The ECB delivered a 25 basis point hike and signalled that in the central scenario rates have now peaked. How long rates will remain at record highs will depend on data releases, but in effect also market reaction to signals.

Pricing in rate cuts too early could actually delay the start of the easing cycle, which may not come before the second half of next year.It wasn’t an easy meeting for the central bank this week, and markets and ECB watchers had been pretty much split on the outcome before a source story this week flagged that the new projections saw headline inflation above 3% next year. Lagarde confirmed that officials debated and analyzed the new forecasts long and hard, and in the end it wasn’t a unanimous vote but a “solid majority” that backed the quarter point hike. The marginal lending rate is now at a record high of 4.50%, and the deposit rate is at 4.00%. The statement sent a pretty clear signal that in the central scenario we have now reached the peak of the tightening cycle.

An FT source story earlier reported that the ECB may still hike again in December. The FT cited people familiar with the thinking of the hawkish camp that they may still push for another hike in December, if wages keep rising and inflation proves stickier than anticipated. The ECB signalled yesterday that in the central scenario, rates have likely reached the peak, but the door to further tightening was left ajar and the December meeting brings the next forecast revision.

So the source story should not be a surprise, but of course it is a reminder that the ECB didn’t fully shut the door to another hike and that the outlook remains data dependent. Lagarde said as much yesterday, but as the markets still ran with the predominantly dovish message, it is no surprise that yields are moving up from yesterday’s lows and that spreads are widening again. The ambiguity of Lagarde’s comments will likely mean markets will take some sessions for rate expectations to settle.

The ECB’s introductory statement said that “based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

Lagarde repeatedly flagged the importance of that passage during the press conference, and a lengthy pause is now likely to follow, with rate cuts likely to come into view in the second half of next year.

The new staff projections see a much shallower growth profile, with GDP expected to expand 0.7% this year, 1.0% in 2024 and 1.5% in 2025. Much of the downward revisions for the next couple of years are due to the weakness in growth during 2023. Lagarde stressed during the presser that the central bank remains confident that activity will pick up next year. As such, a lasting recession is not the central scenario at the ECB — at least for now.

At the same time near term inflation projections have been revised higher, and the ECB now expects CPI to average 5.6% (was 5.4%) this year and 3.2% (was 3.0%) in 2024. However, the CPI forecast for 2025 was actually cut slightly — to 2.1% from 2.2%, which would bring the headline almost in line with the central bank’s target. And core inflation forecasts have been cut throughout the projection horizon, with underlying price increases now seen decelerating to 2.2% by 2025. This is not quite in line with target, but with growth slowing down, and rate settings already restrictive, these forecasts do not signal the need for additional hikes, but merely a sufficiently long period of restrictive policy settings.

