- FX – USDIndex had a good week closing at 102.50. Currently correcting to 102.35. EUR fell to 1.0844 breaking 50DMA again and trades at 1.0970. JPY spiked to 136.26 from 135.60. Sterling drifted 2-month triangle down to 1.2440 from 1.2670 highs last week even as the BoE hiked 25bps and remained slightly hawkish.

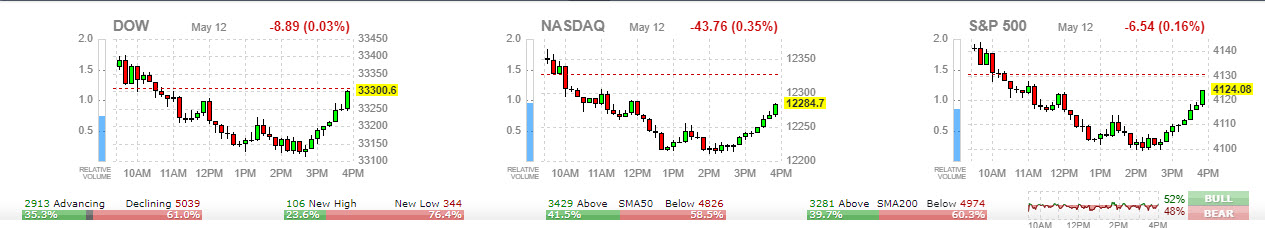

- Stocks- China bourses outperforming and Hang Seng and CSI 300 gaining 2% and 1.3%. In EU, GER40 gapped up US markets closed higher.

- Commodities – USOil – fell to $69.69 post Chinese data hinting recovery. GOLD – steadied above $2010.

- Cryptocurrencies – BTC recovered the $27500.

Today – G7 summit in Japan, US Empire State Manufacturing Index and Eurogroup meeting.

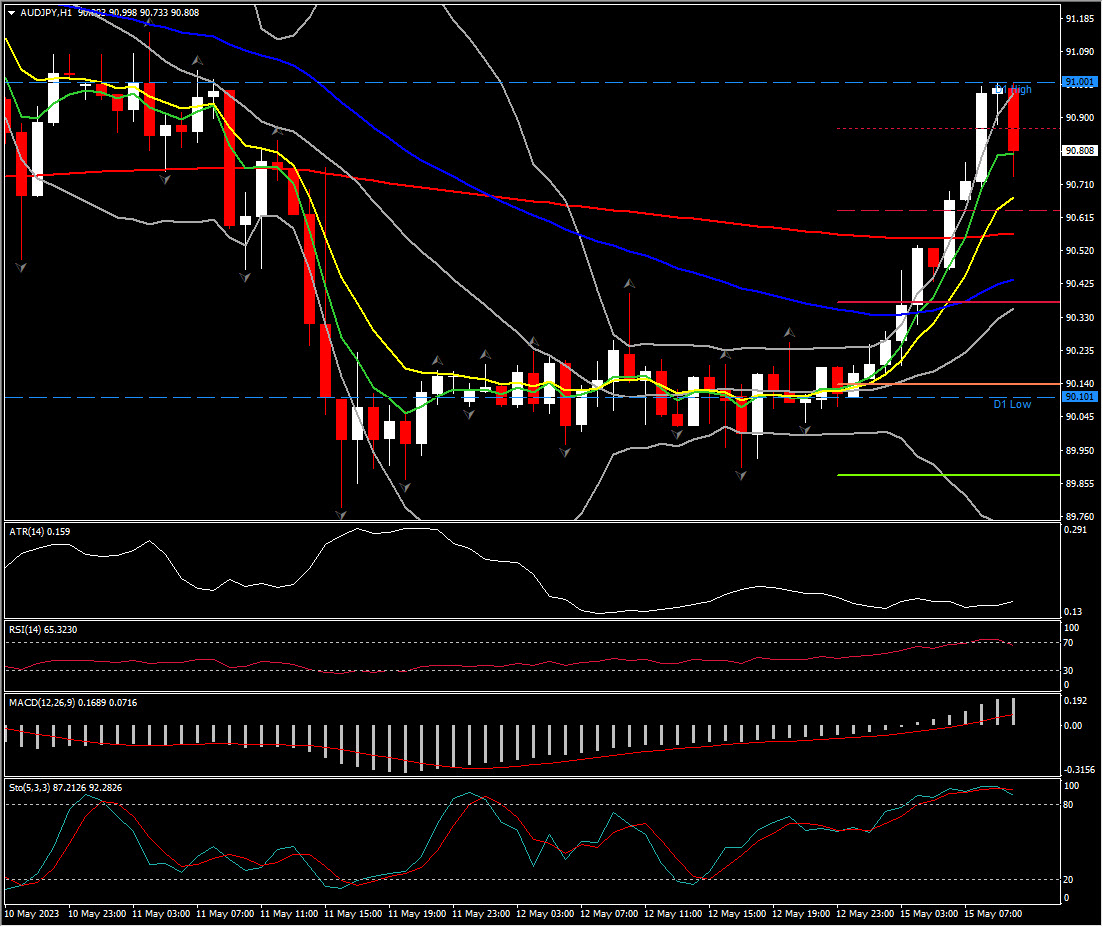

Biggest FX Mover @ (06:30 GMT) AUDJPY (+0.67%). Breached 91 breaking 200-DMA. MAs flattened, but MACD histogram & signal line positive & rising, RSI 66 & falling indicating correction lower, H1 ATR 0.159, Daily ATR 1.096.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.