According to Bloomberg, the Mexican Peso (MXN) is the best performing ‘major’ currency in 2023, up almost 11% against the US dollar, at a five-year high and above its pre-COVID level. No other currency has done as well: the also “powerful” Brazilian real has risen by nearly 8.5 %, while other emerging currencies such as the ZAR or the TRY continue to fall.

Weighted Currency Indices

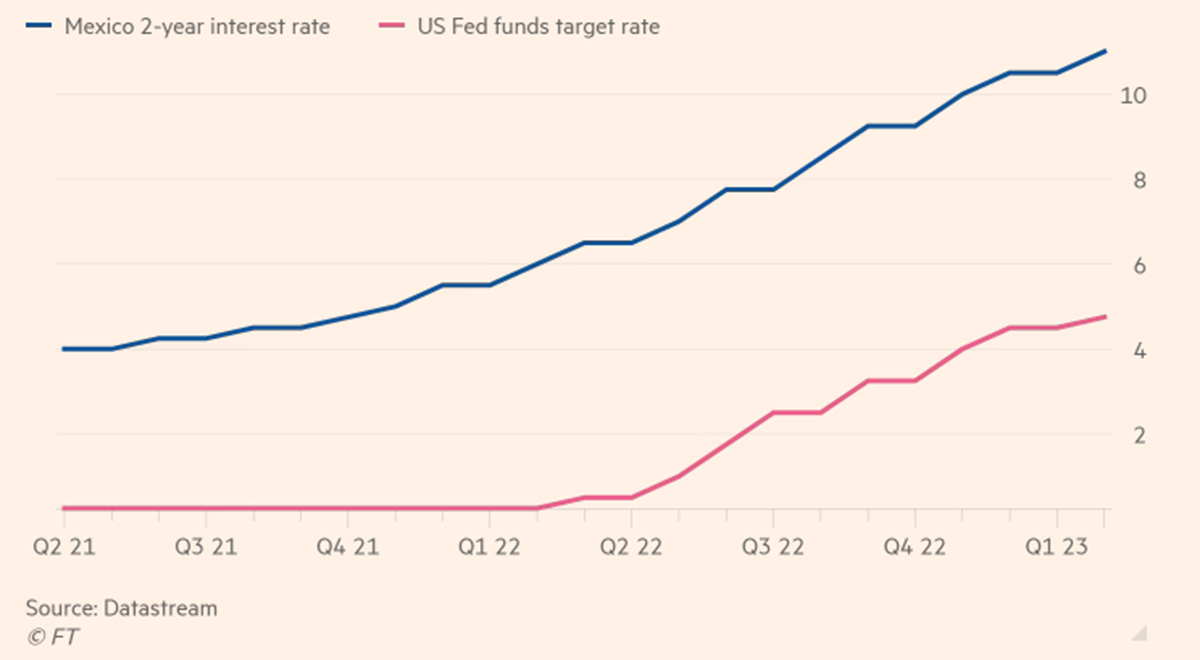

And there are some very good reasons for this: public accounts are well under control, with a debt/GDP ratio close to 50%, and the fiscal austerity policy promoted by President Obrador is keeping public budget deficits under control (3.8%, in line with or below many other advanced economies). The inflation rate stands at 6.25%, with the peculiarity that Mexico is used to dealing with levels slightly below 5% (hence no shocks) and that its central bank, BANXICO, has been very proactive, starting to raise rates 9 months before the FED and doing so 14 times in a row. The official interest rate now stands at 11.25% and guarantees a very high differential compared to other currencies. Not surprisingly, due to this combination of factors, the Peso has increasingly become the vehicle for emerging market investors wishing to borrow a currency with a lower interest rate to buy assets that offer higher rates of return, known as the CARRY TRADE.

The gap between Mexico and US IR is growing

And if that is not enough (which it could be), there are still other reasons. Sharing more than 3,000 km of border with the US and being part of the USMCA (alongside Canada) the country is set to be a prime beneficiary of companies focusing on their supply chains nearer critical markets and away from China in a phenomenon known as “nearshoring”. This is especially true in the case of the automotive industry: in the last few months alone, BMW has announced an investment of 800 million $ to expand its production of electric vehicles, while TESLA will invest some 5 billion $ in a new factory in the north of the country. Foreign direct investment in Mexico reached $35.3bn last year, the highest level since 2015, according to data from the Ministry of Economy.

Finally, the phenomenon of remittances: Mexican emigrants in the US have always sent money back home: this flow has reached record highs, having increased by 12.5% in the last year alone and now represents a whopping 4% of GDP.

Remittances to Mexico, million $

Technical analysis

Let’s start with a longer term perspective with this weekly chart: the USDMXN after 3 years of gains sits at 17.49, in an area that was a very important support in 2015 and 2016. However, you can easily see that in previous years it traded at much lower levels, as low as 9.80 in 2007. This is something to keep in mind, given the current good fundamentals.

USDMXN – Weekly, 2007 -2023

Focusing now on the daily chart, we see that the price is at the bottom of a bearish channel that started in autumn 2021 with the RSI showing a slight divergence and close to the oversold zone. Perhaps therefore it is not the best time to jump on the bandwagon, with the values in the 17.90 and 18.40 zone resistances being the ones to watch carefully in the case of strengthening of the USD in the short term. Even a price at 18.85 levels would not compromise the long term downtrend at all.

USDMXN – Daily

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.