Past interest rate hikes have already begun to impact corporate and household spending and the economy is essentially standing still from mid-2023 to mid-2024, with mild recessions in individual countries. The Bank of Canada is inching closer towards a monetary policy pivot, after welcoming the recent decline in inflation and stating the economy has reached a balance in supply and demand.

Yesterday, the BOC maintained its overnight interest rate target at 5.00% in line with market expectations. The central bank emphasised lingering concerns about inflation risks in its policy statement, noting that it “stands ready to raise the policy rate further if needed.” However, the BOC cited recent statistics showing that the Canadian economy is “no longer in excessive demand.” This trend is expected to contribute to lower inflationary pressures across a wide range of goods and services prices. These findings indicate a small but important change in the economic environment, which could signal a change in the central bank’s future policy actions. However, the market assesses that the turning point is approaching, and a rate cut is now anticipated to occur in March or April 2024.

Meanwhile, the BOE is expected to cut rates earlier (around May), than the Fed and ECB (around June), according to Canada’s international investment and capital markets bank. According to them, 2024 will largely determine the duration and severity of the decline in growth, as well as central bank easing. Economic growth in 2024 is expected to be well below 1.0% for the US, Eurozone and UK, ensuring inflation stabilises back towards target. And the pace of central bank rate cuts over the course of this year is likely to be much faster than current market expectations. The UK economy is expected to grow by 0.3%, as is the Eurozone economy; both are seen growing by 1.1% by 2025.

In the UK, consumer demand is expected to come under pressure as the labour market continues to weaken and past interest rate hikes further weigh on households. As such, growth is likely to slow in 2024, which in turn will help spur a decline in inflation. If the BOE leads the rate cut cycle, UK bond yields will fall faster compared to bonds in the Eurozone and the United States, putting pressure on Sterling.

Technical Overview

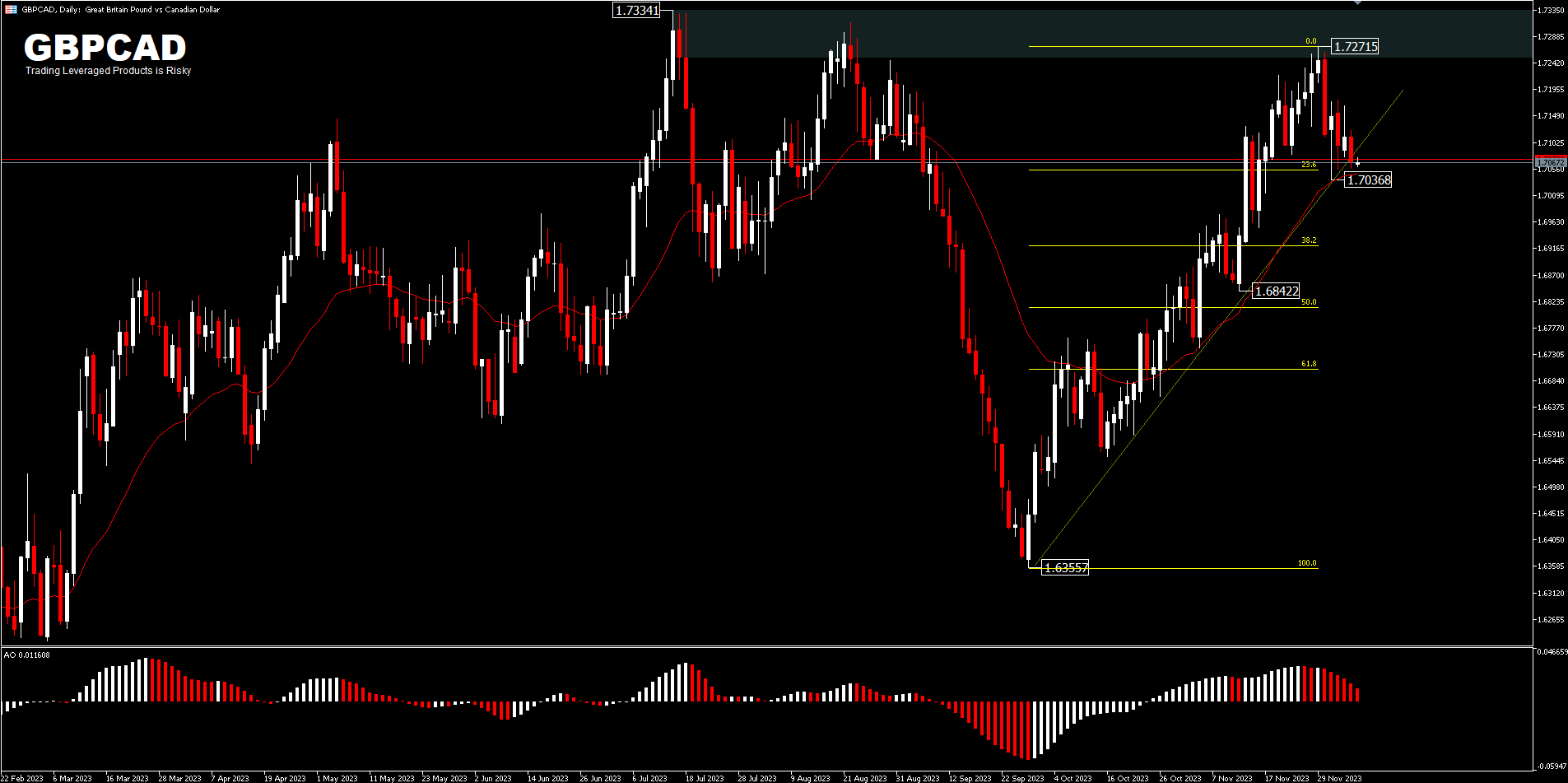

The GBPCAD cross pair rallied over 4% throughout 2023, recording a low of 1.6076 in February and a high of 1.7334 in July and has since fallen until September with a higher low recorded at 1.6355 and a rebound until November at 1.7271.

Technically, the cross pair has experienced a decline in upside momentum, having failed to equalise the July high. The drop on 30 November was the largest daily decline since 14 September. Now, the price is seen consolidating above the 26-day EMA, but is slowly starting to shift interest by breaking the up_trendline. A move below the 26-day EMA and 1.7036 support could test the 38.2%FR [of 1.6355 – 1.7271 retracement] and a little further to 1.6842 support. As long as 1.7036 minor support holds, it will create some consolidation before determining the actual trend.

Intraday bias is temporarily neutral. A move below 1.7036 support will confirm a short-term topping of 1.7271 and price is projected for FE100% [1.6942]. As long as, the support holds, the range of movement will be limited between 1.7036 – 1.7177. (R1: 1.7129; R2: 1.7177; S1: 1.7036; S2: 1.6953)

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.