Boeing Co., an aerospace titan, finds itself in a storm. For nine consecutive days, its shares have been on a relentless descent, shedding 1.07% to close at $208.40 in a trading session that painted a mixed picture for the stock market. While the S&P 500 Index managed to eke out a modest 0.12% gain, landing at 4,467.44, the Dow Jones Industrial Average slipped by 0.20% to settle at 34,575.53.

This descent isn’t without reason. Boeing faces a series of hurdles converging like a storm. Ongoing issues with its 737 MAX deliveries, decreasing demand for its wide-body jets, stiff competition from Airbus and other rivals, and uncertainty in the global aviation industry all contribute to this turbulence.

Intriguingly, a report by Bloomberg adds depth to this narrative. It revealed that Boeing delivered a mere 22 of its 737 MAX planes in August, a sharp decline from 35 in July and 50 in June. Sources in the know point fingers at Boeing’s supplier, Spirit AeroSystems Holdings Inc., citing production woes with fuselages and other vital components of the 737 MAX. The report went on to reveal Boeing’s need to suspend deliveries of select 787 Dreamliner planes due to quality issues and the necessity for rigorous inspections.

These delivery numbers are vital, offering insight into Boeing’s financial health. The company continues to grapple with the aftermath of the grounding of its best-selling 737 MAX jets in 2019 following two fatal accidents that claimed 346 lives. Additionally, lower demand for its wide-body planes, like the 787 and the 777X, reflects changing trends in aviation. The shift towards smaller, fuel-efficient planes and reduced international travel has impacted these once-prominent models.

Across the aisle, arch-rival Airbus SE is gobbling up market share and securing substantial orders. Airbus chalked up 40 deliveries in August, taking its yearly total to 384. A coup de maître arrived in the form of a colossal order from China, valued at an estimated $37 billion. This hefty order included 260 of Airbus’s A320neo family jets and 40 of its A350 wide-body aircraft.

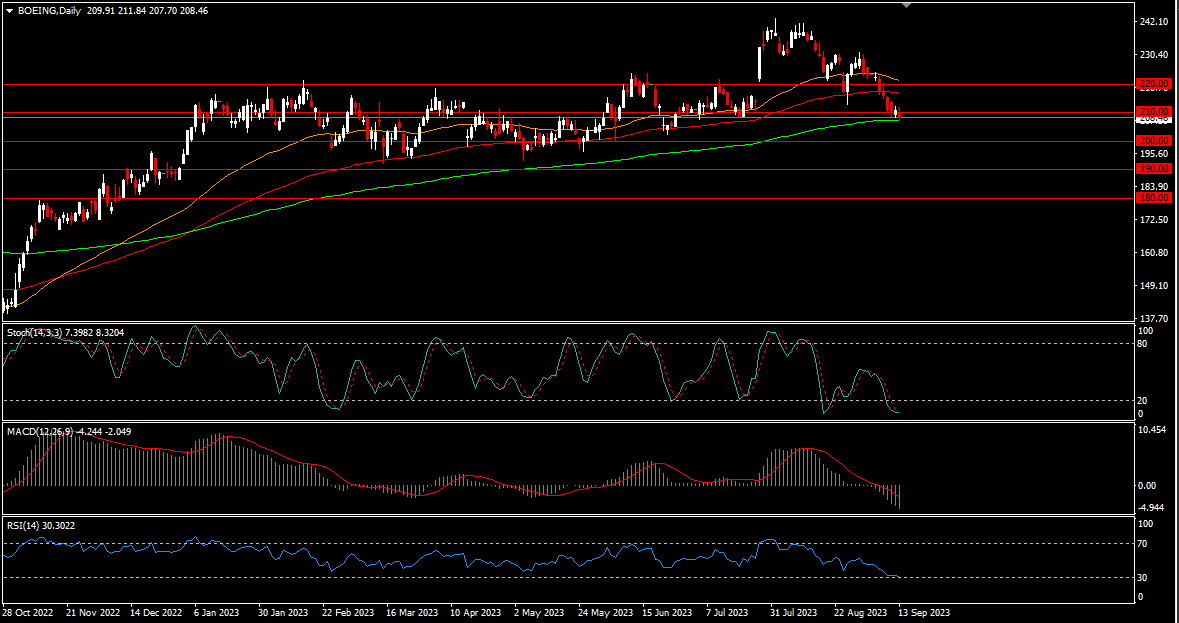

For Boeing, the stock price paints a disheartening picture. Since reaching a zenith of $243.10 in August 2023, it has been a perilous journey. Support levels have crumbled, including the 50-day and 100-day moving averages, with the stock teetering just above the 200-day moving average. Psychological barriers at $220 and $210 have been breached, and now the $200 threshold beckons ominously. This level carried significance from February to May 2023. Should the stock price plummet below, a path to $190 and $180 opens wide. Conversely, if it claws back, resistance looms at $210 and $220, bolstered by the moving averages.

Technical indicators echo this sombre tune. The MACD remains below the zero line and signal line, signalling negative momentum. The RSI sits below the 50 level, indicating bearish pressure. The Stochastic oscillator hovers in oversold territory, suggesting a potential reversal or consolidation.

Boeing, once the giant of the skies, now faces turbulence, battling headwinds from all directions. The path ahead remains uncertain, and investors watch with bated breath as this aviation behemoth navigates through stormy skies.

Click here to access our Economic Calendar

Francois du Plessis

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.