- Gold declines but remains within the descending triangle pattern. Additionally, the correlation with the US Dollar weakens according to statistics.

- Last week, buyers increased the number of contracts by 25,734, and sellers decreased by 2,766.

- UK inflation declines from 4.0% to 3.4%, continuing to make the currency less attractive compared to Gold.

- Investors turn their attention to tonight’s FOMC statement and press conference. What will the event mean for Gold?

XAUUSD – Sellers Continue To Close “Sell” Contracts According To The CFTC!

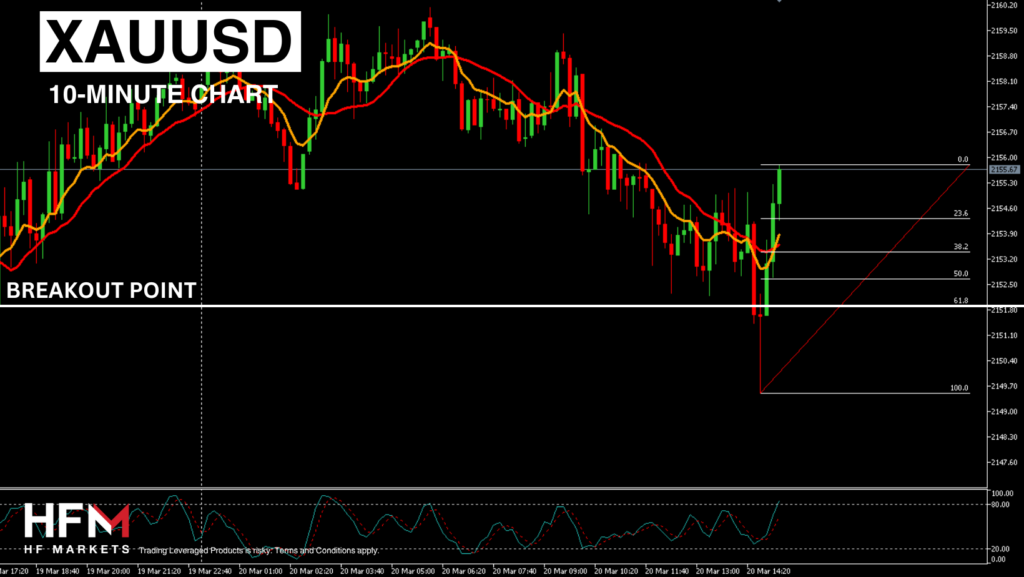

Gold’s bullish price momentum lost its shine on the 12th March, but is not necessarily forming a trend in a different direction. When evaluating the timeframes between the 2-hour chart and the 4-hour chart, the price is forming a descending triangle pattern. On larger timeframes, the price is forming nothing more than a retracement. The price therefore continues to honor the reoccurring price range, as indicated last week. So far, technical analysis continues to indicate a sideways price movement. However, this will also depend on tonight’s FOMC Statement and Powell’s Press Conference.

As consumer inflation has remained higher than expectations for 3 consecutive months and the PPI doubled in 30 days, the monetary policy is now less certain. Investors are hoping for clarification tonight and this can create more volatility. If the Federal Reserve indicate a later cut and/or less cuts, Gold will become less attractive. As a result, the price can break below the support level at $2,147.

What do economists believe is most likely? Most economists believe the most likely scenario is the Fed continues to cut in June as previously planned. However, cuts thereafter will be less frequent. This way, the Fed can support a soft landing while continuing to pressure inflation. The CME FedWatch Tool currently indicates a rate cut is likely in June 2024. If inflation starts to decline, as it did today for the UK, demand for Gold is likely to rise. Interest rates in the US will remain at 5.50%, hence why traders are mainly focusing on the forward guidance.

The US Commodities Futures Trading Commission (CFTC) in its latest report on Friday, confirmed the number of contracts again rose. The number of buy contracts rose by 25,734, and sellers fell by 2,766. The latest numbers continue to indicate many traders and institutions believe the price will either rise or at least retain its value.

Technical analysis is currently indicating downward momentum and a downward intraday trend. However, the Fibonacci levels are indicating the price is now finding support at the current range. Therefore, in order to obtain further clarity, many short-term traders may wait for a bearish breakout of $2,151.12 (61.8 Fibonacci level). This may indicate enough momentum for a stronger sell signal. Momentum in general is likely to increase after the opening of the US trading session.

Tomorrow, March data on business activity in the US and the eurozone will be presented. The US Services PMI from S&P Global is predicted to slow down from 52.3 points to 52.0 points, and the Manufacturing PMI may decrease from 52.3 points to 51.8 points. Both are likely to create volatility during tomorrow’s sessions.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.