Major stock market indices in the Asia-Pacific region are mostly trading lower on Thursday in anticipation of the latest information regarding Japan’s inflation, unemployment rate, and industrial production. Meanwhile, two Hong Kong-listed branches of Evergrande Group halted trading without further explanation, reinforcing instability in China’s real estate sector.

New Zealand

After declining in the previous two sessions, the New Zealand Dollar traded around $0.5940 on Thursday, helped by recent data showing that business mood in the country improved in September for the first time in 28 months, as cost pressures eased further.

Meanwhile, speculation increased that the RBNZ which is still battling high inflation, might take a more hawkish stance at its monetary policy meeting next week. After 525 bps of rate hikes since October 2021, consumer price inflation in New Zealand further declined to 6% in the second quarter of 2023, which is the lowest level in 1-1/2 years, but still outside the board’s target range of 1% to 3%.

The RBNZ is one of many major central banks seeking to end their severe tightening cycle. Weak domestic demand and declining export demand are putting pressure on the New Zealand economy. The New Zealand Dollar has held up against the US Dollar in September, although NZDUSD took a hit in August of 3.9%. The decline was largely due to the deteriorating Chinese economy.

Meanwhile, the US economy remains strong despite high interest rates. The Fed kept interest rates on hold last week, but the pause was hawkish as the Fed warned markets to expect a ‘longer-term’ path of higher rates as it seeks to bring inflation down to the 2% target set by the Fed.

For traders to watch out for, the US will release its third GDP estimate for August today, with the market consensus at 2.0%. This would mark a downward revision from the second estimate of 2.1% and the initial estimate of 2.4%. The US economy continues to post respectable growth figures despite the Fed’s sharp tightening, as the labour market remains strong, and consumers continue to spend.

