The Bank of Mexico chose to keep its highest benchmark policy rate at 11.25%, as expected, at its November 2023 meeting. This decision, the fifth consecutive pause, follows a series of 15 rate hikes since June 2021. Although annual headline inflation eased slightly in October to 4.26% from 4.45% in September, it remains high. Inflation expectations in 2023 remain unchanged, given that rapid convergence to the target range is not expected in the near future. The central bank reiterated its commitment to its core mandate, highlighting its ongoing efforts to create a low inflation environment, and will keep a close watch on inflationary pressures and related variables. The stance of monetary policy is aligned with the direction needed to achieve the 3% inflation target.

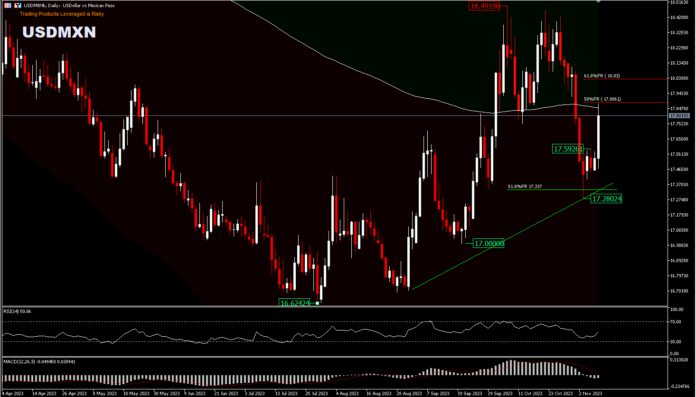

USDMXN was trading around 17.50 levels prior to the news release, and surged strongly by 1.9%, approaching the 50% retracement level (from October peak drawdowns of 18.49 and 17.28) at the time of writing. The Peso strengthened against the US Dollar at the start of the month, but held above the 61.8%FR (from 16.62-18.49 retracement) and sideways for 4 days, as investors anticipated Banxico would remain steadfast in its tight monetary policy.

Strong labour and economic data gave room for the Central Bank to maintain a hawkish stance. Mexico’s business confidence indicator increased for the second consecutive month, reaching its highest level since 2014 at 54. In addition, the manufacturing PMI recovered from a contraction in September to 52.1 in October. GDP growth surpassed forecasts, increasing by 3.3% from a year earlier in the third quarter, while the unemployment rate fell to 2.9%.

Technical Review

USDMXN’s rise on Thursday [09/11] was seen stuck at the 200-day EMA and 50%FR, which could be due to the news effect. However, judging from the economic data, Mexico is likely to improve. Further gains above the 200 EMA will likely test the 61.8%FR level around 18.03 for the rest of the week. A move to the downside would be blocked by the intraday resistance of 17.59 and a move below the support of 17.28 would leave the round figure of 17.00 to be targeted by market participants. However, a move above 18.49 could be the start of a medium-term trend.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.