The new week begins with the Dollar in focus ahead of key economic data in the form of CPI and central bank rate decisions.

Dollar

The Dollar begins the new week adding to the gains accrued last week, ahead of key economic data releases in the form of inflation data for November as well as the much-anticipated FED rate decision. Factors driving this initial exuberance can be attributed to the upbeat data that was released last week in the form of US Producer Price Index data, which matched the market expectations, coming in at the forecasted 7.4% YoY for November versus 8.1% in the prior month. Additionally, the Core PPI rose to 6.2% YoY versus 6.0% expected. Heading into the remainder of the week, investors will be eyeing November’s Consumer Price index, as it will be crucial for any bullish bias, coupled with the FED’s decision on their Interest rate, which has already been priced in at 0.50%.

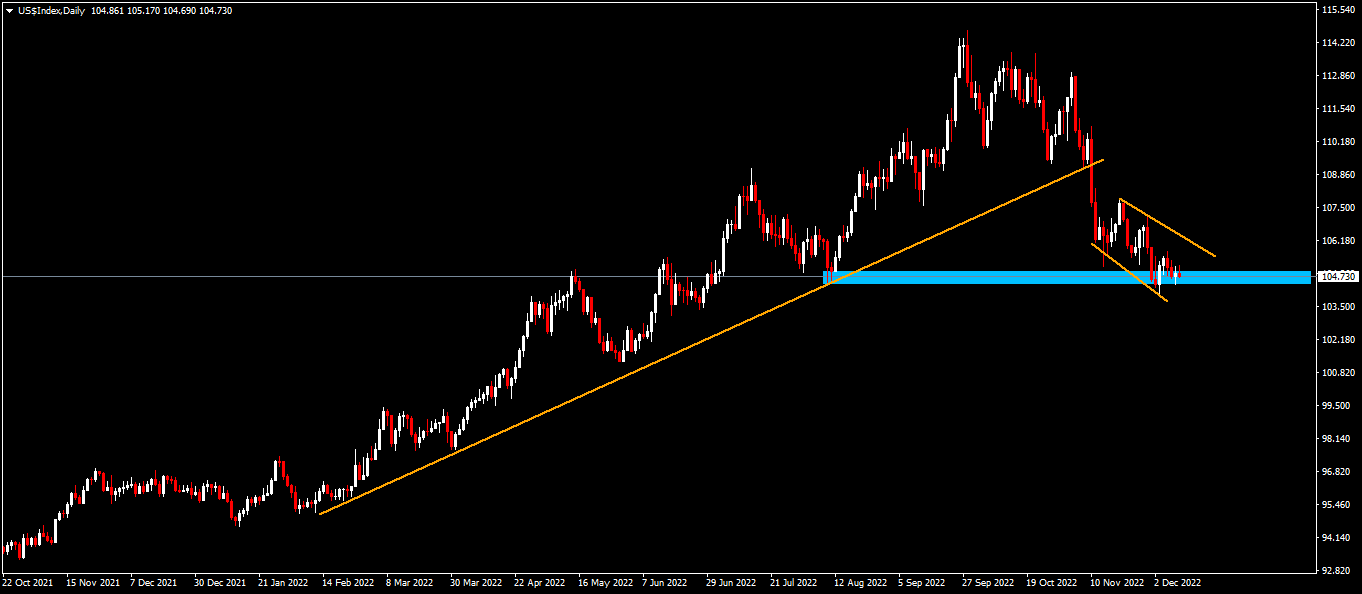

Technical Analysis (D1)

In terms of market structure, price has come to a significant juncture by invalidating the uptrend drawn from Feb 2022. Since then, price has been moving to the downside and sellers have reached a key level of interest located around the 104.01 area where the previous higher-low was formed. The nuance to be noted, however, is that price approached this area in a corrective nature in the form of a descending channel. If bulls can defend this area, the narrative could still remain bullish, however the opposite applies if the area is invalidated by sellers.

