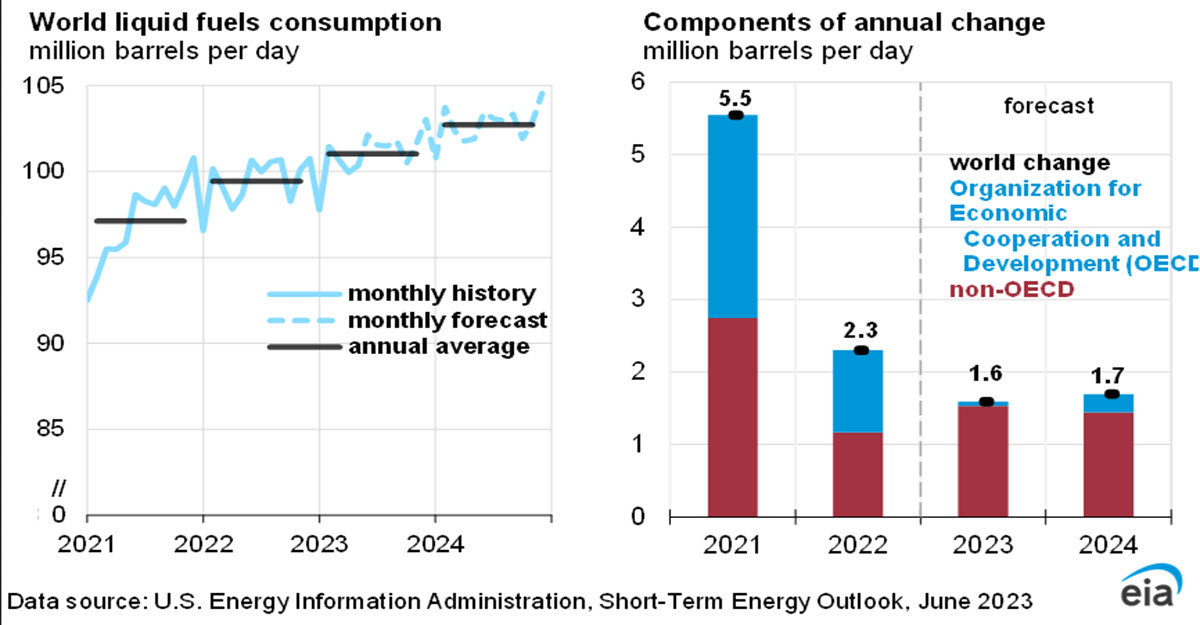

We had already talked about it, but it’s back in the news: IEA (International Energy Agency) Executive Director Fatih Birol expressed his worries about global oil demand on Bloomberg TV yesterday, as of the 2 million bpd growth expected in 2023, at least 60% is expected to come from China, whose growth seems to be much less bright than previously expected. Only the night before, API (American Petroleum Institute) data had shown a huge increase in Gasoline and Distillates in general in US stocks (+2.417mm from 02/23 and +4.5mm from 12/22 respectively), a clear sign that processed products are momentarily oversupplied.

