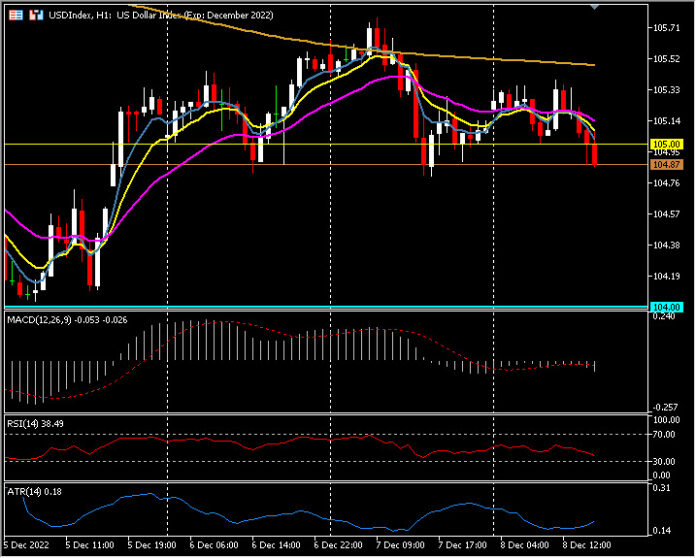

USDIndex, H1

US initial jobless claims edged up 4k to 230k in the week ended December 3 following the -15k drop to 226k in the November 26 week. Claims are up from the 5-month low of 190k in the September 23 week, and a 53-year nadir of 166k in March, but are down from the 241k from the November 18 week which was the highest since mid-August. The 4-week moving average ticked up to 230k after edging up to 229k previously. Initial claims not seasonally adjusted surged 87.1k to 286.4k after dropping -49.7k to 198.3k.

The US holidays are a notoriously difficult time for seasonal adjustments, and this year should be no different continuing claims climbed another 62k to 1.671 million in the November 26 week after jumping 58k to 1.609 million previously. They have generally been on the rise over the past two months from 1.364million in the September 30 week which was not far from the 1,306 million level from May that was the lowest since 1970. This could reflect some of the layoffs reported the past couple of months. The insured unemployment rate inched up to 1.2% in the November 26 week after rising to 1.1% previously following 20 consecutive weeks at 1.0%, and versus an all-time low of 0.9% in June.

Consensus expectations looking forward are now for a 234k December BLS survey week reading that sits above recent BLS readings of 223k in November, 214k in October and 209k in September. For continuing claims, expectations are now for an 89k rise between the November and December BLS survey weeks, after increases of 113k in November and 92k in October. The climb for initial and continuing claims since September implies down side risk for the180k December nonfarm payroll estimate.

The Greenback softened following the data #EURUSD rose to 1.0524, #GBPUSD tested 1.2228 again and #USDJPY tested down to 136.30. Meanwhile, the #USDIndex dipped to 104.87 and has held below the key 105.00 into the US market open.

Click here to access our Economic Calendar

Stuart Cowell

Head Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.