Dollar bulls maintain control of price amid a broad risk-off mood midweek.

Dollar

The Greenback rolls into midweek on the front foot as it sets a two-month high around the 103.50 level. Factors driving this exuberance from investors of the US currency can be attributed to a broad risk-off sentiment from the market at this midweek point. Some of the key influences of the ebb and flow in the risk matrix are:

- Sustained hawkish rhetoric from FED officials, in support of higher interest rates to fight sticky inflation on the back of upbeat US PMI data.

- Concerns about the contents of the upcoming FOMC meeting minutes and what clues could be buried in them concerning the FED’s path on monetary policy.

- An inability to come to an agreement on the looming debt ceiling crisis, which could lead to the US defaulting on its debt obligations.

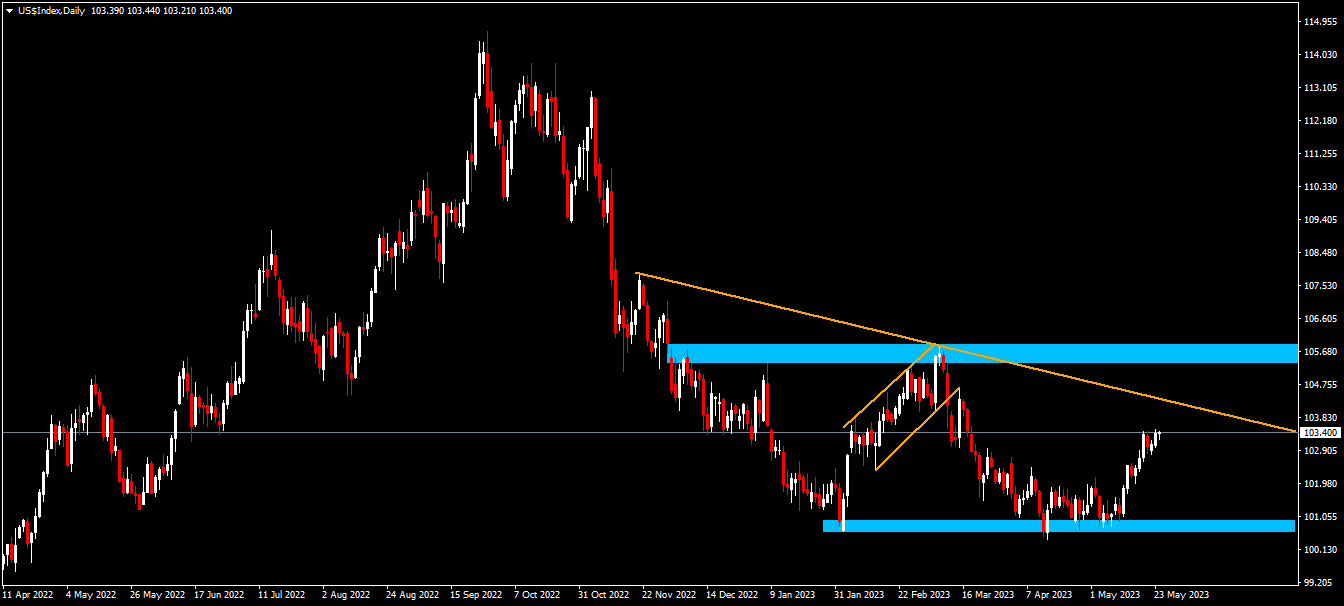

Technical Analysis (D1)

In terms of market structure, price has been trading within a range between the low of 100.36 and a high of 105.80. Current price action still suggests a dominant downtrend until the previous lower-high is invalidated along with the downtrend. If sellers can defend the area and create a new lower-high, price could revisit the low of the range to potentially create a new lower-low.

Euro

The European common currency heads into the middle of the week with bears having the upper hand as price trades at a two-month low. Factors driving this selling pressure can be attributed mostly to dollar dynamics and the broad risk-off sentiment at this point in the week. Some of the Issues driving this weakness in the Euro are:

- The sustained and growing fears from investors that the US could potentially default after the 1st of June are making market participants anxious.

- The upcoming FOMC minutes are making traders hold off on major bets as they await information that will shed some light on the rationale behind the recent 25bps rate hike and give clues about the upcoming rate hike in June.

- ECB President Lagarde’s speech later today (Wednesday) in which she is expected to shed some light on June’s monetary policy, and potentially expand on her commentary that more than one rate hike is still necessary to tame stubborn inflation.