Technical Review

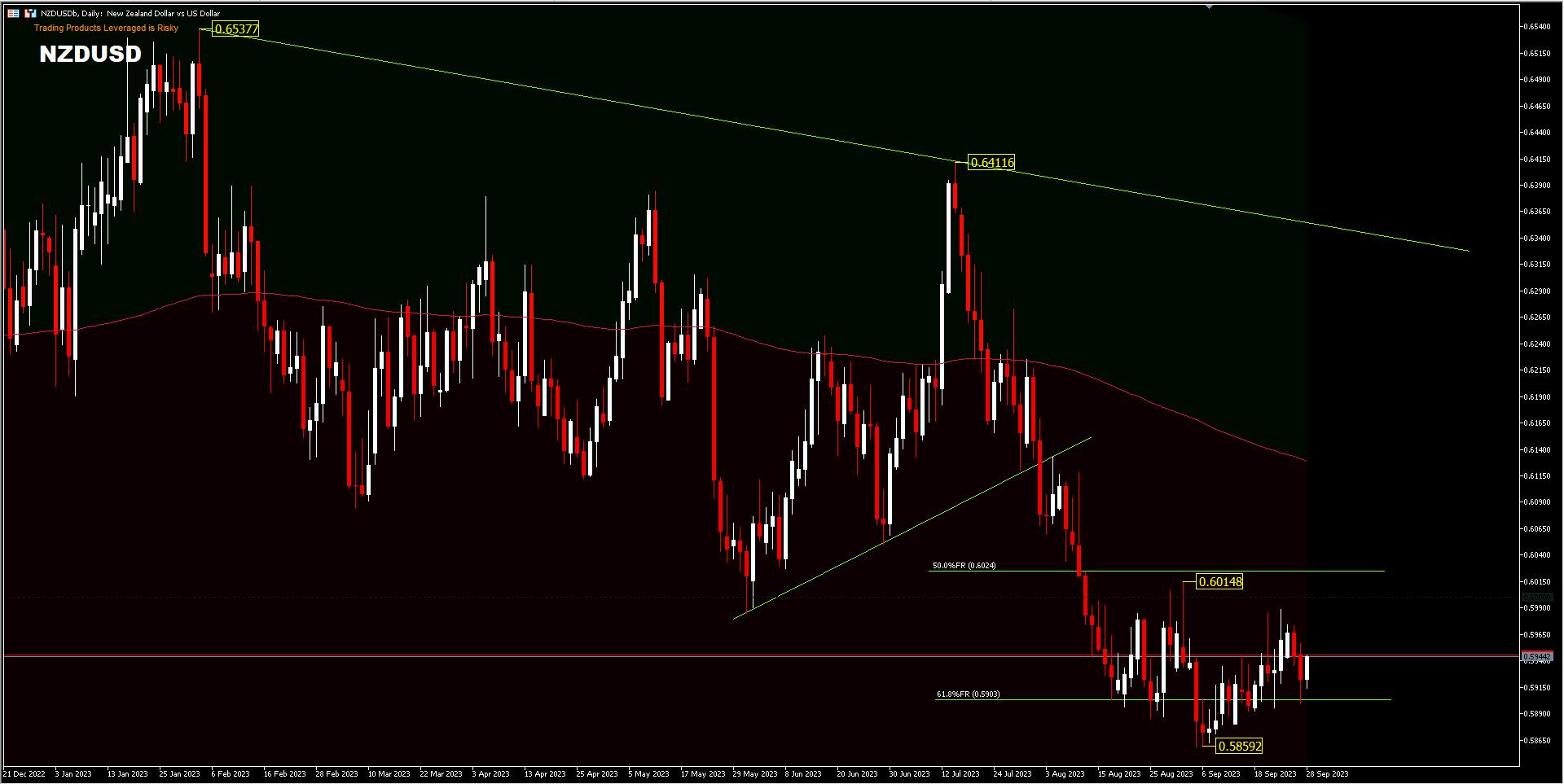

NZDUSD, Daily.

NZDUSD decline, stuck at 61.8% FR level around 0.5900 from 0.5511 and 0.6537 measurements, throughout the month of September. Consolidation is seen to be ongoing within the range of 0.5859 – 0.6014. With 1 working day left in September, it is highly likely that the September candle will produce a monthly doji candle. Technically, the pair is still in a downtrend so a drop below 0.5859 support will confirm, that the decline from 0.6537 is not yet complete. Conversely, a move above 0.6014, the pair could test the 200-day EMA around 0.6120. However, as long as 0.6411 resistance holds, the outlook remains bearish ahead.

Intraday bias remains neutral and trading range remains narrow. A move above 0.5988 will test the upper range of 0.6014 or the 50.0%FR/ EMA 200 level, while a move below 0.5899 support will test 0.5859. A move below 0.5859 will confirm the bearish trend.

Meanwhile in Australia…..

Meanwhile, the latest retail statistics from Australia showed a bleak picture of consumer spending, with August retail sales turnover only marginally increasing on a monthly basis to AUD 35.4 billion, falling short of the anticipated rise. Over the year, sales turnover rose 1.5% y/y. Retail sales only increased by 0.2% in August, compared to the market forecast of 0.3% and after a final growth of 0.5% in the previous month, preliminary data showed. This small increase suggests that consumers continue to hold back their spending as interest rates remain high.

Australia’s inflation rate rose 5.2% y/y in August, up from 4.9% y/y in July and in line with consensus estimates. This marked the first acceleration in inflation since April. Rising fuel prices contributed to the higher monthly inflation rate of 0.8%, up from 0.3% in July. The headline core inflation indicator fell to 5.5% y/y, down from 5.8% y/y in July. The inflation data had little effect on the market, which widely expects a fourth consecutive pause from the RBA in October. The market views the rise in inflation as a temporary change and expects the overall downward trend to continue, with expectations of a rate hike in May 2024.

RBA Governor, Michelle Bullock has emphasised, that the door is open for further rate hikes and the rate decision will be data dependent. This stance is not surprising, as the central bank does not want to suggest that interest rates have peaked, while inflation is still well above the 2% inflation target.

Technical Review

AUDUSD, D1– bearish trend doesn’t look to have stopped yet, although throughout September the pair was seen ranging, but the bias was towards the downside. The trend from 0.8006 peak may still be ongoing. A decisive break of 0.6330 will target 0.6271 and 0.6169 support. The level will now remain the preferred choice as long as 0.6510 resistance holds.

AUDUSD, H4

Trading within range continues and intraday bias remains neutral. Further downside is expected as long as 0.6510 resistance holds. A break of 0.6330 will resume the larger downtrend to 161.8%FE projection of 0.6510 – 0.6384 drawdown and 0.6464 at 0.6260. However, a move above 0.6510 would declare a short-term bottoming has formed at 0.6330.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.