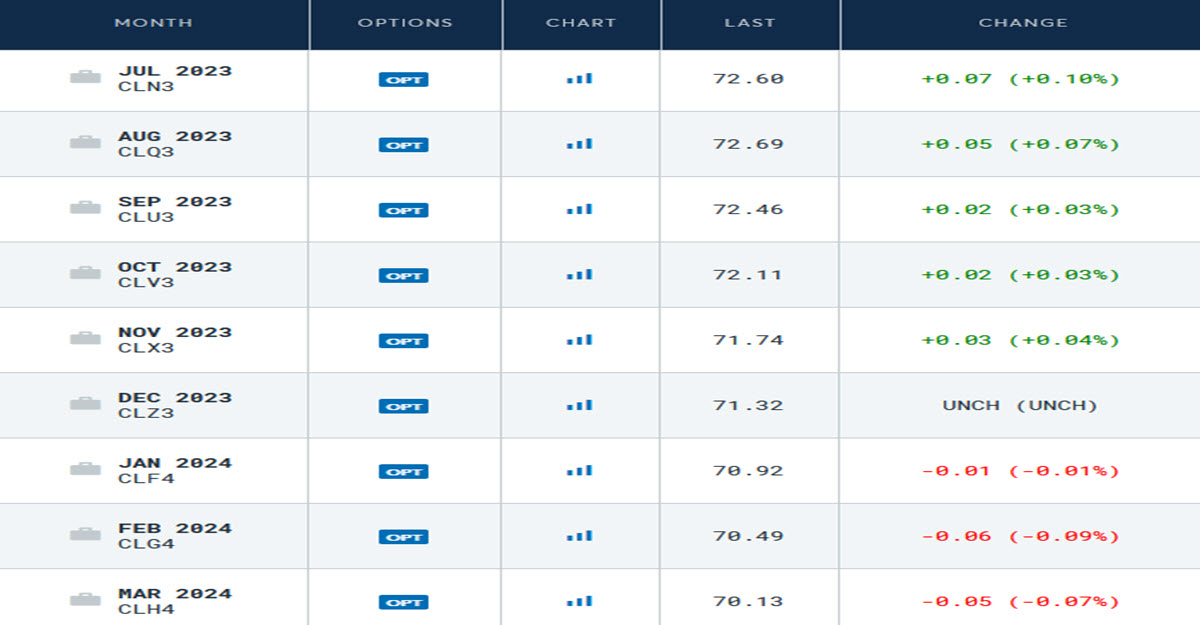

Global Oil Demand Projections, EIA

Over the weekend, at the OPEC+ meeting, the Saudis decided to implement a new production cut of 1mm bpd from July, bringing the total cut from 08/2022 to 4.66mm bpd; the full organisation decided to extend the cuts to the end of 2024. Despite this, the price of Crude Oil is down -41% from the summer 2022 high in the $123 area.

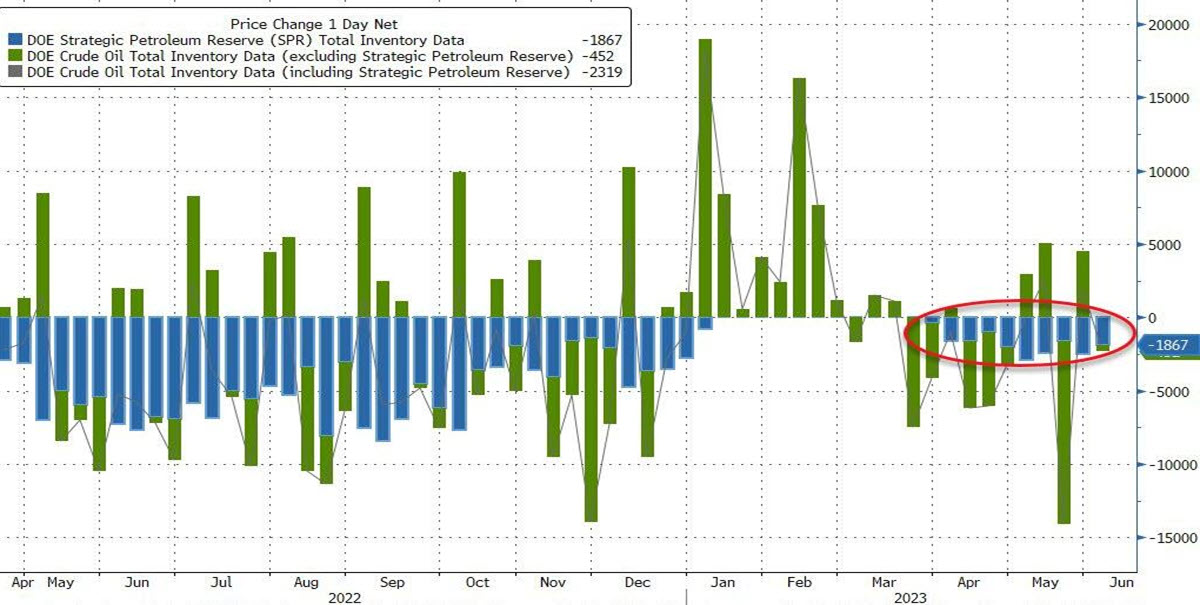

US Oil Production and Rigs Count

The US, on the other hand, the world’s top producer last year with 11.88mm bpd, is trying to compensate and its production has reached an all-time high (12.4mm bpd) even though the number of active wells continues to fall; furthermore, the use of SPR (Strategic Petroleum Reserve) continues to fall to 40-year lows, after a sale of 1.8mm barrels last week.