Euro

The Euro kickstarts the week on the front foot, remaining above the 1.05 level in a week bound to be driven by volatility from key economic data. Factors driving the buying interest in the European common currency in the beginning of the week can be attributed to a lack of economic data on Monday. Heading into the latter half of the week, investors will be eyeing key inflation as that will give some directional bias to the pair, as well as the FED rate decision and ECB rate decision. Both are expected to be 0.50%, and any deviation from the expectation could have significant volatility in the exchange rate between the Euro and the Dollar.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term downtrend formed from mid-May 2022 and has done so in an impulsive break of structure. Since then, the bulls have been driving price, creating higher-highs and higher-lows. Current price has bounced off a key level in the 1.06 area, and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level.

Pound

Sterling begins the week on the front foot with the bulls maintaining the direction of the narrative. Factors driving this buying enthusiasm can be attributed to investors digesting the upbeat data that came out early on Monday morning in the form of GDP data which pointed to growth in the British economy by 0.5% monthly in October following September’s 0.6% contraction. Heading into the rest of the week the narrative will be driven by Dollar dynamics, the high-tier economic data releases and pivotal central bank decisions.

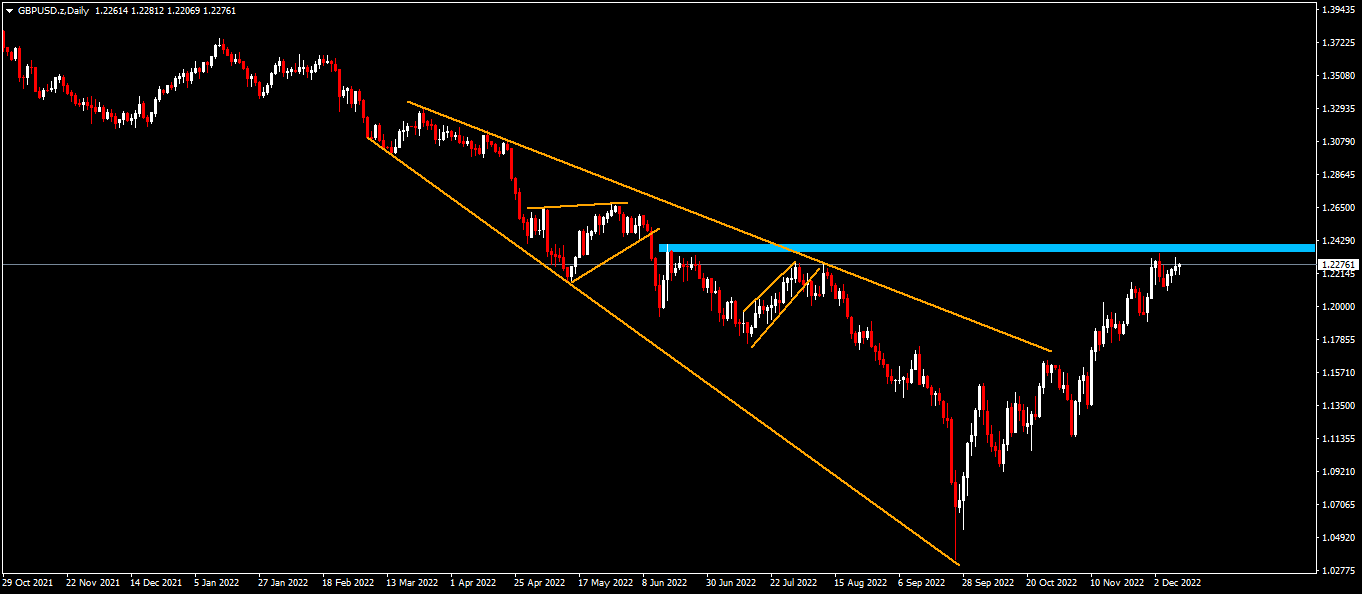

