Tesla.Inc. is a company which engages in the design, development, manufacture, and sales of fully electric vehicles, as well as power storage and photovoltaic systems. It is ranked the 8th most valuable company in the world by market cap at over $830B. The company is scheduled to release its Q3 2023 earnings result on 18th October (Wednesday), after market close.

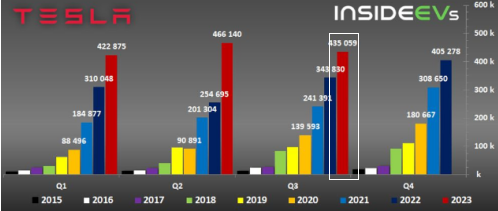

In Q3 2023, Tesla reported total vehicle production at 430,488, up 18% compared to the same period last year. On the other hand, total deliveries hit 435,059, up 27% from the same period last year. Model 3/Y reported production and deliveries up +20% (y/y) and +29% (y/y), to 416,800 and 419,074, while Model S/X reported production and deliveries down -31% (y/y) and -14% (y/y) to 13,688 (the lowest level since Q4 2021) and 15,985. Year-to-date, Tesla has produced over 1.35 million (+45% y/y) electric cars worldwide and delivered over 1.32 million (+46% y/y) electric cars.

The declining production and deliveries compared to the previous quarter come as no surprise as the company has signaled that there will be temporary shutdowns in some of its factories for the purpose of internal upgrades. Nevertheless, the management maintains its volume target around 1.8 million for 2023, highlighting its confidence in its capability to attain the goal (nearly 476,000 cars need to be delivered in Q4 to meet the requirement).

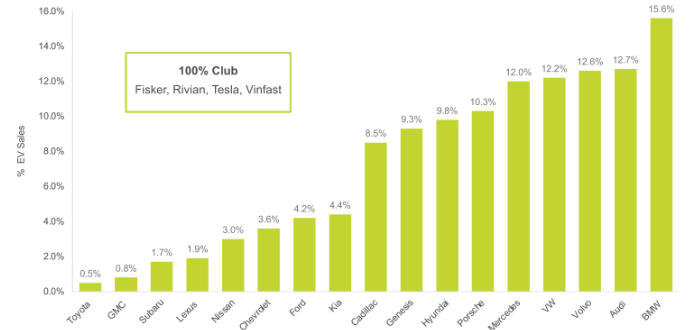

Tesla remains the undisputed leader in EV sales for the quarter, surpassing the industry’s overall growth rate (16.3%). In fact, EV sales in the US market have spurred continuous linear growth following downward pricing pressure, more product availability, and higher inventory levels, as well as growing consumer acceptance towards the EV market. According to Cox Automotive, total sales of EV in the US has hit over 300,000, for the first time ever. Three years ago, in 2020, it had just passed 250,000. Year-to-date, total EV sales reached over 873,000. This has sparked market optimism that EV sales are likely to hit the 1 million milestone by the end of this year.

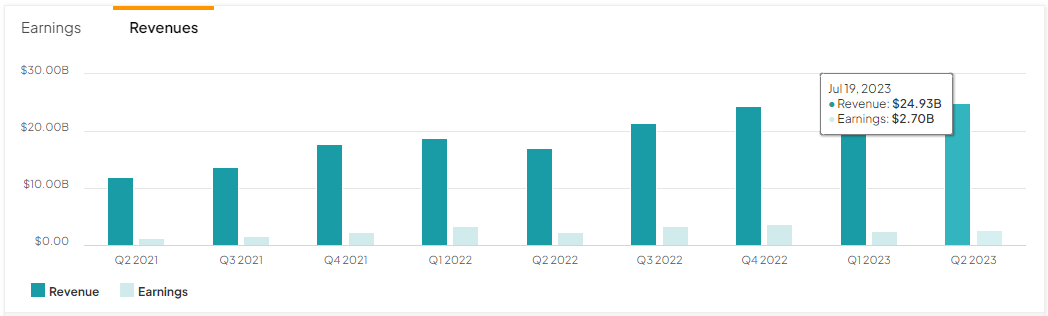

Tesla: Revenues & Earnings (After Deduction of Tax and Expenses). Source: Tipranks

“Revenue is expected to come in at $24.21B; EPS revised downward to $0.74 after the disappointing delivery numbers; Gross profit margins expected to improve but are likely to remain within the 18% range.” – Refinitiv

Indeed, current market stance remains neutral on Tesla. Increasing competition, margins that have been scrutinized following price cut approaches, macroeconomic uncertainties, over 70x forward consensus earnings – these are some of the factors that limit its upside potential in the near term. Nevertheless, some optimists believe that Tesla could eventually benefit from its well-oiled supply chain, superior battery and drive train tech, as well as leading software (Dojo supercomputer, AI development) and self-driving technology – and that it shall remain the major beneficiary of the long-term transition to cleaner transportation and energy generation.

Technical Analysis:

The Daily chart shows the #Tesla share price trading within a symmetrical triangle, currently testing the 100-day SMA that intersects with $252.70 (FR 23.6% extended from YTD lows to highs). The lower line of the triangle serves as the next support, followed by $223.80 (FR 38.2%) and $200.50 (FR 50.0%). On the other hand, a break above the upper line of the triangle and FE 61.8% projection at $275.60 may indicate bullish continuation, towards the next resistance at YTD high $299.28 and FE 100.0% at $301.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.