The second week of October saw UK natural gas futures prices increase by almost 50% to £160, an 8-month high from just £89 last week. The situation was driven by forecasts of colder weather which increased demand amid supply concerns caused by geopolitical risks and labour disruptions at the Australian LNG facilities.

As the weekend approaches, the UK is expecting temperatures to drop sharply, with daytime highs in southern England expected to be 10 degrees Celsius lower than earlier in the week. The first night frosts of the season are possible in central and northern regions.

Regarding supplies, Israel closed a gas field due to safety concerns, while investigations into pipeline leaks in the Baltic raised concerns about winter safety. In addition, some progress was made on Friday in talks between Chevron and unions over a wage and conditions agreement for their LNG plant in Australia, but no final agreement has been reached at the time of writing. (BBC)

Surging natural gas prices and rising US core inflation are two signals that could prompt the BOE to raise interest rates again before the end of the year. The rise in gas prices could mean that the energy component of the inflation basket will continue to put pressure on the headline inflation rate, as it did in August, which in turn will strengthen inflation expectations more broadly.

Senior interest rate setters at the BOE sounded cautious in signalling that the rate hike cycle is complete. Governor Andrew Bailey said at the IMF conference in Marrakesh that UK interest rate decisions would be “tight”. He said despite solid progress in fighting inflation, there was still work to be done. Such developments have helped shore up market expectations of further rate hikes and pushed back expectations of the start of rate cuts. This dynamic is favourable for Sterling.

Meanwhile, the US Dollar surged on Thursday and Friday after the US reported that core services inflation had increased notably in September. Increased safe-haven demand also supported the Dollar amid fears the conflict between Israel and Hamas could spill over after Iran’s foreign minister said Hezbollah militants could open a new front in Israel’s war.

In addition to the prospect of tighter US monetary policy, Sterling faced additional pressure from UK industrial production data. According to the latest figures from the Office for National Statistics (ONS), published on Thursday, the country’s industrial sector activity declined again in August. Manufacturing output fell by -0.8%, versus estimates of -0.4% and a -1.2% decline in July. Overall industrial production fell by -0.7%, versus estimates of -0.2% and -1.1% in the previous month. On an annualised basis, although manufacturing output increased by 2.8% in August, the figure still fell short of the 3.4% forecast. The overall volume of industrial production also fell short of expectations, increasing by only 1.3% against a forecast of 1.7%.

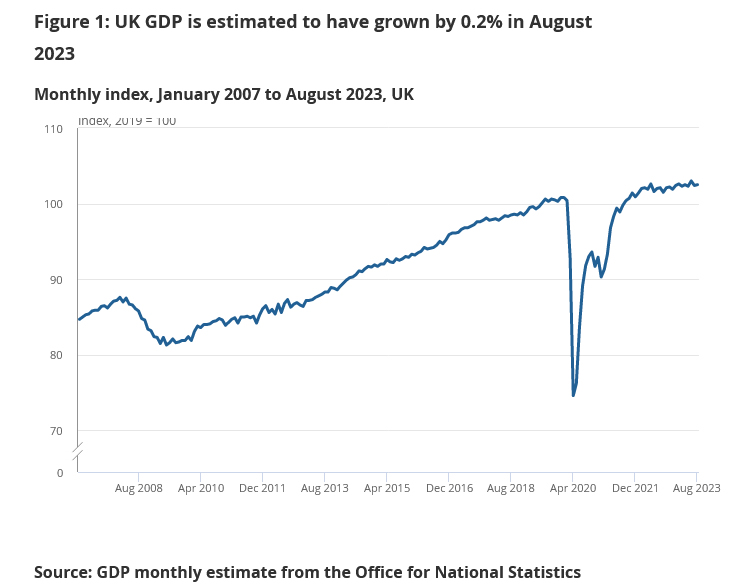

Despite the fact that UK GDP, after contracting by -0.6% in July, increased by 0.2% in August, the risk of a slowdown in economic growth is increasing. This is largely due to developments in geopolitical tensions in the Middle East which are feared to disrupt global supply chains and rising prices of natural energy resources that will increase inflationary pressures.

This situation poses a dilemma for BOE decision makers, between controlling inflation and preventing the economy from slipping into a severe recession. The BOE interest rate was unchanged at 5.25% in September. The next BOE meeting is scheduled for the 2nd of November and whether the regulator will choose to raise rates even by a few basis points remains a significant question.

