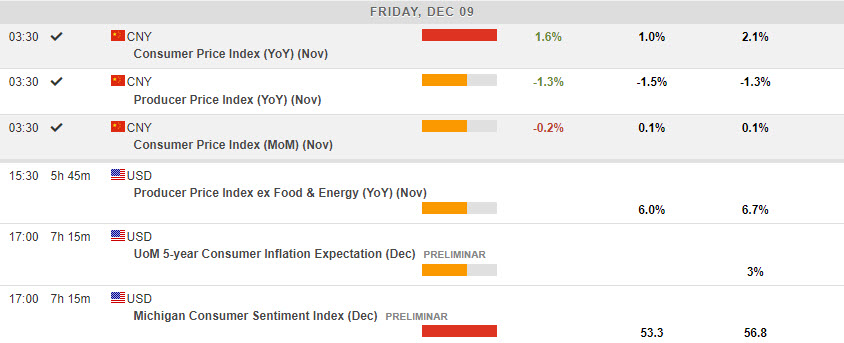

- The USD Index is down at 104.55 for a 3rd day in a row. Wall Street rebounded with the US500 +0.75% (3963) gain breaking a string of five straight losses. Treasury yields rose slightly following the deceleration in unit labour costs & rise in jobless claims. However, the 2/10yr yields are still shouting Recession – the curve remains -83bps. China confirms weak activity once again (Nov. CPI -0.2% m/m from 0.1% m/m). UK regulators fine Santander £107mn for anti-money laundering failures

- The US is set to levy fresh sanctions against Russia and China.

- EUR – retests 1.0600 amid USD weakness and trades at 1.0575 now.

- JPY – slight pull back over 136.00, to 136.30 from 135.80 lows.

- GBP – holds over 1.2200, and trades at 1.2260. Monday’s high touched 1.2345. The UK Chancellor Hunt is to announce plans to relax regulation for UK’s financial services sector, rolling back 2008 rules.

- Stocks – Dip buying and short covering helped the rally and sentiment along with signs China is moving further to ease covid restrictions. JPN225 surged 1.2% and Hang Seng index rose by 1.6% as China’s Premier stated that the shift in COVID policy would allow the economy to pick up pace. The US100 climbed 1.13% and the US30 was up 0.55%, while the rise in jobless claims yesterday (230k) helped limit the selloff, though rates were still cheaper at the end of the session.

- The US Federal Trade Commission blocks the biggest ever gaming industry deal. FTC sued Microsoft Corp MSFT +1.24% to block its planned $75 billion acquisition of Activision Blizzard Inc ATVI -1.54%

- USOil – holds at 1-year lows, below $72.00 at $71.70. USOil found some slight support (a rally to $75.00) after news that the Keystone pipeline in the US was shut down after more than 14,000 barrels of crude oil spilled into a creek in Kansas.

- Gold – extends to $1795 – 4th bullish day away from 200-day SMA.

Today – Caution prevails ahead of today’s PPI and consumer sentiment data, and next week’s CPI, and then the FOMC on Wednesday.

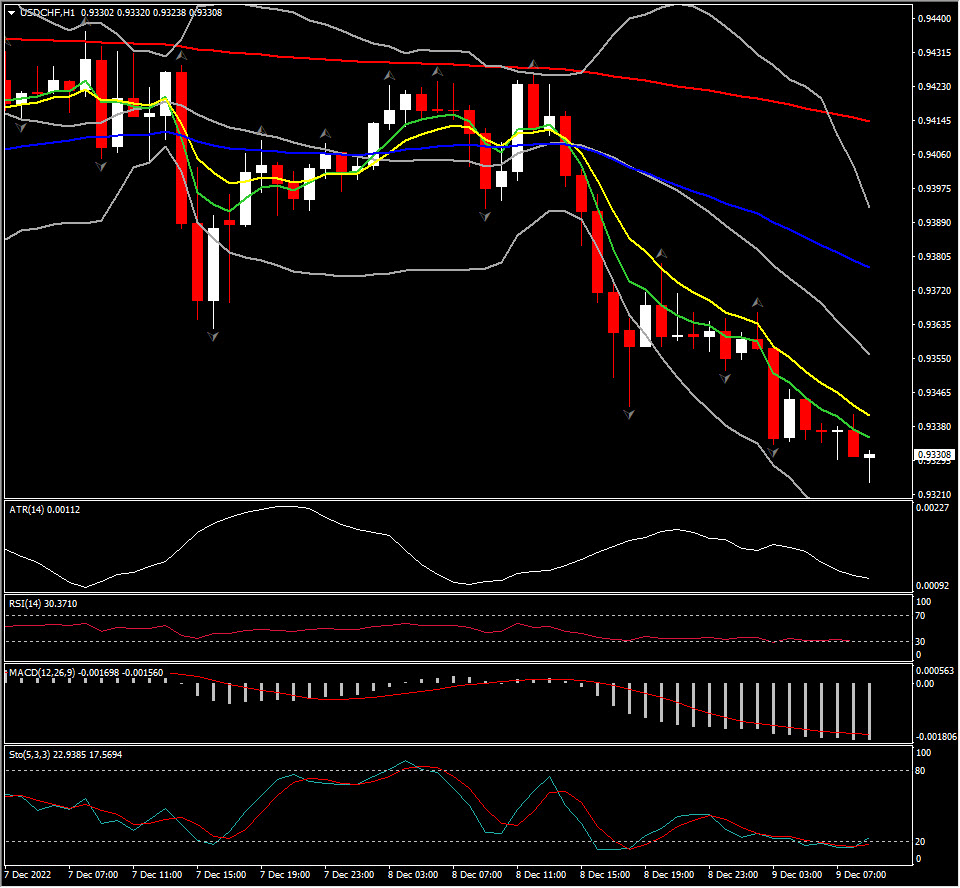

Biggest FX Mover @ (07:30 GMT) USDCHF (-0.41%). MAs aligned lower indicating the continuation of the downtrend, MACD lines are negatively configured, RSI 31 but flat, H1 ATR 0.00113, Daily ATR 0.00872.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.