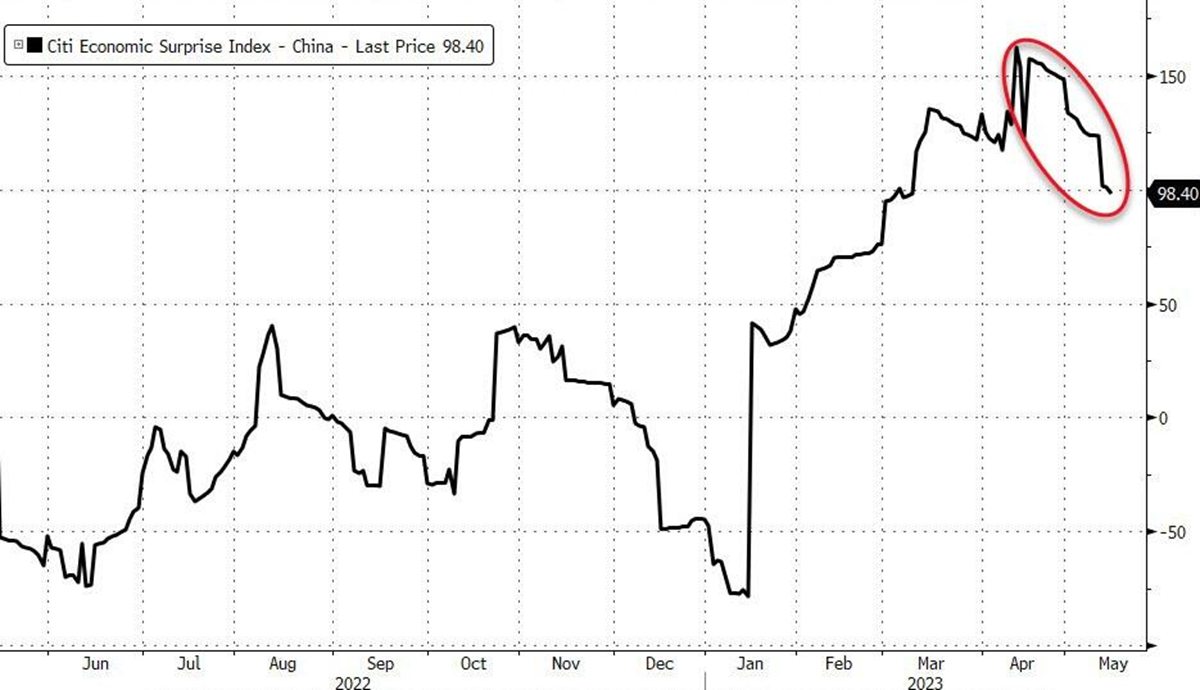

On January 8th, 2023, China officially ended its zero-COVID-19 policy. That was huge: the world’s second-largest economy was about to return to full power after many months, one of the last countries to do so. There was a lot of optimism worldwide: it cannot actually be excluded that the strong risk rally at the beginning of the year was partly a consequence of such an encouraging outlook. But things are cooling down fast: just last night, a set of negative data, ALL below expectations, cast a new shadow on the economic outlook. Investments and industrial production fell m/m, and while retail sales rose, it was by less than expected especially in comparison to last year, dictated by Covid restrictions. Youth unemployment reached 20.4%. Property Development Investment fell as well as aggregate financing data has been dramatically weaker than expected despite continuous liquidity injections. GS is now expecting a 25bp broad RRR cut in June, down from 3.65%. The CITI Economic Surprise Index summarizes the issue quite well as does the USDCNH performance, back close to the 7.00 level (from 6.70 earlier this year).

Citi Economic Surprise Index – China

But why do we care about? According to data recently published by the EIA, global demand for liquid fuels is expected to stand at 100.99 million barrels per day, with a growth of 1.6 mm b/d, HALF of which is expected to come from China. You will also remember that in early April OPEC+ decided on a further production cut of 1.16 mm b/d on top of the 2 mm cut previously, for a total of 3.66 mm barrels removed from world production each day. Several analysts thought at the time that the cartel had gone too far with its cuts, UNLESS it expected demand to stagnate. So, the possible Chinese slowdown is quite an important issue and has mainly to do with the global demand outlook, not only in the oil market.

In this scenario, the US Government is finally back in the crude-buying game, preparing to buy up to 3 mm barrels of sour crude oil to be delivered in August (after having sold more than 200 mm barrels from its Strategic Petroleum Reserve, at its lowest level since 1983). All this after, failing to buy in December 2022 (having bid too low) and with several restrictions (purchases will be of ‘sour crude oil produced in the United States by United States producers’). As 3mm is approximately just 3% of daily production/demand, this is likely a rather irrelevant factor.

In this scenario, the US Government is finally back in the crude-buying game, preparing to buy up to 3 mm barrels of sour crude oil to be delivered in August (after having sold more than 200 mm barrels from its Strategic Petroleum Reserve, at its lowest level since 1983). All this after, failing to buy in December 2022 (having bid too low) and with several restrictions (purchases will be of ‘sour crude oil produced in the United States by United States producers’). As 3mm is approximately just 3% of daily production/demand, this is likely a rather irrelevant factor.

TECHNICAL ANALYSIS

Crude Oil was trading in the $120 area just about a year ago, in June 2022. Since then, the downward trend has been extremely clear and currently the price is at $71.07. On the downside, the level to watch is quite obvious: the area between $64 and $62. This is a very strong level that has served as resistance/support since at least 2018. A break could lead the price first to the $58 area and then possibly even to the $51 area; at the moment however it is a little premature to take such ‘extreme’ behaviour under consideration.

Upwards the areas to watch are first $73.25 and then the $78.5 / $79 area. Only Crude Oil trading above these levels again could indicate the beginning of a new price rise, to be confirmed in the $82.5 / $83 area. At the moment the RSI marks 42 and the MACD is negative.

US Crude Oil Spot – Daily

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.