Renewed faith in the banking system has increased this week’s risk sentiment to the benefit of global currencies.

Dollar

The Greenback rolls into midweek trading at close to the weekly low (102.02) which was set on Tuesday during the New York session. Factors attributed to this selling pressure can be linked to the improved risk sentiment driven by hopes that the FED won’t be required to continue its hawkish monetary policy stance. This risk-on mood was further improved as the US banking fears were significantly eased after an announcement that SVB would be acquired by First Citizens BancShares, which has significantly renewed confidence in the banking sector and stabilised the risk of a systemic collapse.

Technical Analysis (D1)

In terms of market structure, Current Price action has formed a potential reversal pattern in the form of a descending channel. The pattern has been partially validated as an impulsive break of structure and continues to move to the upside as bulls take control of the narrative. Henceforth price could remain bullish if buyers can defend the potential bull flag continuation pattern that is currently being formed. Conversely, if sellers break through the above-mentioned support level around the 102.09 level, the narrative could shift towards the bears and challenge the low of the year.

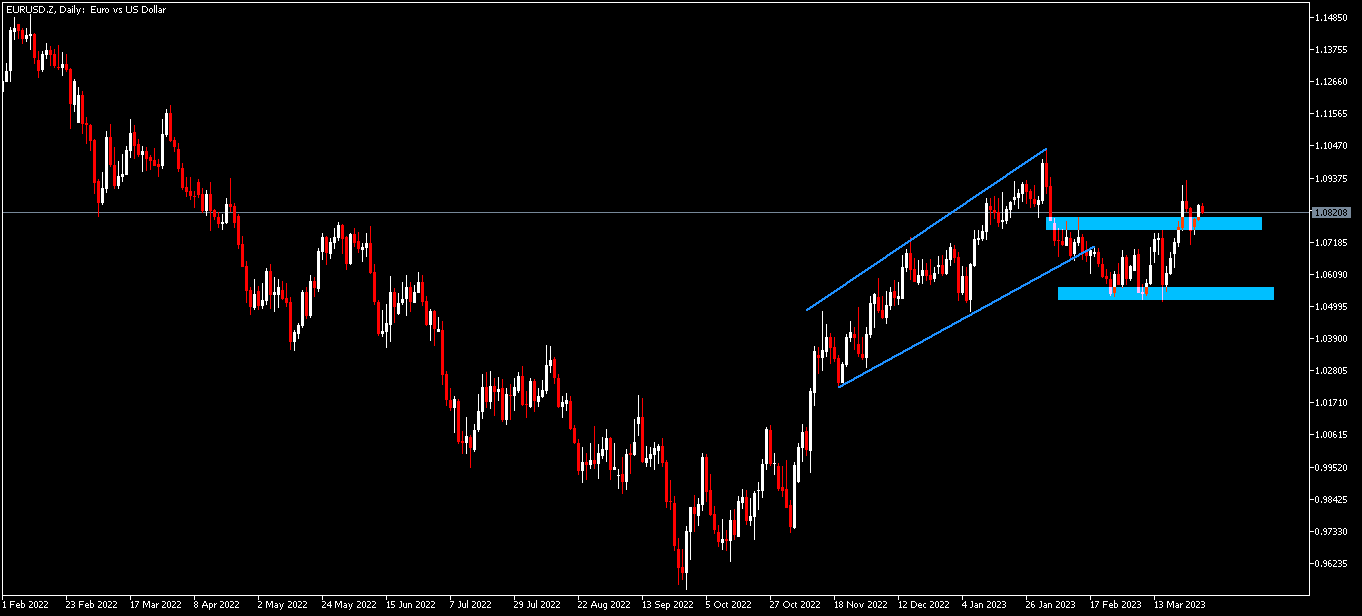

Euro

The Euro continued to build on the gains for the week as it rose for the second consecutive day before hitting the crucial 1.084 resistance. Factors driving this buying interest from the bulls can be attributed to the easing banking crisis which has led to a mostly weaker Dollar, as well as the expectations from the ECB to remain hawkish on their monetary policy stance, with the market pricing in a 0.25% increase in interest rates at the next ECB meeting on May 4.

Looking ahead traders will be eyeing inflation data coming from Europe on Thursday and Friday, which will undoubtedly add another plot to the ever-changing story line of inflation vs the response from central banks.

In terms of market structure, Current price has approached an area with sell side pressure in the form of an ascending channel, which gives bears the possibility of driving price if the current bear flag continuation pattern plays out successfully. Conversely if the bulls can sustain the pressure, price could break above the level and continue the uptrend if it invalidates the resistance area in an impulsive wave.

