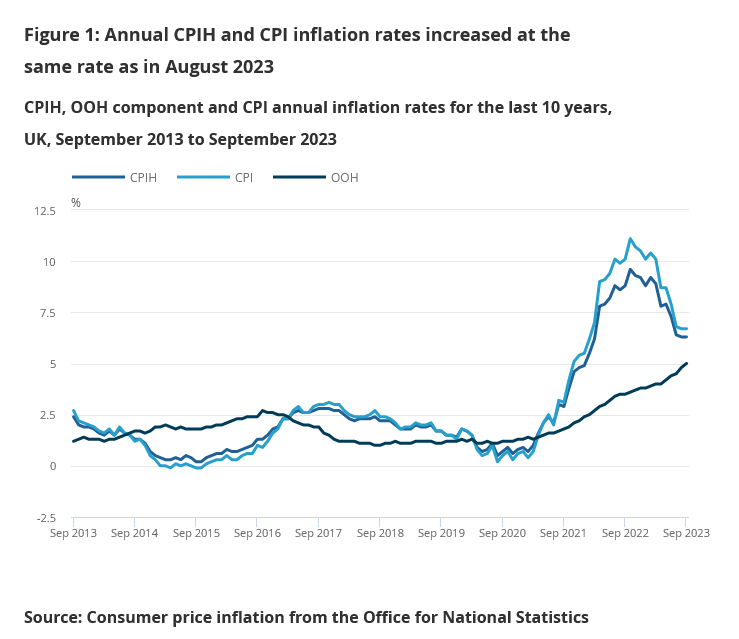

The Pound strengthened slightly to $1.2210 following reports of inflation remaining high in September, despite the BOE making a series of rate hikes over the past few months. GBPUSD gains were short-lived, as a stronger US Dollar became a stumbling block for the Pound. UK annual consumer price inflation held at an 18-month low of 6.7%, contrary to market expectations which forecast a slight decline to 6.6%, while the core rate fell less than expected to 6.1%.

Meanwhile, labour data released earlier this week showed that overall payroll growth in the UK slowed from 8.5% to 8.1%, falling short of the projected 8.3%. In addition, the number of job vacancies fell to a two-year low in August. On Saturday, BOE Governor Andrew Bailey expressed his confusion over the persistent strength of payroll growth in the UK, while Chief Economist Huw Pill emphasised on Monday that the central bank should not assume too early that the fight against high inflation has been won.

Meanwhile, Eurozone CPI settled at 4.3% y/y in September, down from 5.2% y/y in August. Core CPI was 4.5% y/y, down from the previous month’s 5.3% y/y. The highest contribution to the Eurozone’s annual inflation rate came from services (+2.05 percentage points, pp), followed by food, alcohol & tobacco (+1.78 pp), non-energy industrial goods (+1.06 pp) and energy (-0.55 pp).

EU CPI was 4.9% y/y, down from 5.9% y/y in August. The lowest annual rates were recorded in the Netherlands (-0.3%), Denmark (0.6%) and Belgium (0.7%). The highest annualised rates were recorded in Hungary (12.2%), Romania (9.2%) and Slovakia (9.0%). Compared to August, annual inflation fell in twenty-one Member States, remained stable in one and increased in five.

