM).

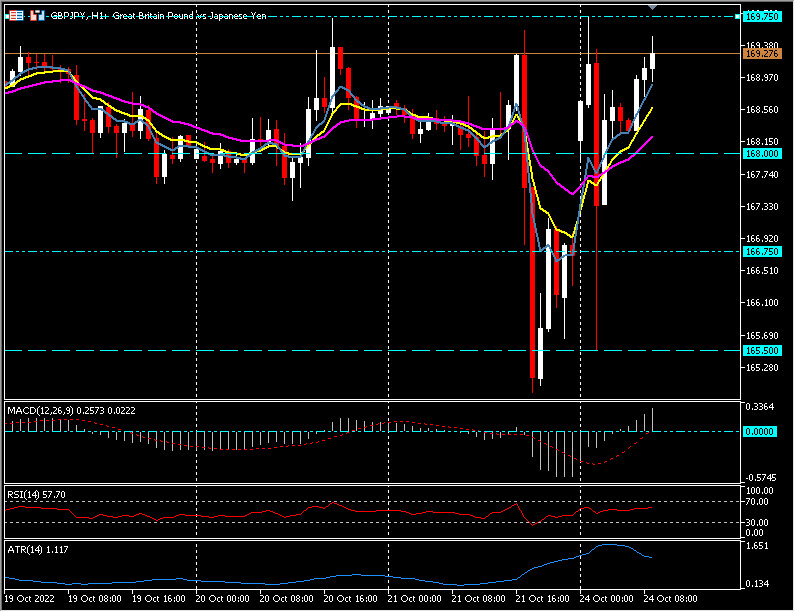

Biggest FX Mover @ (06:30 GMT) GBPJPY (+1.11%) Johnson will NOT run – Sterling rallied from sub 165.500 lows Friday and again today to 169.75 highs. MAs aligned higher, MACD histogram & signal line positive & rising, RSI 57.50 & rising, H1 ATR 1.117, Daily ATR 3.005.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.