The echoes of the recent BRICS summit resonate with significance, promising to cast ripples across the market’s landscape. As the curtains fall, let’s unpack the main takeaways that hold the potential to reshape market dynamics in profound ways.

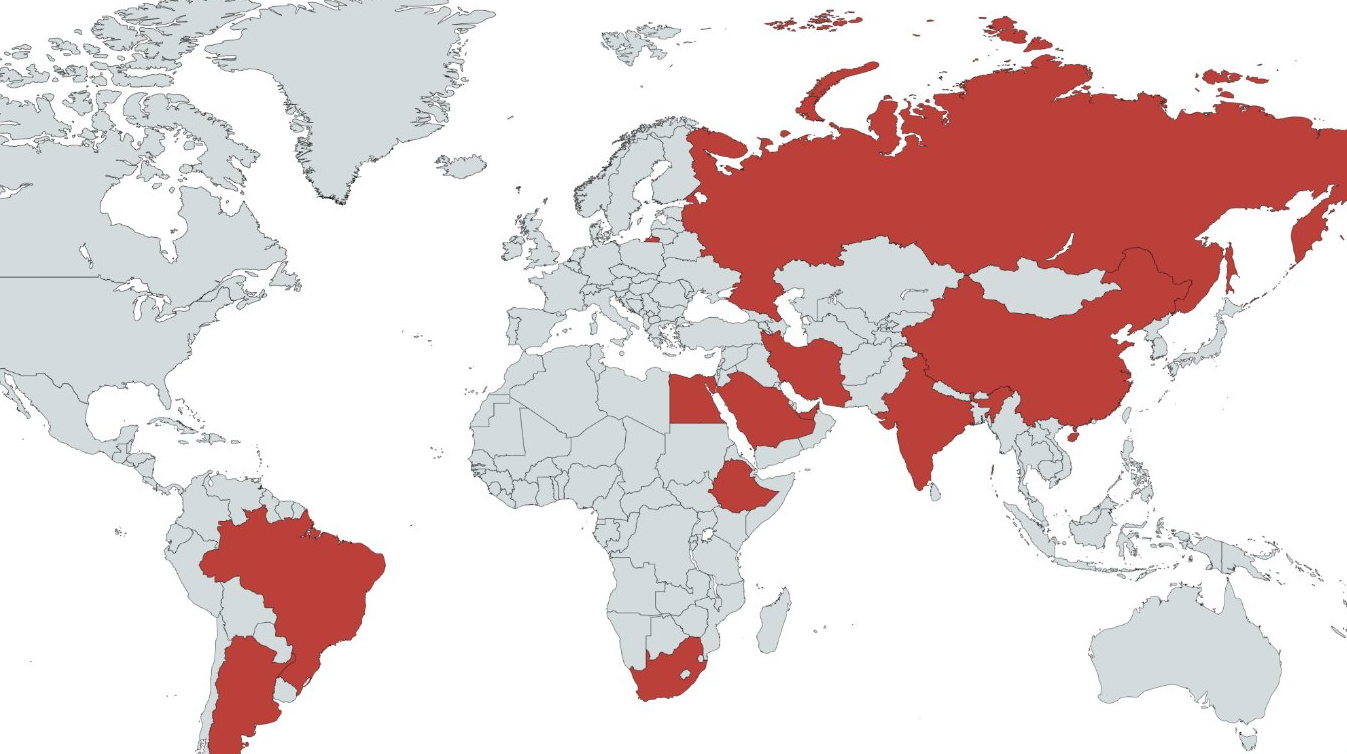

In a bold stride, BRICS leaders have extended a hand to welcome new allies into their fold. The distinguished list includes Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates, set to officially join the BLOC on January 1, 2024. This coalition amplifies the prowess of emerging giants, propelling the BRICS alliance into uncharted territories of economic and geopolitical influence. With the BRICS+ initiative at the helm, the intention is clear: foster deeper cooperation among developing nations, chipping away at the West’s long-standing dominance in global affairs.

In a bold stride, BRICS leaders have extended a hand to welcome new allies into their fold. The distinguished list includes Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates, set to officially join the BLOC on January 1, 2024. This coalition amplifies the prowess of emerging giants, propelling the BRICS alliance into uncharted territories of economic and geopolitical influence. With the BRICS+ initiative at the helm, the intention is clear: foster deeper cooperation among developing nations, chipping away at the West’s long-standing dominance in global affairs.

The summit’s resonance extends far beyond just welcoming new faces. In a seismic move, BRICS leaders have declared a decisive shift away from the US Dollar in their trade and investment dealings. With a pioneering spirit, they’ve unveiled the BRICoin – a digital currency backed by a basket of national currencies and Gold. Steering this innovative financial vessel is the BRICS Monetary Fund (BMF), destined to serve as a robust pillar of support for member nations in times of economic turbulence.

The BRICS leaders have expressed their support for the Belt and Road Initiative (BRI), an ambitious project spearheaded by China, charting routes that crisscross Asia, Africa, and Europe. The applause was more than symbolic; BRICS nations pledged to deepen their involvement and investments in the BRI. Their focus spans energy, transport, digital connectivity, and sustainable development. The stage is set to craft bridges that span continents, fostering connectivity and synergy.

ambitious project spearheaded by China, charting routes that crisscross Asia, Africa, and Europe. The applause was more than symbolic; BRICS nations pledged to deepen their involvement and investments in the BRI. Their focus spans energy, transport, digital connectivity, and sustainable development. The stage is set to craft bridges that span continents, fostering connectivity and synergy.

At the heart of it all, the BRICS summit stood as a stronghold of unity. The leaders united their voices, resonating with a commitment to multilateralism, climate action, human rights, and international harmony. The chorus resounded with calls for a more democratic United Nations, a rejuvenated World Trade Organization, a fortified World Health Organization, and a financial ecosystem grounded in balance and sustainability. Amid this symphony of solidarity, the summit stood steadfast against unilateralism, cyber threats, and other disruptors of global equilibrium.

As the summit’s echoes fade, market watchers hold their breath, awaiting the real-world resonance of these decisions. The effects could be as varied as they are profound:

- Amplified Voices: The expansion of the BRICS family heralds a recalibration of global dynamics. A beefed-up bloc flexes its muscles in trade negotiations, influencing market access and opportunities. TThis holds both opportunities and challenges for both BRICS and non-BRICS countries.

- Shifting Financial Landscapes: The birth of the BRICoin steers the BRICS nations towards a financial realm less tethered to the US Dollar’s whims. Financial stability gleams on the horizon, but the journey won’t be without obstacles. Navigating the technical, regulatory, and political waters demands finesse.

- Connectivity Unleashed: The BRI’s embrace brings promises of development and economic growth to regions it touches. Unity blossoms as connectivity deepens, but shadows loom – concerns of debt, environmental balance, and strategic jostling emerge as the initiative’s footprints spread.

- Multilateral Might: The reaffirmation of multilateralism echoes as a rallying cry for collective action. While this united front holds the promise of global cohesion, it’s not without its share of resistance from pockets that favour alternative approaches.

In this unfolding saga, the BRICS summit emerges as a cornerstone of transformation. As these narratives intertwine, the market readies itself to navigate a fresh horizon, where change and opportunity intersect.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.