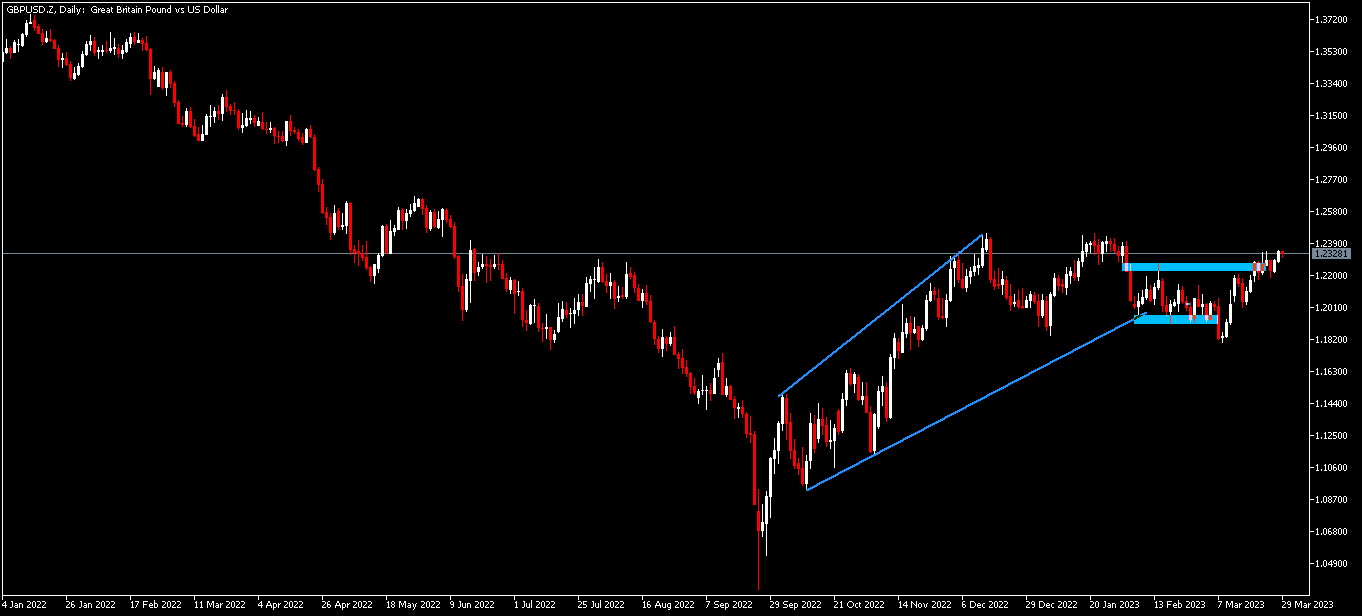

Pound

The Pound heads into the middle of the week struggling near multi week highs, at levels last seen in February. Factors attributing to this continued buying interest from the bulls can be linked to the loss of bullish impetus in the Dollar, through a combination of factors ranging from a less hawkish FED, on the back of comments made last week which signalled a pause in interest rates being on the horizon. Additionally, the easing fears of a full-blown global banking crisis have improved traders’ appetite to take on more riskier assets, which has resulted in a withdrawal from the safe-haven US Dollar, to the benefit of riskier currencies such as the Pound.

Technical Analysis (D1)

In terms of market structure, the bulls have been in control of the narrative and price has tested the key 1.244 level and has since pulled back forming a potential bearish double top. As price retests this peak formation again, two scenarios present themselves. Namely, if the area is defended by sellers in this current bear flag continuation pattern it could result in the potential reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the middle of the week retreating from a one-week low. The recent downward trend seen this week can be linked to a more positive risk-on sentiment, mostly driven by the ability of the banking system to defend itself from a systemic collapse, which has renewed the optimism for traders to withdraw briefly from safe assets such as the Dollar and Gold.

Looking ahead, investors in the yellow metal will be keeping an eye on inflation data coming from the Eurozone, which will be a catalyst for the next directional impetus where the price of Gold is concerned.

Technical Analysis (D1)

In terms of market structure, price action has been mostly bullish, with clear higher-highs and higher-lows being printed out. Current price action has just printed out an impulsive wave, confirming the reversal pattern in the form of a descending channel and the W-formation intersecting the adjoining uptrend. Henceforth price is likely to remain bullish if it keeps being supported by the new uptrend that has formed.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.