Chinese GDP for 2022 at 3.0% missed expectations (5.5%) significantly and represented the slowest growth for the world’s second largest economy since 1976 and the end of the austerity of Mao Zedong. Q4 GDP beat expectations at 2.9% vs 1.8% but was still very weak. Retail Sales & Unemployment also beat at -1.8% vs. -9.5% and 5.5% vs. 5.8%, respectively. Japanese 10-yr yields still trade over 0.50% above the BOJ ceiling ahead of BOJ tomorrow. The UK Jobs market remains v tight (Unemployment 3.7%) – Earnings up (6.4% vs 6.1%) but still way short of Inflation. (CPI & Retail Sales data tomorrow). German HICP inflation confirmed & unchanged at 9.6%.

- The USD Index recovered from under 102.00 at 101.70, to 102.15 now.

- EUR – holds over 1.0800. The pair touched 1.0875 on Monday (9-mth highs) and trades back to 1.0820 now.

- JPY – dipped again touching 127.20 lows, but is now back over 128.00 and has tested 128.80 today.

- GBP – Sterling tested 1.2290, slipped back to 1.2160 lows and has recovered 1.2200 following the UK data.

- Stocks – The US markets closed higher on Friday (+0.33-0.71%), following generally good Banking Earnings, tempered by cautious outlooks and job losses. US500 FUTS trade at 4002.

- USOil – rallied again to test $80.00 but has since slipped to $79.00 following the Chinese data.

- Gold – the Bid remains strong as $1900 holds, $1930 was tested yesterday, the precious metal is back to $1910 now.

- BTC – Weak USD helps to lift prices over $20k and holds over $21k today.

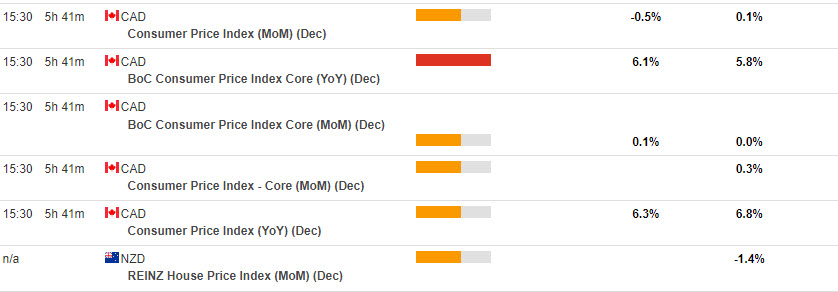

Today – Canadian CPI, Speeches from Fed’s Williams, ECB’s Centeno & Chinese Vice Premier Liu. Earnings – Goldman Sachs, Morgan Stanley & United Airlines.

Biggest FX Mover @ (07:30 GMT) CHFJPY (+0.53%). Bounced from a test of 137.50 zone on Friday and adds to gains today at 139.20 but is down from 149.00 highs in December. MAs aligned higher, MACD histogram & signal line positive & rising. RSI 66.80 & rising, H1 ATR 0.230, Daily ATR 1.856.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.