Technical Analysis

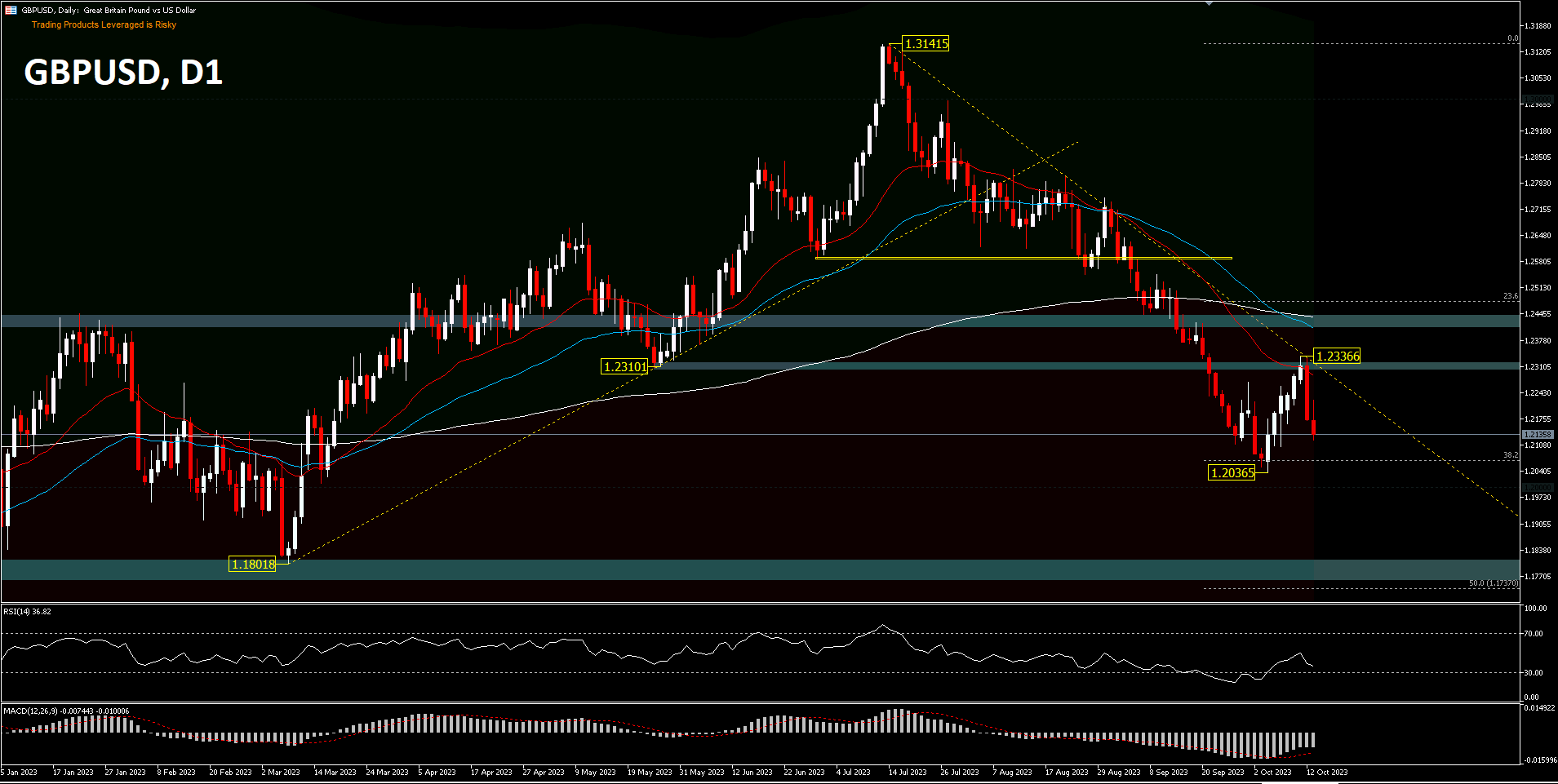

GBPUSD’s decline from the medium-term peak of 1.3141 is still a correction from the rise to 1.0330 (2022 low). But the risk of a total trend reversal is increasing. A sustained break of the 38.2%FR retracement of 1.0330-1.3141 pullback will open the way to the 50%FR level of 1.1737 first. For now, the risk will remain on the downside as long as the 52 EMA holds, in case of a rebound. All daily technical indicators still validate the recent decline.