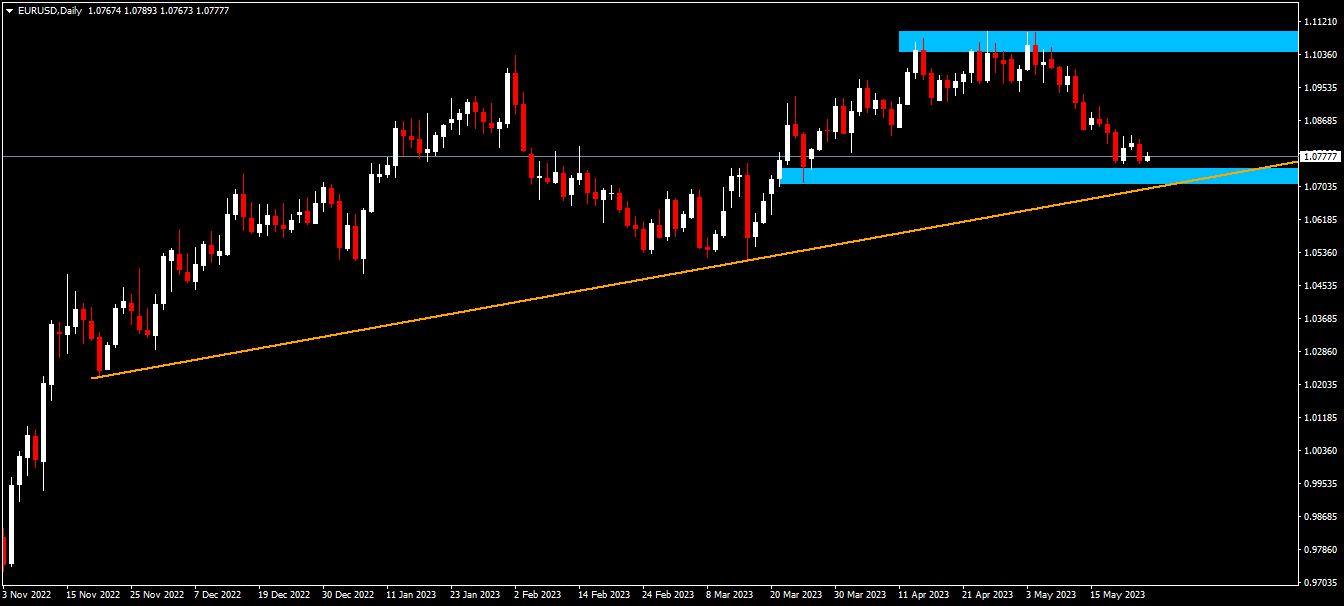

Technical Analysis (D1)

In terms of market structure, price has been trading within a range between the low of 1.070 and a high of 1.090. Current price action still suggests a dominant uptrend until the previous higher-low is invalidated along with the uptrend. If buyers can defend the area and create a new higher-low or maintain the current one, price could revisit the high of the range to potentially create a new higher-high.

Pound

The Pound heads into the middle of the week rebounding from a two-month low around the 1.237 level. Factors driving this intraday resurgence from the British currency can be linked to positive inflation data in the form of CPI coming in at 8.7% yoy compared to the previous 10.1%. Other factors driving current price can be linked to:

- Positive inflation data which backs and justifies the BoE’s hawkish narrative and allows the Pound to brace for a potential upside gain.

- Upside potential being capped by Dollar dynamics which could drive price down in the short term as the risk sentiment benefits dollar inflows.

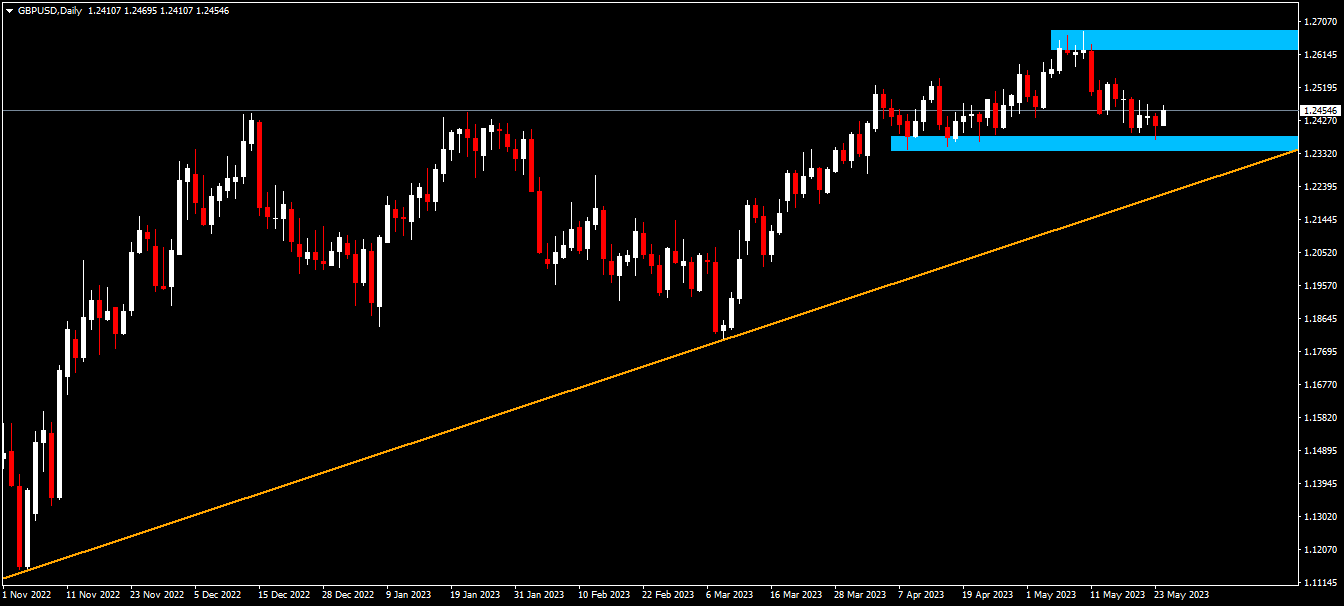

Technical Analysis (D1)

