Treasuries remained firm, yields finished off of their lows. Wall Street turned mixed in the afternoon after the US30 and US500 shed their advances. Hawkish Fedspeak from Bostic and Daly generated some cold feet and subsequent profit taking ahead of Fed Chair Powell’s comments later. The advent of $90 bln in coupon supply also weighed a bit.

The FOMC minutes warned that an “unwarranted easing in financial conditions” would complicate the Fed’s efforts to bring down inflation, and the big rally in bonds and stocks in recent sessions is not what the FOMC wants to see. Already there has been some push back from Daly and Bostic regarding boosting rates over 5%. Will Powell feel compelled to oppose market rallies?

- The USDIndex remained weak on the softer outlook on the FOMC, falling to a low of 102.94, though it closed at 103.19.

- EUR – steady above 1.0700.

- JPY – hovering around 132.10.

- GBP – closed above 20-day SMA, retesting 1.2200.

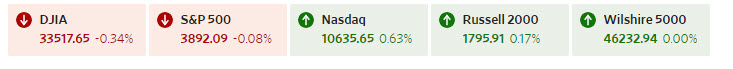

- Stocks – The US100 was up 0.63% at the close as tech found support from China’s reopening plays. The US30 dropped -0.34% and the US500 was off -0.08%. Wall Street is in the green with gains of about 1.5% to 2.4% for the year-to-date. The US500 is over 9.4% above its October low.

- USOil – 2.8% higher at $75.85 per barrel and Brent up 2.4% at $80.46. Optimism over China’s economic re-opening has been supportive, boosting demand expectations. China announced more financial support to households and governments in a bid to revive the economy.

- Gold – slightly lower at $1871 from $1881.

Today – Speeches: BoJ’s Kuroda, ECB’s Schnabel, BoC Governor Macklem and Fed’s Chair Powell.

Biggest FX Mover @ (07:30 GMT) EURAUD (+0.24%). Spiked by 41 pips at the EU open. MAs slightly higher, MACD histogram & signal line remain positive and rising. RSI 68 but flattened, H1 ATR 0.0028, Daily ATR 0.01406.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.