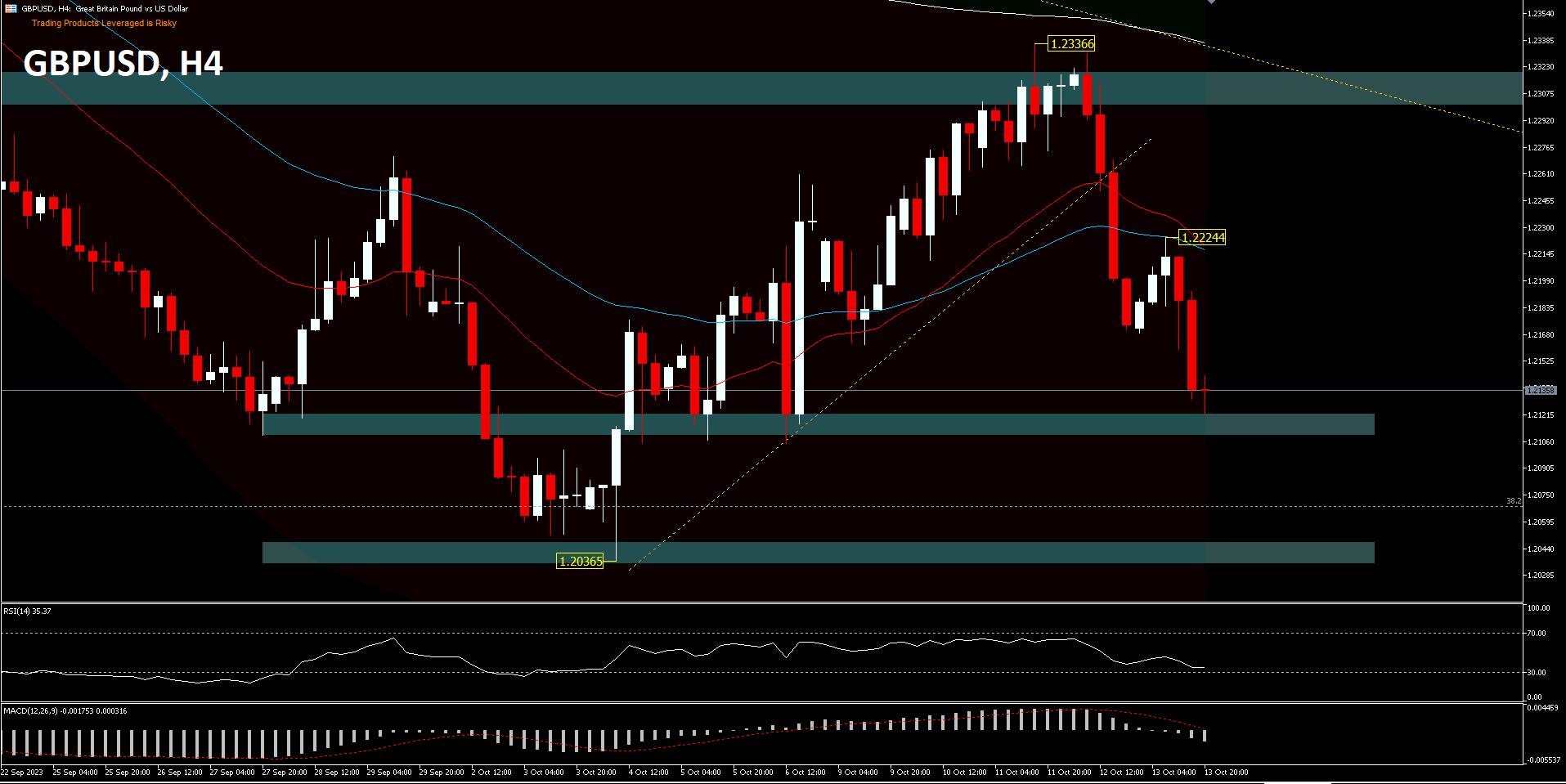

H4 – The rebound from 1.2036 continued higher last week, but was rejected by the short-term descending channel resistance [EMA 200] and has been weakening since then. Initial bias remains to the downside this week for a retest of 1.2036. A strong breakout will resume the overall decline from 1.3141 to the next support at 1.1801. On the upside, a move above 1.2224 minor resistance will change the intraday bias to neutral first. However, the risk will remain on the downside as long as 1.2336 resistance holds.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.