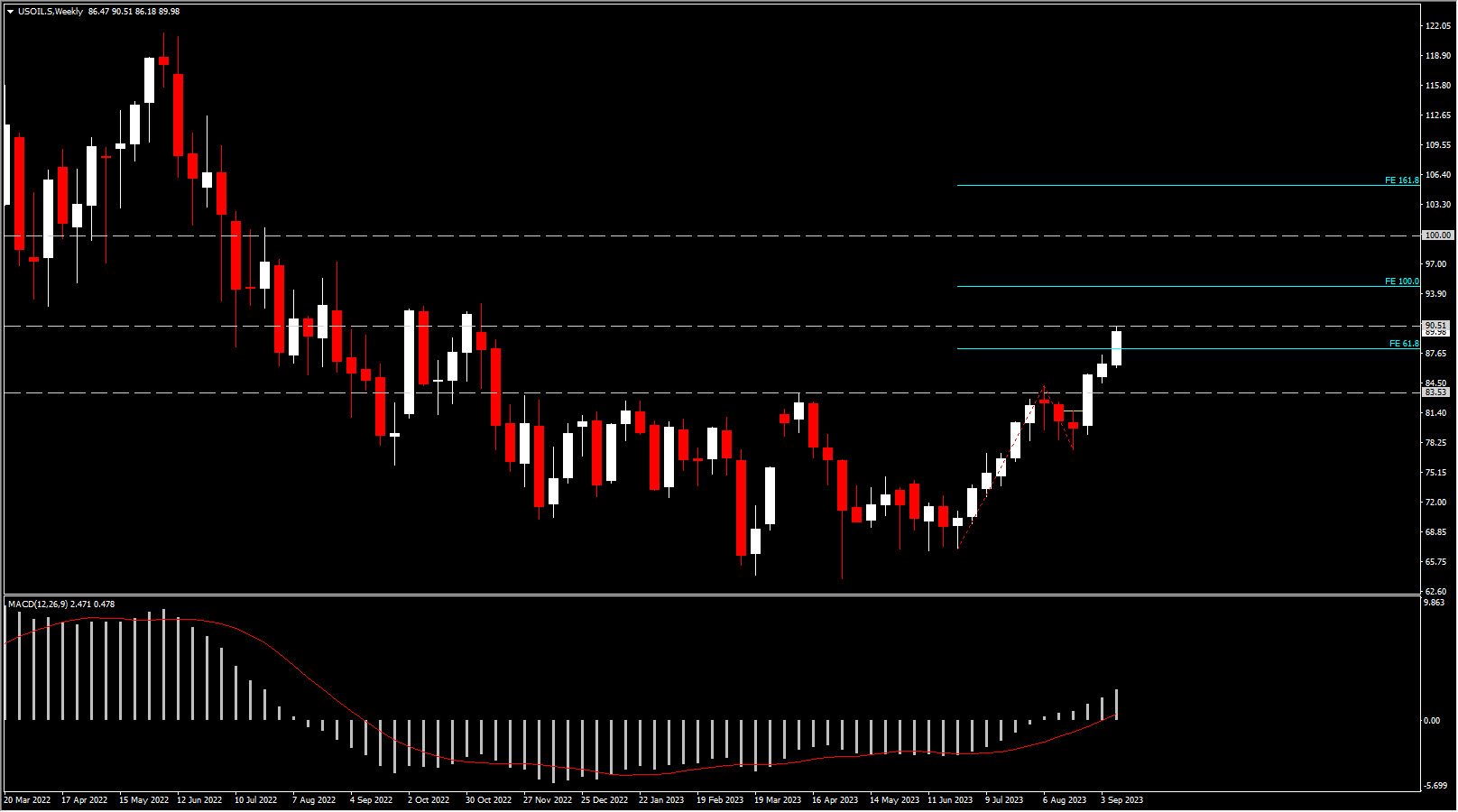

How long “sufficiently long” will turn out to be remains open, and Lagarde made it clear during the presser that this will largely depend on future data releases and the outlook for inflation. Uncertainty still remains high, especially as oil prices are rising and are likely to head towards $100 towards the end of the year, when output cuts and supply restrictions are set to hit rising demand.

The ECB’s forecast is based on an oil price of $81.8 per barrel next year, falling to $77.9 per barrel in 2025, which seems optimistic if China’s economy bounces back. Russia’s war against Ukraine and the lack of an agreement on transport through the Black Sea, coupled with weather events, could push up food inflation again.

Looking ahead, data dependency will remain key, and the central bank didn’t fully close the door to another hike. The hurdles to further tightening seem pretty high now, however, and a steady hand through the rest of the year and early 2024 is our main scenario. How long rates will have to stay at this restrictive level will also depend on future data releases, and of course the strength and speed of the transmission of previous rate hikes.

Developments in the economies of the US and China will likely play a key role here, but also the ability of European manufacturers to adjust to the cut-off from cheap Russian gas and incentives to move production facilities outside of the EU. These factors are outside of the remit of the ECB, which has to focus on trying to keep a lid on domestic price pressures as wages continue to rise and the labour market remains tight, despite signs of sluggish growth.

Bonds rallied on the announcements and presser, and in the immediate future the challenge for Lagarde and Co will be to prevent markets from running too far ahead of the ECB with regard to the timing of the first cut.