In terms of market structure, price has been trading within a range between the low of 1.234 and a high of 1.267. Current price action still suggests a dominant uptrend until the previous higher-low is invalidated along with the uptrend. If buyers can defend the area and create a new higher-low or maintain the current one, price could revisit the high of the range to potentially create a new higher-high.

Gold

Gold heads into the middle of the week under some significant pressure as it rebounds off a two month low at the $1 953 level. Factors driving this selling pressure can mostly be mostly linked to dollar dynamics in the form of:

- Continued hawkish FED expectations inviting more sellers to participate.

- Safe-Haven inflows to the Dollar continuing to put a cap on gold bids amid debt ceiling fears.

- Recession risks potentially putting a floor underneath price and inviting new buyers at discounted prices.

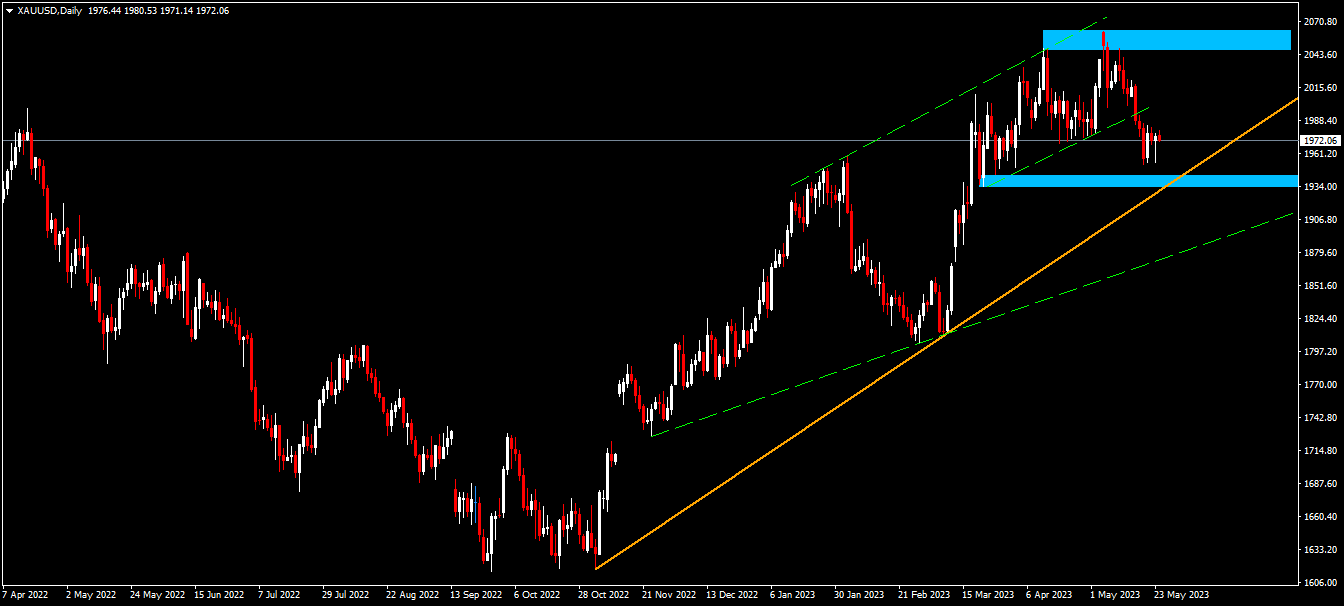

Technical Analysis (D1)

In terms of market structure, price has been trading within a range between the low of $1 930 and a high of $2 078. Current price action still suggests a dominant uptrend until the previous higher-low is invalidated along with the uptrend. If buyers can defend the area and create a new higher-low or maintain the current one, price could revisit the high of the range to potentially create a new higher-high.

Click here to access the Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for informational purposes only and not as independent investment research. This communication does not contain investment advice or recommendations or a solicitation with the intent to buy or sell any financial instrument. All information presented comes from reliable, reputable sources. Any information that contains indications of past performance is not a guarantee or a reliable indicator of future performance. Users should be aware, that any investment in Leveraged Products is subject to a certain degree of uncertainty and that any investment of this kind involves a high level of risk for which the liability and responsibility is solely borne by the user. We are not responsible for any losses arising from any investment made based on the information provided in this communication. Reproduction or further distribution of this communication is prohibited without our prior written permission.

Risk Warning : Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as it carries a high level of risk to your capital. Before trading, please ensure that you fully understand the content of the risks involved, taking into account your investment objectives and level of experience and seek independent advice and input if necessary.