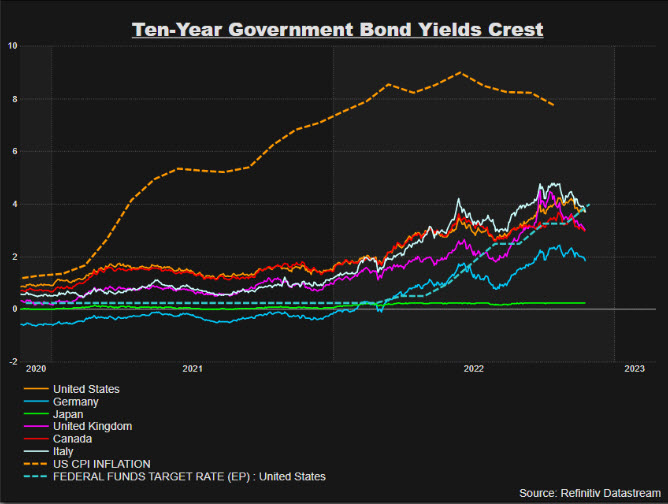

- The USD Index holds at 9-day lows above the key 105.50 at 105.67 today, following the FED mins on Wednesday. US 10yr Yields lower (-1.39% at 3.66%) Asian Stocks also lower (Nikkei -0.35%, Hang Seng -0.30%)

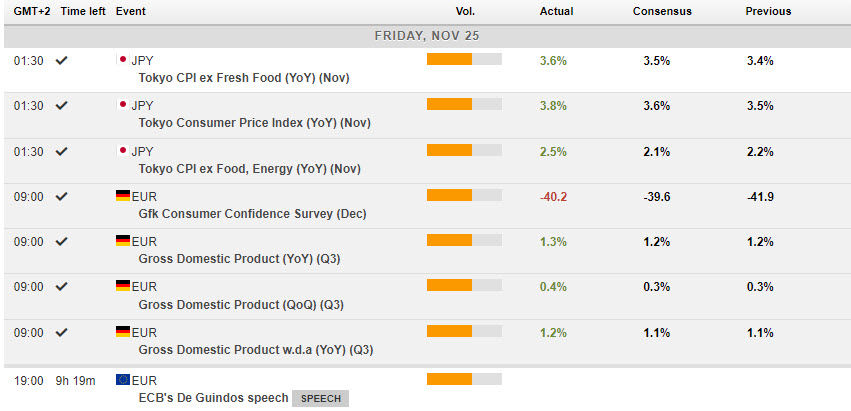

- JPY Tokyo CPI leaps to 3.8% from 3.5%

- NZD Retail Sales much better at 0.4% vs -2.3%

- Germany – final reading of Q3 GDP beats too at 0.4% vs 0.3% but GfK missed at -40.2 with expectations of -39.6.

- Chinese Covid cases hit a new record daily high of 32,695 local infections on Thursday. Reported cases are widespread across the country and in major industrial, commercial and manufacturing centres.

- EUR – declined from an 8-day high at 1.0448, back under 1.0400, but has since recovered to 1.0420.

- JPY – eased all the way down to 138.00 zone and a 7-day low, from over 142.20 on Monday. A rally today was capped at 139.00 and the pair now trades at 138.60.

- GBP – Sterling continued to rally on the weaker USD breaking & breaching 121.00 to top at 121.50 yesterday. Holds the 121.00 level today.

- Stocks – Wall Street closed for Thanksgiving – Open later on Friday for half day trading – US500 +23.68 (+0.59%) 4027 on Wednesday – FUTS trades at 4042 now.

- USOil – Lifted from 2-mth lows at $77.50 to $78.40 now, following reports that Saudi & Iraq are “promising market stability” & the G7 proposed price cap is higher than expected.

- Gold – Tested up to $1760 before slipping to $1753 and holding the key $1750 level.

- BTC – Sentiment woes continue but rallied to $16.8k yesterday before cooling to $16.4k now.

Today – all done except a speech from ECB’s De Guidos.

Biggest FX Mover @ (07:30 GMT) AUDCHF (+0.27%) continued to recover from a test of 0.6300 earlier this week. Trades at 0.6395 now, testing 0.6400. MAs aligning higher, MACD histogram & signal line positive but colling, RSI 64.70 & rising, H1 ATR 0.00078, Daily ATR 0.00668.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.