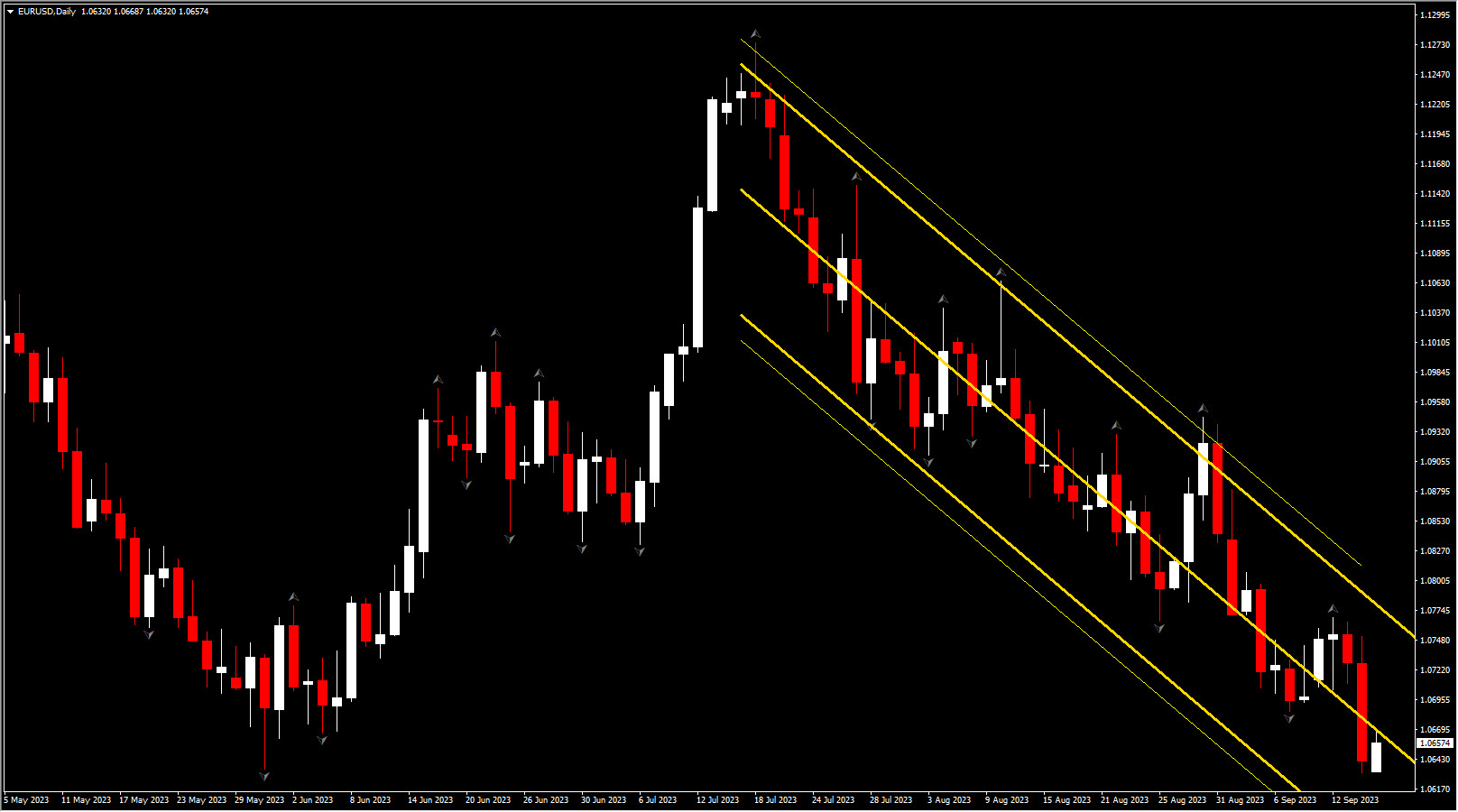

“Higher for longer” remains the message, but if growth indicators continue to deteriorate the central bank will struggle to prevent markets rates from falling faster than is needed to maintain a sufficient degree of restriction. If the Fed hikes again later in the year, as many expect, EURUSD will also remain under pressure, which will add to the ECB’s inflation problem, and exacerbate the impact of rising oil prices. It will certainly make it difficult to get EURUSD to lift to 1.09, which is the central bank’s baseline scenario for the next couple of years.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.