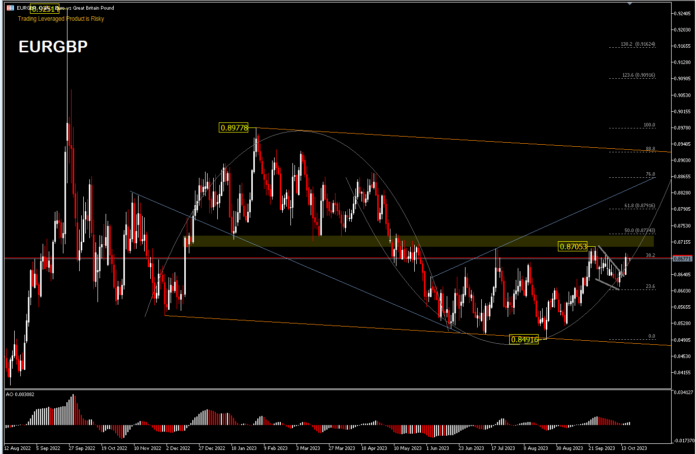

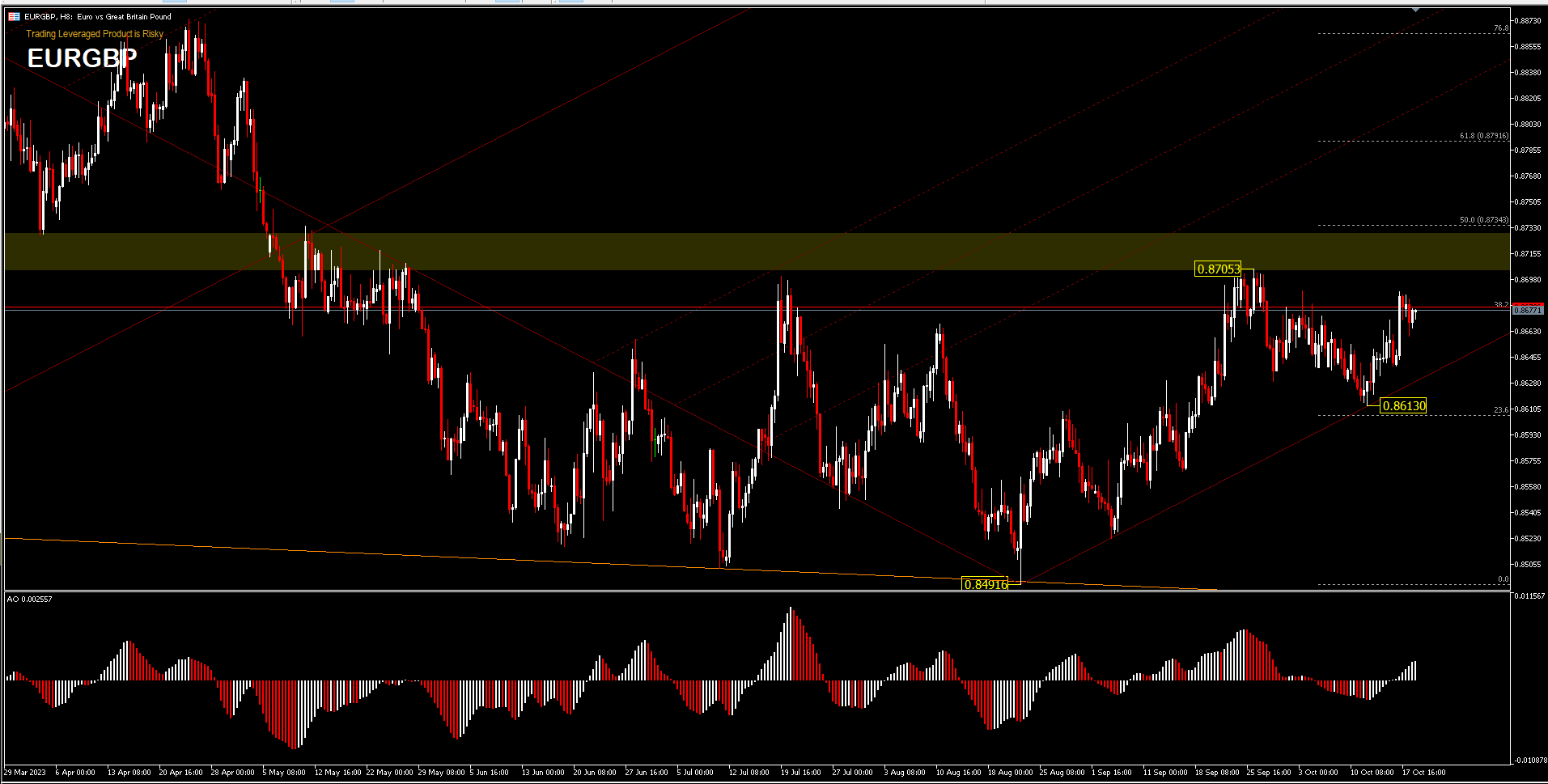

The EURGBP pair is trading in a narrow range at the 38.2% FR level of the 0.8977-0.8491 drawdown. The downtrend from the 2022 peak [0.9251] is seen as part of a long-term ranging pattern from the 2020 peak [0.9498]. A break of the 0.8705 resistance would confirm that this decline has been completed. A rise from 0.8491 could then resume the stalled rally with projections to target the 50.0% FR and 61.8% FR levels, at 0.8734 and 0.8791 respectively. However, rejection from 0.8705 would keep the downtrend alive for a drop back to the 0.8491 bottom price.

Intraday bias [H8] on EURGBP looks neutral. A break of the 0.8705 resistance would resume the 0.8491 rebound and bring more bullish implications. Nevertheless, a break of 0.8613 would turn the bias to the downside and resume the decline from 0.8705.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.