SPR Weekly Change (Blue), US Department Of Energy

All this activity on the production side has caused one effect: the Crude Oil futures chain is in backwardation. This means that contracts with future maturities cost less than the front-end contract. It is normal for large industries or – for example – airlines to plan their purchases months and years in advance to lock in the price at a certain level. There is a practical implication to this: speculators and professional traders such as the big oil companies will tend to sell the spot contract (putting further downward pressure on the price we all see) and buy the next futures at the same time, as prices will converge at expiry. This is until a new equilibrium is reached: at the moment it seems that the negative tilt is fairly limited (the Mar24 trades $2.47 lower than the Spot which is at $72.60 right now).

TECHNICAL ANALYSIS

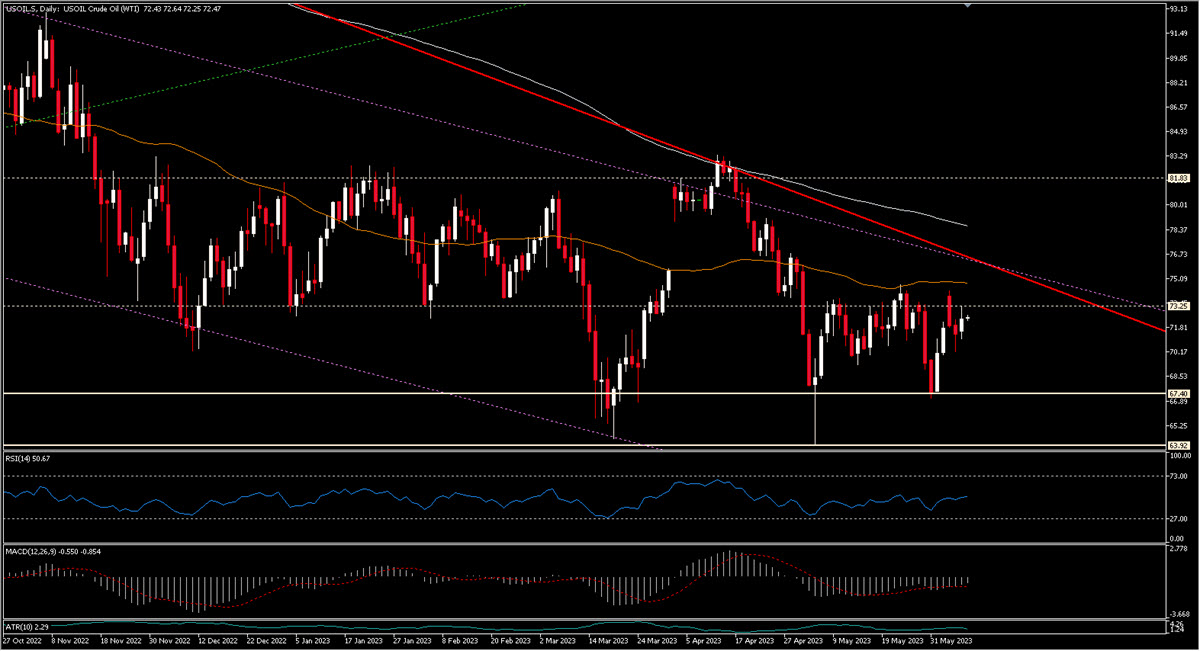

On the long-term chart, we note 2 things: 1) the clearly bearish trend of the last 15 months 2) the relevance of $67.40 and $63.90 as supports.

Crude Oil, Daily, 2018 – Today

Zooming in, we can notice that we are close to resistance zones: $72.60, $73.50 then there will be $74.60 or so where the Daily 50MA currently passes and the bearish trend will probably pass. RSI is neutral, MACD slightly rising but negative. Downwards, there are various minor levels such as $71, $70, $69.15 and $68.40. But the really important ones are 67.40$ and 63.92$: if they were broken, there would be a serious possibility of falling to the 58.60$ area in the medium term (although $61.80 would be another minor support). In case of serious economic problems, $51 is the long-term pivotal level.

We could start to be positive in the medium term only above the bearish trend and the Daily 200 MA , so probably above the GAP opened after the April OPEC meeting, above 79$.

Crude Oil, Daily, 10/22 – Today

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.