- The NASDAQ appreciated in value for a fifth consecutive week regardless of the stronger employment data. Investors turn their attention to global inflation releases.

- Analysts expect US inflation to decline to its lowest level since April 2021. According to predictions, inflation has fallen from 3.4% to 2.9%.

- Bitcoin witnesses one of its strongest bullish price movements in almost a year. Over the past week, Bitcoin has risen more than 12%.

- Analysts advise the longer-term outlook for the GBPJPY is for the Yen to end higher in 2024. Though, the Pound continues to obtain mainly buy signals in the meantime.

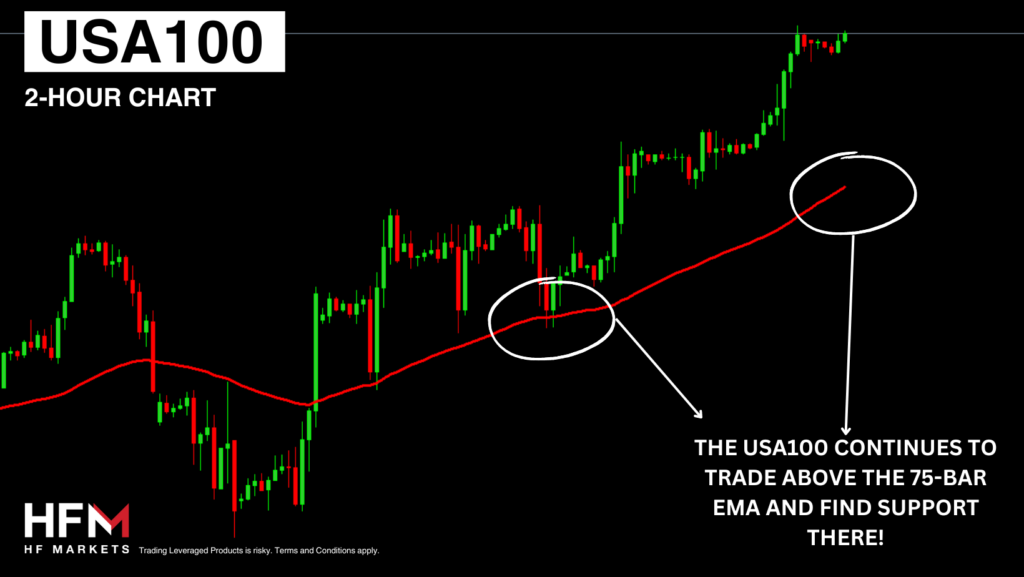

USA100 – How can Inflation influence the USA100?

The USA100 is trading at its highest point in history having risen 43% in 12 months and 8.57% in 2024. On the two-hour chart, using the 75-bar EMA and the various oscillators, the asset has not received a bearish signal since the 1st of the month. Investors changed their outlook for monetary policy as the employment sector continues to remain unbalanced. However, even with an interest rate cut in March being unlikely, investors continue to price in a cut as early as May 2024. For this reason, the stock market continues to rise as earnings data is generally well received.

According to Bloomberg, any decline in inflation will be well received by stock investors even if it’s at a lower magnitude. According to some analysts, for a negative stock reaction, inflation will need to read 3.3% and above. If inflation does indeed decline to 3.0% or below, investors will price in a rate cut as early as March, or May at the latest.

According to Fibonacci levels, if inflation does indeed decline and the USA100 is to rise, the longer-term target will be $20,443 and the medium-term target $18,935. According to Fundamental Analysts, a bullish trend is possible seeing that interest rates are falling, and economic growth continues.

On Friday, from the top 20 most influential stocks, only 3 declined meaning 85% of the “significant” stocks rose in value. The best performing stock from the “top 10” was NVIDIA which is approaching their earnings release (21st February). Analysts expect NVIDIA’s earnings per share to rise from $4.02 to $4.53, which is potentially why investors continue to heavily expose funds to the semiconductor. NVIDIA stocks have risen 49% in 2024 alone and have become the fifth most influential stock.

Bitcoin’s Spot Exchange-Traded Funds Received an Additional $146 Million!

Bitcoin has been rising in value for five consecutive days but is now close to its previous point of collapse. The upward price movement is being driven by the higher risk appetite and the latest Bitcoin ETFs. The market share of Bitcoin has risen 0.28% over the past 24-hours even though the total cryptocurrency market capitalization has slightly fallen. The price this morning opened on a large price gap and continues to mainly see buy signals so far.

The market is supported by an influx of funds from the recently launched Bitcoin ETFs, as well as amid expectations of the next halving, which is due in April. This week, BTC-based spot exchange-traded funds received an additional $146 million according to reports. Bitcoin has risen more than 9% in 2024.

GBPJPY – More Bad News for the UK Economy?

According to analysts, the Japanese Yen is likely to rise in value against most major currency pairs in 2024. However, against the Pound the currencies continue to weaken and receive signals in favour of the GBP. If the price declines below 188.211, sell signals are likely to materialize.

The price of the Pound will be influenced by its upcoming employment data, inflation rate and Gross Domestic Product. Analysts expect UK inflation to increase from 4% to 4.1% and for monthly GDP data to show a decline of 0.2%. If the inflation rate reads lower than 4.1% and GDP does indeed decline 0.2% or more, the Pound could witness pressure across the board.

The Yen on the other hand is not likely to be influenced by any events in Japan, but instead the Dollar. If the Dollar declines, the Yen may see an increase in demand as the Dollar’s main competitor.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.