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term trendline. Since then, the bulls have been in control of the narrative and have tested the key 1.229 level. The nuance to note at this juncture is the corrective nature of the approach to the area in the form of an ascending channel, which means price is coming under pressure as sellers enter the market and buyers take their profit off the table. If the area is defended it will result in the reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the new week with the bears struggling to put a damper on the bullish narrative, in a week that will be pivotal in terms of the directional bias of the yellow metal. Investors will be keenly eyeing the November CPI due to be released on Tuesday 13 December. The market has forecast a decline in the inflation narrative, with the annual CPI in the US expected to have decreased to 7.3% in November, and the Core CPI expected to also edge slightly lower to 6.1% from 6.3%. If the data comes in as it’s been forecast, it could be welcome news for bulls as a softer inflation report could feed into the “pivot” narrative and benefit the bulls. If the contrary comes to pass, Gold could come under selling pressure.

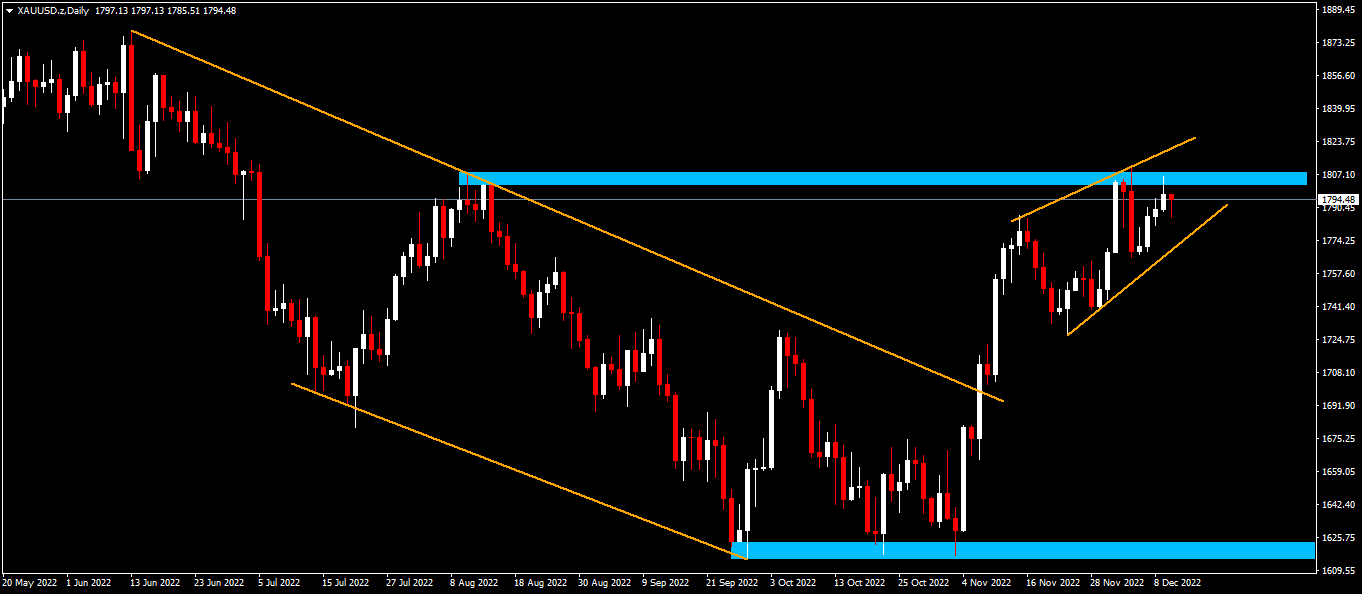

Technical Analysis (D1)

In terms of market structure, Gold has broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently price action has pulled back from a significant resistance at the $1 809 area in the form of a potential reversal pattern (rising channel). If sellers can defend this area it will confirm the reversal pattern, however if buyers maintain their interest, price could break above and remain bullish.

Click here to access our Economic Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.