GER40, Daily

As attention turns to the approaching Fed and ECB announcements, the GER40 index maintains stability near its best level since September last year. The German blue-chip index is in a bull market, having risen more than 28% from a low of 11859.45 in 2022, joining other European indexes that have recently put up a stunning recovery.

This week is important for the GER40 index, considering that the Fed will announce its monetary policy decision. The bank is expected to raise interest rates by 0.25% in its first decision this year. The Fed will probably try to tone down the euphoria by being a little hawkish, given that bond yields are falling and global markets are surging. Besides that, this week’s ECB meeting will also end on Thursday. The ECB will of course be different from the Fed, because it is still dealing with very high inflation rates. The market expects the bank to increase interest rates at this meeting by 0.50%. Meanwhile, the Norges Bank and Bank of England are the other two leading central banks to watch this week.

Technical Analysis

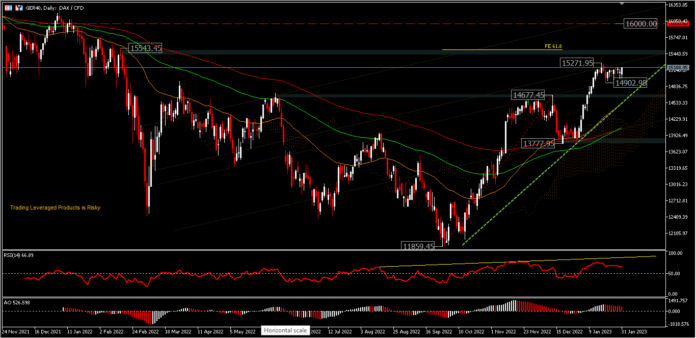

The daily chart of GER40 shows that the index has been in a strong bullish trend in the last few days. It recently managed to move above the key resistance level at 14,677.45, its December high. By moving above this level, the index has confirmed the trend continuation from 11,859.45.

The index is currently around 15,188.95, above its 52 day EMA, and Kumo is bullish. At the same time, AO has been moving above neutral and the RSI is at 66, and it does not yet show overbought levels. On the upside, a move above the 15,271.95 minor resistance is projected for the FE 61.8% level around 15,543.45 and the major resistance is seen at the 16,000 round figure. Meanwhile, a move under the minor support at 14,902.95 could test the resistance level which has now become support at 14,677.45.

Overall, the index is still in the rising channel, although divergence is visible but has not shown any change, because the bias tends to still be seen moving northwards with higher highs and higher lows.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.